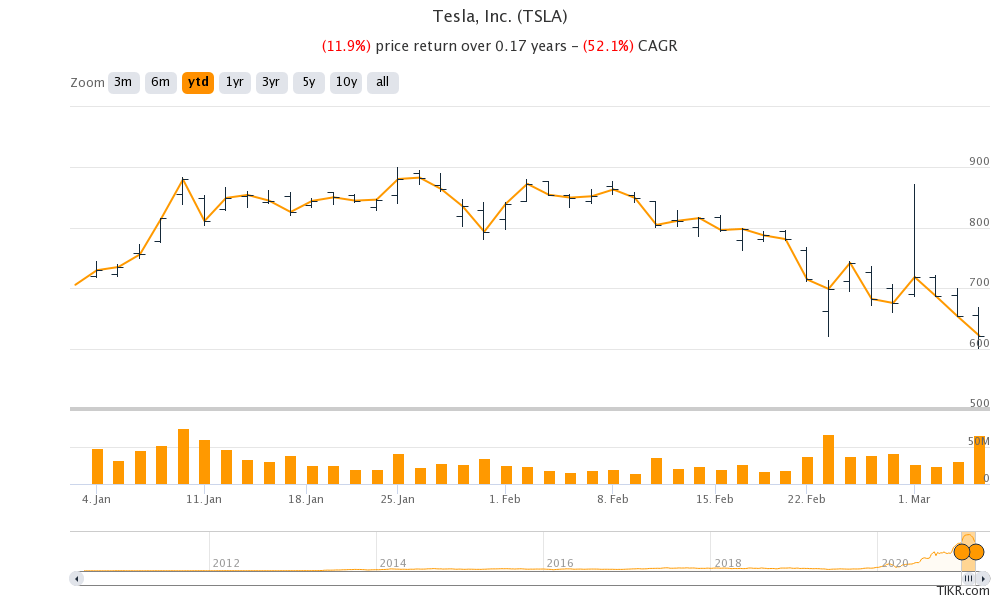

Tesla (TSLA) stock fell almost 5% yesterday and took its year-to-date losses to 11.9%. The stock is in a free fall and things might only get ugly from here.

Tesla stock now trades below the price level at which it joined the S&P 500 last year. The stock is among the biggest S&P 500 losers this year and is now down 31% from its 52-week highs. To put that in perspective, the company has lost almost $300 billion in market capitalization from the peak which is above Toyota Motors’ current market capitalization.

Why is Tesla stock falling?

To begin with, there has been a broad-based selling in growth stocks especially in the green energy and electric vehicle stocks. Electric vehicle stocks were red hot last year and Tesla soared 740% during the year. NIO, also known as the “Tesla of China” gained over 1,100% in the year. After the sharp rise in these stocks, markets are now questioning their valuations as the growth rates especially on a sequential basis are coming down.

Secondly, there is a growing realization that pure-play electric vehicle companies don’t have a free pass anymore. Legacy automakers like Ford and General Motors are doubling down on their electric vehicle plans that would lead to higher competition.

Ford Mustang Mach-E

Morgan Stanley analyst Adam Jonas believes that Ford’s electric Mustang Mach-E is taking away market share from Tesla cars in the US. According to his estimates, Tesla had a market share of 69% in the US electric vehicle market in February 2021 as compared to 81% in the corresponding month in 2020. Even as Tesla might report higher absolute sales in the US market on the back of rising electric vehicle sales, it is losing market share.

Rising competition is a risk

Over the next couple of years, we’ll get multiple all-electric models from legacy automakers. This includes Ford’s F-150 which is set to be launched later this year. The model has been America’s best-selling pick-up for decades and would be pitched against Tesla’s Cybertruck that the Elon Musk company revealed with much fanfare in 2019.

Then we’ll have models from start-up electric vehicle companies like Lucid Motors, Nikola, Fisker, and Canoo. Overall, there is a real risk of the market getting overcrowded with a flurry of new models.

As is visible in China currently, this would lead to price competition. A price war would dent the profitability of electric vehicle companies who anyways don’t have a good track record on the metric.

Tesla earns billions from carbon credits

Looking at 2020, Tesla made $1.58 billion from the sales of regulatory credits, a year-over-year rise of 166%. The credits directly flow to the company’s bottomline and were more than double of its 2020 GAAP income. Think of it this way, Tesla would have posted a net loss in 2020 on a GAAP basis had it not been for the carbon credits. As legacy automakers ramp up their electric vehicle sales, they would need fewer of these carbon credits which has been the prime earnings source for Tesla.

Ron Baron sells some Tesla shares

Ron Baron’s firm, which is among the most prominent Tesla bulls has sold $1.8 million Tesla shares for its clients. He said that “It was painful selling every single share” but justified it based on “risk mitigation” as Tesla shares accounted for a big part of some client portfolios. Personally, Baron hasn’t sold any Tesla share.

Baron has a $2,000 price target for Tesla and expects it to become a $2 trillion company. Currently, Tesla is the only company that has a market capitalization of over $2 trillion. Baron is not the only person who sees Tesla’s market capitalization rising to $2 trillion.

Gene Munster

Gene Munster, the co-founder of Loup Ventures, expects Tesla’s market capitalization to cross above $2 trillion over the next three years. Munster had correctly predicted that Apple’s market capitalization would hit $2 trillion. He expects Apple to be the best performing FAANG stock in 2021 also for the third year in a row.

Muster sees a possible foray from Apple into electric vehicles as the biggest risk for Tesla. Apple is rumored to be building its electric vehicle capabilities through an internal project codenamed “Titan.” If Apple bets big on electric vehicles, it can be a tough competitor to incumbents. Apple has the financial strength and technical expertise to become a major competitor in the electric vehicle industry.

Tesla stock’s valuation

Meanwhile, markets now seem to be getting apprehensive over Tesla and other electric vehicle stocks amid rising competition. Even after the crash, Tesla stock trades at an NTM (next-12 months) price to sales multiple of over 12x which is not cheap by any standards.

During the fourth quarter 2020 earnings call, using a hypothetical example Musk said that it can generate as many revenues from Robotaxis and FSD (full self-driving option) as it is making from selling cars. He also said that all these revenues would be almost gross profit and would add to its net income.

Elon Musk

Taking the example of annual revenues of $60 billion, Musk said, “So — and the pace you get 20 PE on that, it’s like $1 trillion and the company is still in high-growth mode. So, I think there is a way to sort of like justify the valuation of the company where it is using just the cars and nothing else, the cars with FSD.” He added, “And I suspect at least some number of investors are taking that approach.”

One would have to think on similar lines to find value in Tesla stock as it is not possible to otherwise justify it having a market capitalization that’s thrice of Toyota Motors. All said the downtrend in Tesla stock might continue for some more time now.

You can trade in Tesla stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account