According to reports, Apple is contemplating a deal with South Korean automaker Hyundai-Kia to produce its autonomous electric car. Can Apple be the ultimate Tesla killer?

Reports suggest that Apple is in the final stages of reaching an agreement with Hyundai-Kia to produce its electric cars at Kia’s Georgia manufacturing plant. Both Hyundai and Apple stocks were trading higher today on the news. Hyundai stocks have spiked in January also amid reports that the company is in talks with Apple for a partnership to produce electric cars.

Apple-Hyundai partnership

Notably, last year we saw a rally in stocks of companies that manufacture parts for electric cars after reports suggested that Apple’s electric car would hit roads somewhere by the middle of this decade. Lidar stocks also rallied on hopes that Apple’s entry into electric vehicles would lead to higher demand for lidars that are used as sensors in autonomous cars.

According to reports, Hyundai’s chairman Euisun Chung is betting on mobility and sees it as the company’s future. Legacy automakers like Ford and General Motors are also betting on mobility. General Motors’ Cruise attracted investments from Microsoft that would help it commercialize self-driving cars. Tesla also sees mobility as a key driver and during the company’s fourth quarter earnings call, Musk tried to justify the company’s valuation using mobility.

Tesla

Musk said that Tesla can generate as many revenues from Robotaxis and FSD (full self-driving option) as it is making from selling its electric cars. Musk believes that all these revenues would be almost gross profit and would add to its net income.

Taking the example of annual revenues of $60 billion, Musk said, “So — and the pace you get 20 PE on that, it’s like $1 trillion and the company is still in high-growth mode. So, I think there is a way to sort of like justify the valuation of the company where it is using just the cars and nothing else, the cars with FSD.” He added, “And I suspect at least some number of investors are taking that approach.”

Can Apple be the Tesla killer?

Over years, analysts have labeled many companies as Tesla killers. A lot of electric models were also termed Tesla killers. However, in hindsight, none of these companies or models could pose a threat to Tesla’s dominance in the electric vehicle market.

Tesla expects its deliveries to rise at a CAGR of 50% over the next few years implying no real threat from the so-called Tesla killers. That said, even the most bullish Tesla analysts and fans would agree that Apple’s entry into electric vehicles could be among the biggest risk for Tesla.

Gene Munster on Apple

Incidentally, Loup Ventures’ co-founder Gene Munster, who correctly predicted that Apple’s market capitalization would rise above $2 trillion and expects Tesla’s market capitalization to also rise above $2 trillion by 2023, also sees Apple’s entry into electric vehicles as he biggest risk for Tesla.

Apple is long being rumored to be building its electric vehicle capabilities through an internal project codenamed “Titan.” If Apple bets big on electric vehicles, it can be a tough competitor to not only legacy automakers but pure-play electric vehicle makers like Tesla and NIO. Apple has the financial strength and technical expertise to become a major competitor in the electric vehicle industry.

Many agree that if any company has a realistic chance of taking on Tesla and Elon Musk in the electric vehicle industry, it can be Apple.

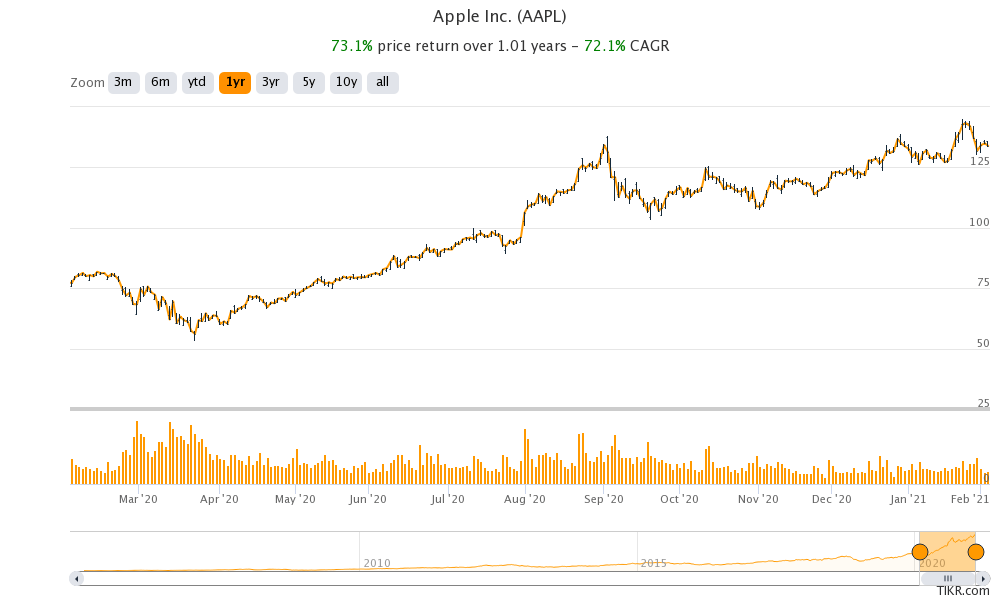

What would electric vehicles mean for Apple stock?

Foray into electric vehicles could be a long term driver for Apple stock. Morgan Stanley analyst Katie Huberty sees it as a big opportunity for Apple. “Smartphones are a $500bn annual TAM. Apple has about one-third of this market. The mobility market is $10 trillion. So Apple would only need a 2% stock of this market to be the size of their iPhone business,” she wrote in a client note.

Electric cars

Not much is known yet about Apple’s electric cars. Last year, citing sources, a Reuters report said that Apple is working to “radically” lower the battery costs and increase the range. The source called Apple’s battery technology the “next level” and compared it with “the first time you saw the iPhone.” Batteries are a key component of an electric cars. It not only impacts a car price but also determines its range that is very important while choosing an electric car.

NIO

Chinese electric vehicle maker NIO came up with its BaaS (battery as a service) service last year where users can swap their batteries. It also helps lower the vehicle price as a user can buy NIO’s electric car without the battery and then take the battery on rent.

More details have now emerged about Apple’s electric car. “The first Apple Cars will not be designed to have a driver,” CNBC reported citing an unmade source. It added, “These will be autonomous, electric vehicles designed to operate without a driver and focused on the last mile.”

Apple could see a rerating

Entry into electric vehicles and autonomous driving would help Apple in two ways. Firstly, it would be a long term earnings driver. Secondly, it would help in expanding the valuation multiples for Apple stock. To be sure, Apple’s current valuation multiples are the highest since 2007. However, the current valuation seems justified by the digital transformation that we’re seeing amid the COVID-19 pandemic.

Should you buy Apple stock?

Munster sees Apple’s valuation as justified as he expects the stock to be the best performing FAANG in 2021 also for the third year in a row. “It’s a year out there but I’m fast-forwarding the conversation to the middle and back half of next year, and we’ll be talking about 2022 at that point. If the market can sustain these 35 multiples — you know, we’re not talking about an Amazon-like multiple here — I think that that path is there,” said Munster.

You can trade in Apple stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account