Global markets are cautiously higher this morning after the release of more positive data on the vaccine front while US treasury yields are ticking higher as a risk-on attitude from investors persists.

China’s Shanghai Composite Index appears to be leading the rally as the Asian benchmark advanced 1.1% at 3,414, followed by Singapore’s Straits Time Index (STI) and Korea’s KOSPI Index, which gained 1.3% and 1.9% respectively during their corresponding stock trading session.

European markets, on the other hand, opened mildly higher today with Belgium’s 20 index leading the advance by jumping 1% at 3,621 followed by the German DAX and the French CAC 40 index, which are trading 0.6% and 0.5% higher today as well.

News on the effectiveness of the vaccine being developed by British drugmaker AstraZeneca (AZN) are contributing to today’s uptick in global markets, as the vaccine front-runner said its treatment showed a 70% efficacy in protecting patients against contracting the disease.

Meanwhile, disappointing news on the economic front seem to be capping the markets’ advance in Europe, since the IHS Markit Composite index came in at its lowest reading in the past six months at 45.1 as a second wave of the virus in the region has temporarily derailed the economic recovery.

Accompanying the cautious advance of European markets today, US stock futures are also gaining this morning, led by E-mini futures of the Dow Jones Industrial Average, which are advancing 0.6% at 29,383, followed by S&P 500 futures, which are up 0.5% at 3,572.

US markets keep struggling to move higher lately, as a rising number of daily virus cases in the North American country keep weighing on the economy’s short-term outlook. On Friday, the US posted more than 200,000 infections in a single day with deaths also moving above the 2,000 mark last Thursday according to virus-tracking website Worldometers.

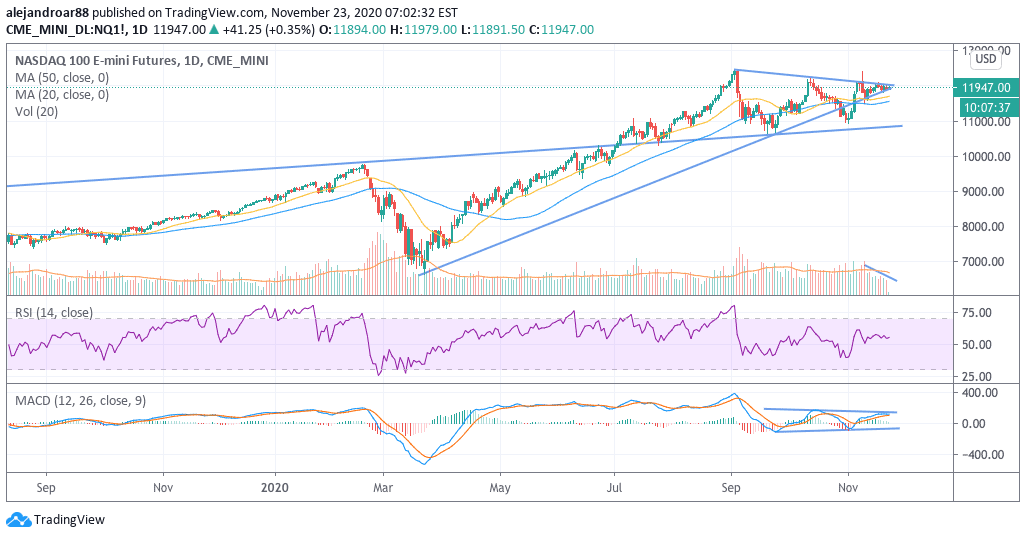

The Nasdaq 100 index nearing an interesting breaking point

The tech-heavy Nasdaq 100 index is trading 0.35% higher today at 11,947 as it approaches a potential breaking point. The chart above shows that the price action has already reached the tip of a symmetrical triangle that could result in a pronounced move in any direction over the next few weeks.

This pattern is also accompanied by a sideways consolidation seen by the index since early September as investors have started to rotate towards virus-battered stocks on hopes that a vaccine could offer more upside after months of strong performance from the tech sector amid the pandemic.

E-mini futures of the Nasdaq 100 have seen lower trading volumes as well while they remain fluctuating in this narrow range as buyers and sellers are still making up their minds in regards to what’s next. At this point, traders should keep an eye on the direction that the next few sessions take as that could indicate where things will be headed from now.

Any upticks from these levels could lead to another push to all-time highs while a downturn could end up retesting the October or September lows of 11,000 – 10,600.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account