WTI oil futures are rising almost 1% this morning at $42.29 per barrel as vaccine optimism and hopes of prolonged supply cuts from the Organization of the Petroleum Exporting Countries (OPEC) keep pushing the price of crude higher.

With today’s jump, oil futures are set to close the week with a 5.4% gain as news of a 94.5% effectiveness seen on the vaccine treatment produced by American biotech firm Moderna and Pfizer’s intention to seek approval for its own treatment “within days” have kept the price of oil moving higher.

Meanwhile, traders were optimistic about OPEC’s willingness to extend the cartel’s supply cuts as surging virus cases in Europe and the United States have prompted governments to impose restrictions and curfews, a situation that is weighing on the short-term outlook for crude demand.

OPEC members are scheduled to meet formally on 30 November and 1 December to discuss policy matters and a decision on this matter is expected to come up after the virtual gathering.

Moreover, US crude inventories rose by nearly 800,000 barrels, with the build-up falling short of analysts’ expectations by almost 900,000 barrels.

What’s next for oil futures?

The virus situation in North America will keep impacting the short-performance of oil futures, as the demand for distillates could suffer if more states move to impose lockdowns and other restrictions.

The number of daily coronavirus cases in the country ended at its highest level since the pandemic started just yesterday, with more than 192,000 Americans testing positive for the virus in the last 24 hours.

Meanwhile, the number of deaths associated with the virus has climbed above the 2,000 level for the first time since May according to virus-tracking website Worldometers.

Although vaccine hopes are probably providing a floor for oil in the long run, the short-term outlook for crude remains capped as vaccine distribution concerns are yet to be addressed.

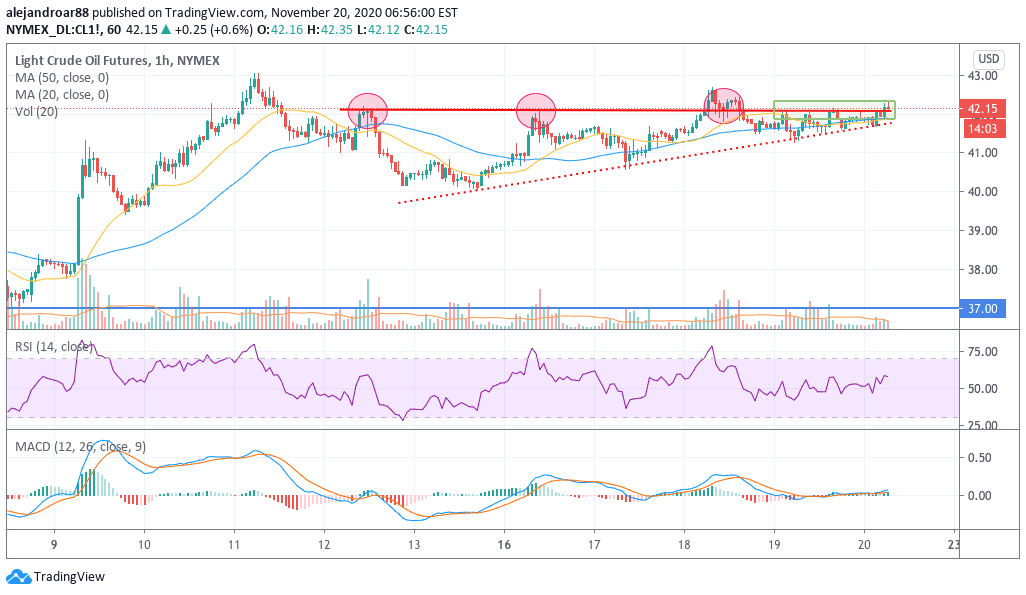

That said, the hourly chart for WTI oil futures shows that the US benchmark has failed to break the $42 level almost 7 times in the past 8 days. Each retest has been followed by a higher low, which indicates that bulls are taking over the price action.

A break above $42 seems imminent given the current formation – a bullish ascending triangle – but news on the vaccine or OPEC’s front could end up determining the direction that the price of the commodity will take in the following sessions.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account