The price of Bitcoin (BTC) seems to be determined to pop above its $16,000 psychological threshold as the cryptocurrency jumped to $16,200 in early cryptocurrency trading activity today, making this the second time in which the cryptoasset has traded above this level since the month started.

This latest bull run appears to be driven by comments from billionaire investor Stanley Druckenmiller, who disclosed that he currently holds a position in Bitcoin (BTC), following a similar investment thesis to the one he has on gold. The founder of Duquesne Capital highlighted that both instruments can serve as a hedge against the continuous fiat debasement carried on by central banks.

These remarks helped reverse the downtrend triggered by Pfizer’s vaccine news, as the price rebounded from a $14,800 low on Monday to as much as $15,800 today after retreating from an intraday high of $16,200.

Meanwhile, today’s uptick seen by Bitcoin is also partially supported by a weaker dollar, as the value of the North American currency – tracked by Bloomberg’s US dollar index (DXY) – is down 0.13% at 92.872 in early forex trading action.

In regards to his position in Bitcoin, Druckenmiller told CNBC: “Frankly, if the gold bet works the bitcoin bet will probably work better because it’s thinner, more illiquid and has a lot more beta to it”.

He further added that there is “a lot of attraction” to the cryptocurrency as a store of value from millennials and from a group that he denominated as “West Coast money”, referring to wealthy tech professionals who live in Silicon Valley, California – a region that is considered a center of innovation for America.

What’s next for Bitcoin?

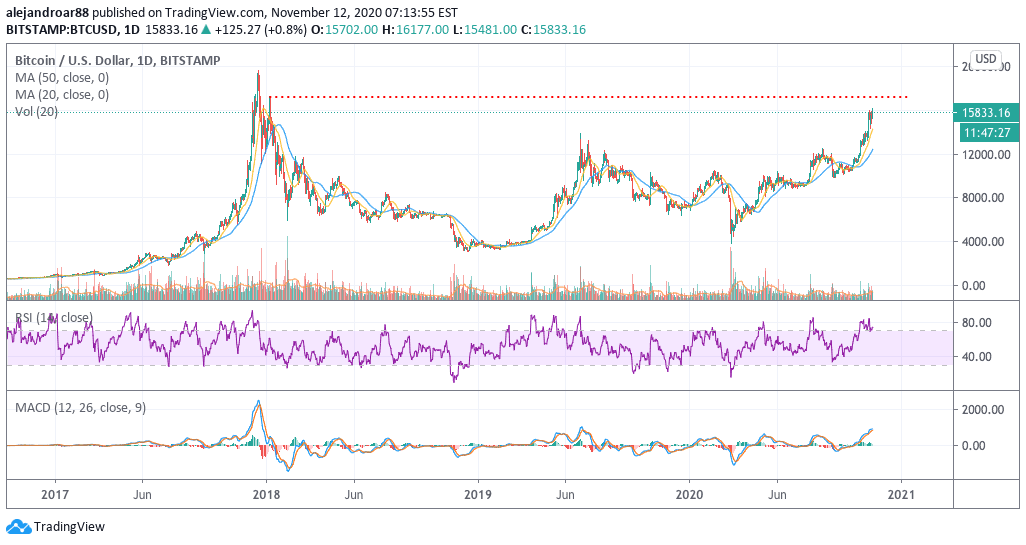

Bitcoin (BTC) has delivered a remarkable 120% gain since the year started, as the price of the cryptocurrency has reacted positively to the latest weakness seen by the US dollar amid the Federal Reserve’s accommodative monetary policy.

That said, the greenback’s decline only explains a portion of Bitcoin’s bull run, as a retail trading boom has also benefitted the cryptocurrency, while statistics also show that Bitcoin and other cryptoassets remain a top pick among the portfolios of the younger generation.

Moreover, Bitcoin traders are also counting on increased interest from institutional investors as a potential catalyst for stronger upward moves, which is the reason why Druckenmiller’s comments are considered bullish by crypto investors.

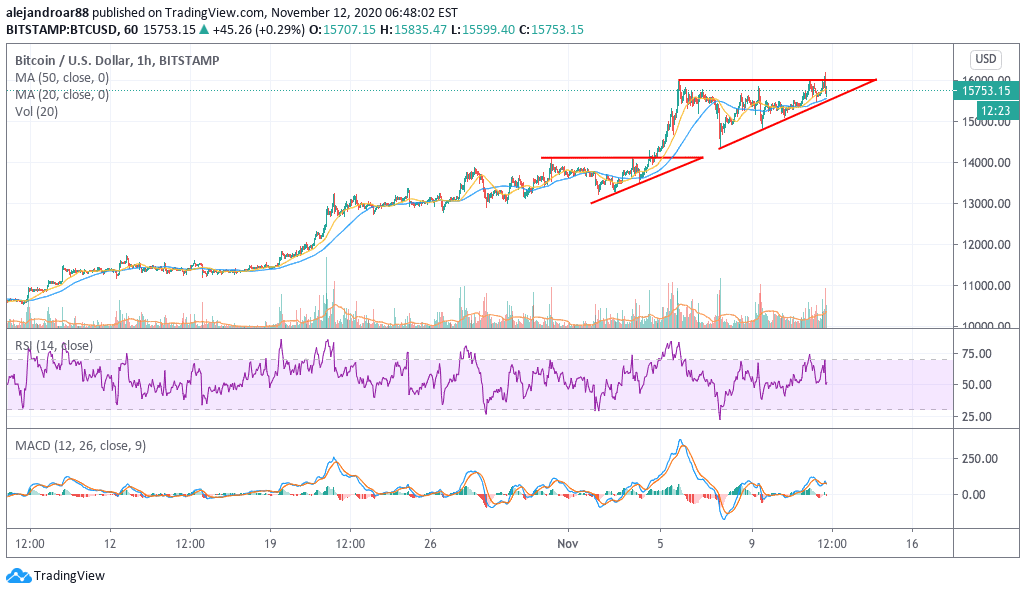

The hourly chart above shows two identical ascending triangles forming, with the first one preceding Bitcoin’s uptick from $14,000 to $16,000 while the second one could turn out similarly as the $16,000 resistance continues to be weakened.

Conservative traders could wait until the price breaks above the $16,000 level again before jumping on board, while aggressive traders may prefer to take a position now to take advantage of today’s breather.

If the price were to move above $16,000, the next stop could be the $17,200 resistance seen in January 2018, with all-time highs on sight if this positive momentum continues.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account