Oil prices recovered strongly last month and posted their best month in history as supply cuts and moves to reopen economies kicked off an oil rally. Now, oil traders wonder what lies ahead in June.

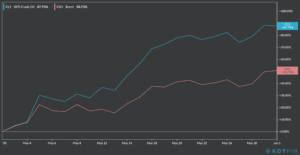

The price of the West Texas Intermediate (CL1), the US benchmark for oil prices, jumped by 88% during the month, moving from $18.84 to $35.41 in the last 30 days while the Brent (CO1), the global oil benchmark, posted a 51% gain moving from $25.27 to $38.10.

May’s performance of the WTI was the best month on record for percentage gains and it was primarily fueled by supply cuts from multiple oil producers including those agreed by OPEC+ nations on early April and voluntary cuts from non-OPEC countries including the US and Norway.

Oil futures left behind their dark days in April, when the price of WTI futures went negative for the first time in history, as June futures were settled above the $30 mark on 19 May, pointing to a more stable oil market.

Based on technical analysis, oil prices have moved above their $32 resistance line and are pointing towards the $40 level, moving closer to the commodity’s 200 daily moving average, a technical indicator that tracks the mid-term performance of a financial asset.

“When I look at the crude oil price, I would say when you look at that chart, we’re coming right up into the downtrend resistance line and a close above about $33 and change leaves the next resistance at $42”, Craig Johnson, chief market technician for Piper Sandler, told CNBC’s Trading Nation on Friday.

Meanwhile, Goldman Sachs told its clients in a recent note: “The oil market rebalancing continues to gather speed, driven by both supply and demand improvements … These improvements are taking out the risk of a sharp pull-back in prices although we re-iterate our view that the rebalancing will take time”.

The global demand for petroleum pulled back during April as a result of the economic slowdown caused by the coronavirus outbreak, which resulted in a plunge in oil prices for the month.

This situation appears to have been reversed during May and possibly for the first weeks of June, as economies around the world continue to reopen and factories restart their activities.

Meanwhile, supply cuts from major oil producers have helped fueling the price of the commodity up and experts do not expect another boost in production over the coming months.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account