Barrick Gold (GOLD.N) posted a near 45% rise in profit on Wednesday, with the miner benefitting from a surge in gold prices since the coronavirus pandemic has pushed investors towards safe havens in times of crisis.

Meanwhile, the Ontario-based firm was forced to cut its production outlook for the precious metal due to a dispute with the government of Papua New Guinea.

The world’s second-largest gold miner now expects gold production to range between 4.6 million ounces to 5 million ounces this year compared with an earlier range of 4.8 million ounces to 5.2 million ounces.

The government of Papua New Guinea had announced in April that it would not renew a 20-year special mining lease for the Porgera gold mine, which is jointly owned by Barrick and China’s Zijin Mining, due to environmental damage and social unrest.

Barrick, led by chief executive Mark Bristow, said it would challenge the decision on the mine, which accounted for about 5% of Barrick’s gold production last year.

Mining row is ‘nationalization without due process’, claims Barrick

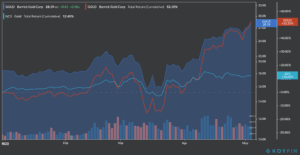

Bristow has said the move is “tantamount to nationalization without due process”, and comes at a time when gold prices have jumped by about 12% this year, fueled by growing investor appetite for safe stores of value as the health emergency stalls business activity around the world.

Barrick’s adjusted profit rose to $285m, or 16 cents per share, in the first quarter ended 31 March, from $184m, or 11 cents per share, a year earlier.

Revenue for the quarter slightly missed analysts’ estimates, falling short by $70m from the $2.79bn consensus to end up the three-month period at $2.72bn. Total sales were up 30% compared to the first quarter of 2019.

The company’s realized gold price came in at $1,589 per ounce, which is 17% higher than Barrick’s initial estimate of $1,350 per ounce and 7.1% more than the price recorded the previous year.

Barrick Gold’s shares have risen by more than 50% this year. However, the stock opened around 3.5% down at $27.18 in New York on Wednesday on news of the production cut.

Barrick’s Bristow said: “Operational and financial delivery were on plan despite the fact that the group’s prime focus during the latter part of the quarter had been on ensuring the safety of Barrick’s people”.

Meanwhile, commodity experts are anticipating higher gold prices for the rest of 2020 and forward, as major central banks around the world, including the Federal Reserve and the European Central Bank, increase their monetary base to inject money into the financial markets, in an effort to contain the economic fallout from the health emergency. Historically, there’s a high correlation between expansive monetary policies and the price of this precious metal.

Barrick has operations in eight different countries including the United States, Argentina, the Dominican Republic, and various African countries.

You can trade Barrick Gold shares by choosing a broker from our list of the best stock brokers or you can buy an ETF that tracks gold mining companies, such as the iShares RING.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account