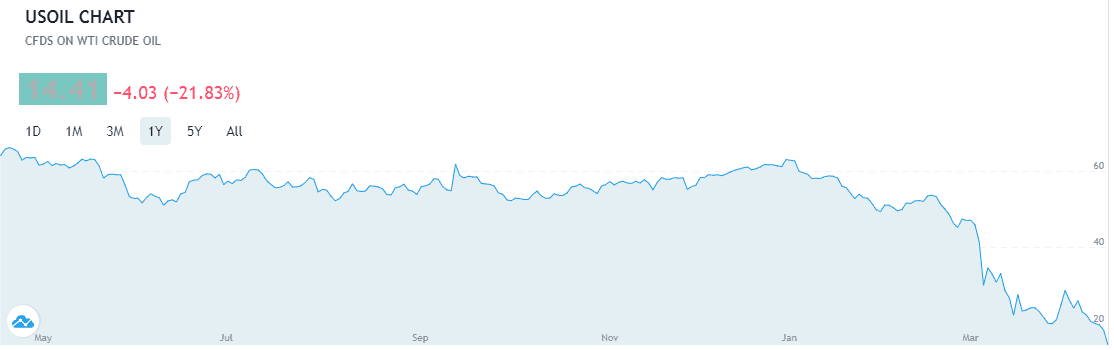

Oil prices slumped to their lowest since 1999 as forecasts show a growing glut of oil, despite the largest ever production cuts of 9.7 million barrels a day from OPEC and its allies last week.

“It hasn’t taken long for the market to recognize that the Opec+ deal will not, in its present form, be enough to balance oil markets,” said Stephen Innes, chief global market strategist at Axicorp.

Indeed, the record growth in US crude inventories of 19 million barrels a day last week has forced the Department of Energy to consider convincing domestic oil producers to keep crude in the ground.

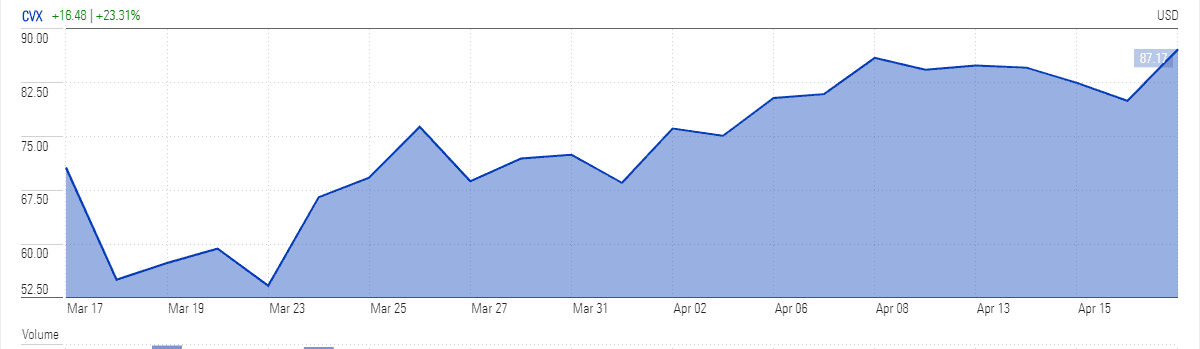

The oil glut has sent US crude futures below $15 a barrel, making it more difficult for US players to hold their ground as their breakeven levels stand somewhere around $40 a barrel. Chevron (NYSE: CVX) is among those oil majors that have sustained dividends despite the 50% oil price collapse during the last two months. The company has suspended capital investments and share buybacks along with asset sales to sustain dividends.

However, the latest oil price shock could force Chevron to revisit its decision to go ahead with investor payouts as the global economy heads towards the recession, which could weigh on oil demand throughout 2020.

“Over the last month, the total number of active oil rigs in the US has fallen by more than 35 per cent, highlighting the impact that the current low oil price is having on drilling activity. This drilling slowdown will translate into lower production in the coming months,” wrote ING’s Warren Patterson and Wenyu Yao in a research note.

Chevron’s stock price has regained almost half of its losses from March lows due to its strategy of sustaining dividends and hopes of higher oil prices. The latest market data and analysts forecasts, however, are indicating that oil prices will take a longer time to stabilize.

If you plan to buy shares of Chevron after the oil price collapse, you can checkout out our featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account