United Airlines (NASDAQ: UAL) chief executive Oscar Munoz (pictured) in a stark warning to staff said demand for air travel is “essentially at zero” and laid the ground for job cuts.

The third-largest US airline flew less than 200,000 people in the first two weeks of April, a 97% drop from the more than 6 million people it flew during the same time in 2019. It expects to fly fewer people during the entire month of May than it did on a single day in May of last year.

“The historically severe economic impact of this crisis means even when travel demand starts to inch back, it likely will not bounce back quickly,” wrote Munoz and President Scott Kirby in a memo to staff.

United expects to get $5bn in payroll support under the CARES Act – barring it from cutting staff until 30 September.

But Munoz told staff “the challenging economic outlook means we have some tough decisions ahead as we plan for our airline, and our overall workforce, to be smaller than it is today, starting as early as October 1.”

So far more than 20,000 United employees have volunteered for unpaid leaves of absence.

JPMorgan also expects massive layoffs after Sept. 30 and calls airline relief package a ‘disaster’. “Unfortunately, we simply don’t see any way for most US airlines to avoid massive layoffs unless the industry-specific payroll protection grants/loans are extended,” JPMorgan analyst Jamie Baker says

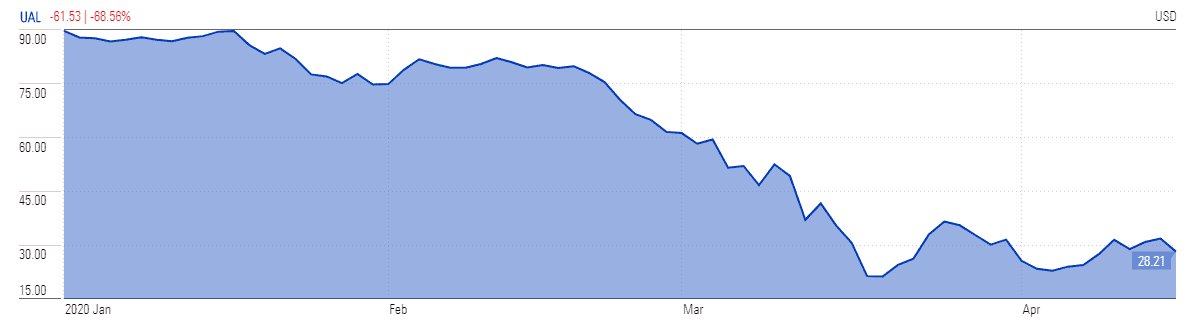

Day traders are enjoying big price moves of airline stocks; the shares of airlines rebounded in Friday trade on a broader market rally after posting big losses on Thursday. Airline stocks are among the worst performers during the last two months as they have canceled more than 90% of scheduled flights. United Airlines stock traded 4% higher on Friday afternoon, but it has lost close to 70% of value in stock trading since the beginning of this year.

Meanwhile, American Airlines chief executive Doug Parker came up with a more optimistic tone in an address to customers and employees. Parker said the company is ready to restart flights once the travel-related restrictions are lifted.

You can trade United Airlines stock price swings using the services of our featured stockbrokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account