Personify Financial Review 2020 – Low Credit Rates Approved

Did you know that a bad credit score, usually less than 629 on the FICO scale, doesn’t disqualify you from getting a personal loan? Despite this, people like you may struggle to get a lender. For one, it is a fundamental consideration for most lenders, and they consider you a high risk. Secondly, if you are lucky to get one, they may charge you a high-interest rate. One such a lender, you may want to consider is Personify Financial. The company believes more than just your scores and credit history.

Personify Financial offers internet installment emergency loans with a swift turnaround. It issues unsecured funds for people with bad credit. So, they may be willing to listen to you, but as we already told you, ready yourself for high APRs. Its rates run from 35% to 179.99%, and, in some cases, an origination fee — both of which will drive up the cost of your loan.

Can you contend with the costly rates? Perhaps, you are willing to sign off on that to get the money. But don’t you think it’s essential to find out how the lender fares in other areas? Well, we have this comprehensive review to help you make your decision.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

What is Personify Financial?

Personify provides quick unsecured short-term funds, which you repay plus interest and fees. It divides the repayments into equal monthly installments spread over an agreed period. Its services are entirely online, not to mention that it is available in California, where it is based, and in 21 other states.

The San Diego-based lender can offer you a minimum of $1,000 up to a maximum of $10,000 for between a year and four years. Its interest rate starts from 35% and can skyrocket to 179.99%. All these – the amount, term, and cost of the loan – are subject to your state’s financial laws.

While the rates are prohibitively high, many people who have used the service laud Personify Financial’s funding speed. It is only a matter of hours after you get the nod that the money reflects in your account.

Personify Financial APR is to the maximum APR some lenders charge. Coupled with other factors such as your credit score and your location, you can pay as much as triple digits in interest.The Pros and Cons of Personify Financial Loan

Pros:

- Fast loan turnaround (48 hours max).

- Considers people with bad credit.

- Flexible terms.

- Able to apply for prequalification

- High maximum limit.

- Convenient online application

Cons:

- Charges origination fee.

- Prohibitive interest rates.

- The $1,000 minimum is a bit high.

Personify Vs Personal and installment loan providers, how does it compare?

Personify is an online personal loans provider that specializes in advancing medium term loans to poor credit borrowers. It stands out from its competition because of the maximum amount limits of its loans as well as the extended repayment period. And you don’t need an excellent credit score to qualify. We compared it to other online personal loan lenders Oportun, Rise Credit, and Advance America and this is how it faired:

Personify Loans

- Access personal loans of between $1,000 and $10,000

- Minimum credit score of 550 FICO points

- Loan APR range from 35% to 179.99%

- Loan repayment periods of between 12 and 48 months

Rise Credit

- Offers loan from between $500 to $5000

- Bad credit score is allowed

- Annual rates starts from as low as 36% to as high as 299%

- Depending on the state, the repayment term ranges from 7 to 26 months

Advance America

- Loan limit starts from $100 to $5,000

- Requires a Credit Score of above 300

- For every $100 borrowed an interest of $22 is incurred

- Weekly and monthly payback installments

Oportun

- Loan amount starts from $300 to $9,000

- No minimum credit score required

- Annual rates fall between 20% to 67%

- Loan should be repaid in a span of 6 to 46 months

How Does Personify Financial Work?

Personify Financial loans are a good fit for you if you have low credit. You need, however, to be asking for at least $1,000 as this is the least amount it offers. Combine that with its high-interest rates, and you realize it is advisable to consider other cheaper alternatives. We recommend it as an option of last resort, perhaps.

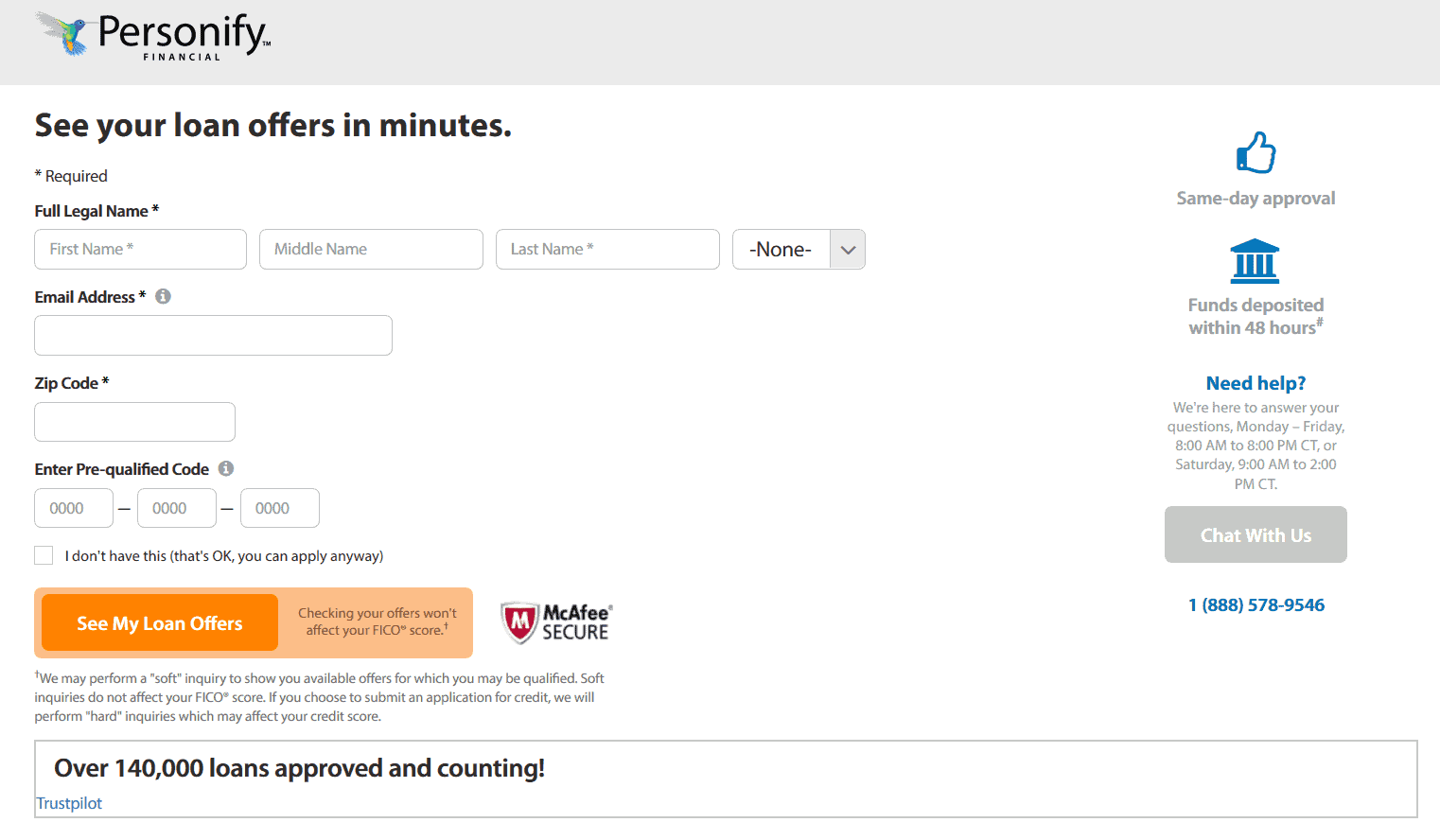

All those aside, Personify is one of the few personal loan providers that allow you to apply for prequalification. To do so, you merely complete a soft credit inquiry form for the lender to check your ability to repay the loan. This search only takes a few minutes, and it doesn’t affect your credit scores. If your request prequalifies, you get estimated potential loan offers. These offers have corresponding rates and terms that you qualify for as at that moment. And all you provide for prequalification are your name, email address, and ZIP code.

To apply for the loan, use the link Personify sent to your email after the prequalification. This link directs you to the continuation of your application which needs the following details:

- Your address

- Phone number

- Date of birth

- Social Security number.

Once you have entered the details, you can click Confirm and Continue.

Like any other lender, Personify, too, it interested in what you intend to do with the money you ask. Yet that comes after you enter the amount you wish to borrow. Afterward, you’ll need to shed a little light on the frequency of your income and specify your next expected three paydays.

With every field filled and ready, review your application before you submit. Of course, this is the moment your documents undergo rigorous checking. Then the lender communicates their decision. If the underwriters verify your information in the online process, you qualify for the loan. And it will take only between 24 and 48 hours to settle everything.

On the other hand, if the underwriters are unable to verify your data electronically, a representative may get to you for extra documentation ahead of the loan processing. Personify takes up to two days to communicate their decision. After the verdict, it takes about 24 to 48 hours for the funds to reach your account.

How and when do I get the Funds?

Personify Financial deposits the funds into your checking account within 24 – 48 hours, subject to the day of the week and the time of approval.

In most cases, though, the lender deposits the money the next business day. The actual availability of funds, however, is solely dependent on your bank.

Borrowers approved and e-signed under the lender’s First Electronic Bank loan program have money in their checking account within 48 hours. But this is only applicable to loan applications submitted between Sunday 9 a.m. and Thursday at 6 a.m. Pacific Time.

What Types of Loans does Personify Offer?

Personify Financial specializes in offering bad credit loans. It offers loans from $1,000 to $10,000, with terms of between 12 to 48 months. You can choose the frequency of repayment as biweekly, semimonthly, or monthly.

The repayment schedules might be confusing. Biweekly translates to once every two weeks, while semi-monthly means twice a month. To save yourself the confusion, you can define specific dates. This flexibility helps you to line up your repayment and paycheck schedules.

The Documents You Need to Apply

Personify accepts application electronically via the internet from a PC, smartphone, or tablet. Sometimes the process is straightforward, and they verify all the information without asking for any documents. However, there are cases where they aren’t able to confirm the data. In such a case, the lender may reach out for the papers that could help verify your identity, your employer, and your source of income. So, you may need to provide the following:

- Upload a copy of ID, passport, or driver’s license

- Recent pay stubs

- Bank statement

- Proof of address – a current utility bill will do.

These documents help in the verification of your application in line with some state’s laws. For example, if you are a legal resident of Illinois, under the Consumer Installment Loan Act (205 ILCS 670/17.4), the lender must obtain proof of income before approving a loan.

Personify allows you to send the documents electronically, which only takes a few minutes. Afterward, the lender may take up to two business days after to get back with a decision.

Once they request these documents, you have up to ten calendar days to submit. Failure to submit the documents over the said period will void your application.

Different states have statutory provisions that require lenders to comply with several factors including interest rate caps on consumer loans, proof of income and the term of the loan.Eligibility for a Personify Financial Loan

If you need a loan through Personify Financial, you must meet the following:

- At least 18 years old.

- A permanent resident of the US.

- Have a valid bank account.

- A resident of eligible states.

- No less than 550.

Eligible states include:

- Alaska

- Alabama

- Arizona

- California

- Delaware

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Kentucky

- Missouri

- Mississippi

- Montana

- Oklahoma

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Washington

How Personify Loan Repayment Work

During loan application, Personify gives you the liberty to choose how you wish to repay the loan. Your options include:

ACH: Perhaps the most popular option used by payday and other lenders. This Electronic Fund Transfer saves you the headache of remembering to make your payments in time. By signing up for this option, you accord the lender the right to electronically withdraw funds from your checking account periodically, in your case, on every payment due date.

Paper Check: You can write a check and send it to the lender by mail. To avoid the inconvenience that comes with mailing, send it early to allow enough time to cover the mailing duration. Remember, it’s your responsibility to ensure the payment arrives on time.

Phone or borrower portal: Call Personify to authorize payment from your checking or savings account via debit card. Alternatively, you can log in to the borrower portal and initiate the order.

Since the lender doesn’t penalize you for settling your loan early and charge interest on reducing balance, you may as well pay the loan sooner to avoid unnecessary costs.

How Much Does Personify Loan Cost?

Short-term loans are not the best credit facilities because they are very costly. Personify loan is no exception. Secured loans offer the best value, but they take time to process. That’s why when you need quick money, same-day loans are your only option.

While we celebrate Personify for its fast decisions and funding speed, with APR ranging between 35% and 179.99%, you might want to consider another lender. If you stick with the lender, you might pay more than triple the amount you borrow. What sense is there? It’s even more worrying if you sign enter for a long term deal.

Personify’s loan terms vary from state to state. For jurisdictions with interest caps, the rate may be on the lower side, but those that don’t, borrowers can pay the maximum possible price. It’s even worse if you add the origination charges and late fees.

Yes, Personify Financial charges origination fees in some states. And depending on your state, you may pay as much as 5% of the principal amount. That only means you part with a minimum of $50, making your actual loan balance to be $1,050. As you can see, this fee can significantly add to your debt, more so if you are asking for a reasonably large amount.

Remember, the costs are calculated based on the amount you borrow. Thus, it doesn’t matter how low the monthly installments are, as the lender spreads the total price across the repayments.

Besides origination fees, you are liable to late fee charges for each late payment. If you activated the auto repayment, but you didn’t have enough money in the bank account to cover that month’s payment, you could end up paying the late payment penalty. That explains why, in certain situations, the last payment balloons.

When you quickly need cash, you may be willing to sign off on that interest rate merely to get your hands on the money. But you must understand how that interest pile up.

You may be quick to jump to Personify Financial loan over payday loan, just because you need cash quickly with its offers. But you must pay close attention to its interest and fees and compare it to what its peers charge. So, you might want to consider other bad credit lenders with better rates that can help you save on excessive interest. After all, you don’t want to enter into a debt that will be problematic to settle.

Most short-term loans charge high rates of interest and fees. They can quickly trap you in a debt cycle. You should consider other options such as state-sponsored programs, nonprofits, and local charities that offer free financial services.Customer Service at Personify

Whereas Personify has scored below par in the cost of the loan, it performs pretty well on the customer service front. But you are paying for it, anyway. We wouldn’t expect anything less.

Riding on the premise of creating “Human Approach to Lending,” Personify gives you maximum attention, with multiple ways to reach out for help. You can connect their support staff by phone, email, or live chat.

It’s not only that, but also, the representatives are respectful, straightforward, and competent. They know and understand their product well. So, if customer care is the only thing on your requirement list, Personify wins. Plus, the fact that you can access the platform anywhere and anytime at the convenience of your hand devices and PC, you’ll not look elsewhere.

Personify Financial Review: The Verdict

All you need to apply for a Personify Financial loan is necessary information, and the entire process is smooth. Our primary concern is the rates. Remember, you are applying for a loan because you have a cash flow problem, so you don’t want to put yourself in an even worse problem of servicing unending debt.

Personify argues that getting a loan when you need it should be a hustle-free process. On that, we agree. At no point, however, should you trade convenience for quality. It may be fast, simple, and conveniently accessible, but all that is pointless if it offers costly loans.

Bottom line, Personify Financial is a quick option for accessing unsecured installment loans, but, depending on the state you reside, there are better options out there.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

Is personify financial scam?

No, Personify Financial is the proprietary service registered under Applied Data Finance. It operates under the federal laws of the US and conforms to the jurisdictional requirements. In a nutshell, the lender is legit, and reports to customer data to credit bureaus.

Can I pay off Personify loan early?

Yes. Personify Financial will not fine you for prepayment. Besides, advance payments help you save on interest and fees. The earlier you pay off the loan, the cheaper the interest you pay in the long run

Personify Financial loan or a payday loan, which is better?

Personify personal loans are not only cheaper than payday loans, but they are also manageable to pay. Also, the lender doesn’t charge prepayment fees. So, a loan from Personify is far much better than a payday loan. But that doesn’t rub away the fact that it is still expensive and there are much better installment loans than it.

Can Personify Help me improve my credit score?

Yes, Personify report to credit bureaus, so, if you make prompt payments, you have an opportunity to build your credit

Personify Financial loan or a payday loan, which is better?

Personify personal loans are not only cheaper than payday loans, but they are also manageable to pay. Also, the lender doesn’t charge prepayment fees. So, a loan from Personify is far much better than a payday loan. But that doesn’t rub away the fact that it is still expensive and there are much better installment loans than it.

Can Personify Help me improve my credit score?

Yes, Personify report to credit bureaus, so, if you make prompt payments, you have an opportunity to build your credit.

US Payday Loans A-Z Directory

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up