Credit Score | Ultimate Credit Score Checking Guide In 2020

Although you might not know it – credit rating bureaus have a significant amount of information on our financial background. Each and every credit product that we have ever taken out can be traced back to the ‘t’. Whether that’s a loan, credit card, overdraft, or cell phone subscription – your payment performance will remain on file – forever.

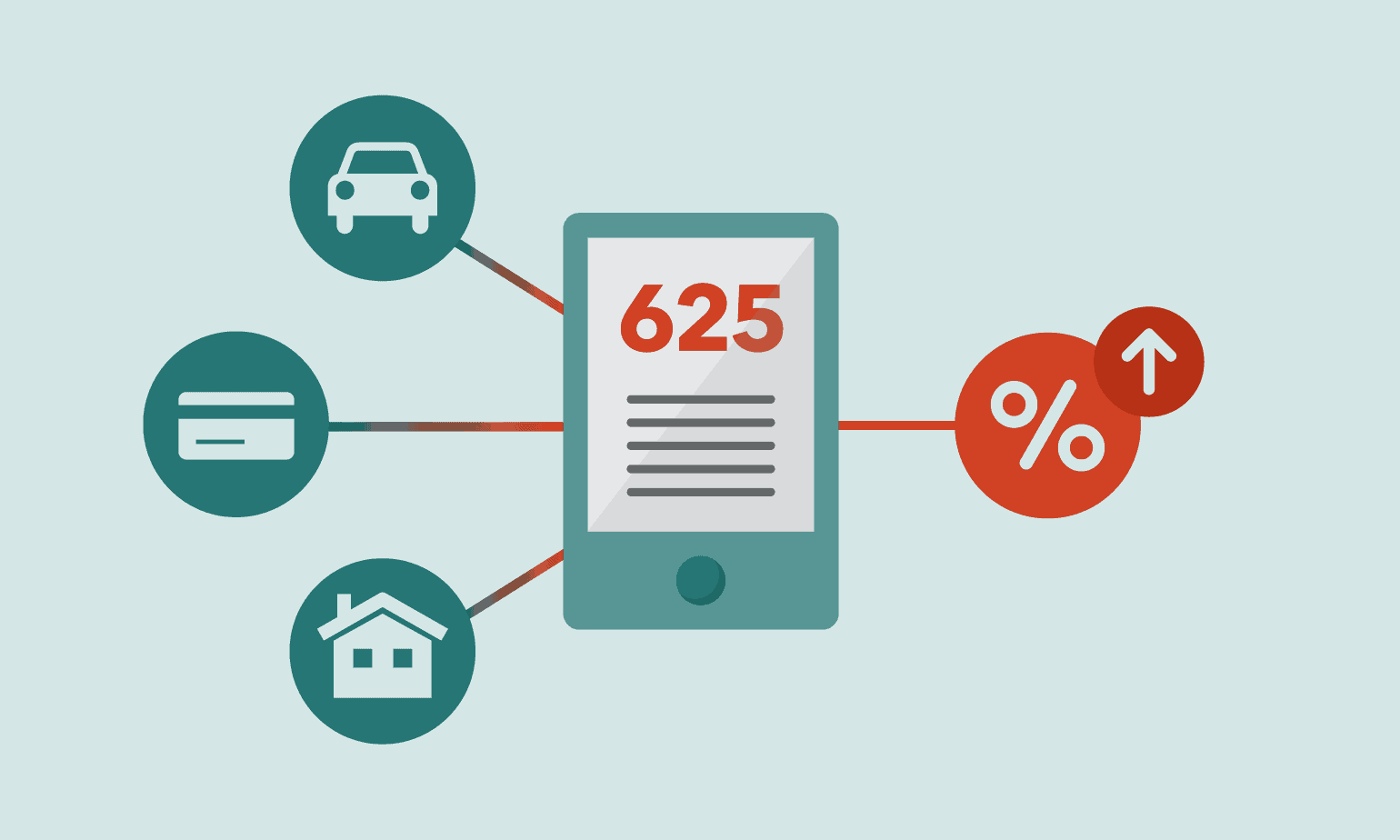

What this means for you is that your FICO credit score plays a major role in your ability to acquire financing. Not only this, but your underlying score will also dictate how much you pay in interest, with the very best rates reserved for those with good or excellent credit.

With that being said, we decided to create the ultimate guide on How to Check My Credit Score. We explain everything from why your FICO credit score is important, what can affect it, how you can improve it, and more.

What is a credit score?

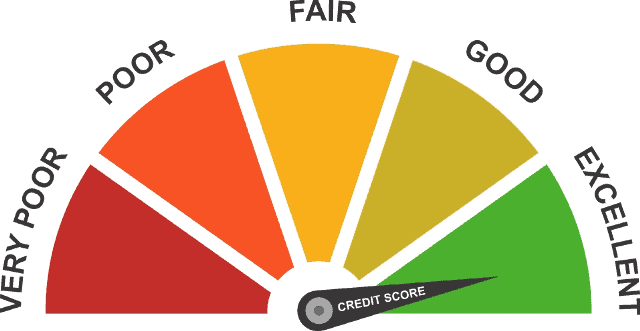

Unless you have never taken out a credit product before, then you will all-but certainly have a credit score. In a nutshell, this is a score that tells lenders and financial institutions how responsible you are with credit. In its most basic form, if you have a consistent history of always repaying your debts on time, then it’s likely that you have a good credit score. On the contrary, if you have a history of missing payments, paying late, or defaulting on your debts, then your credit score is likely to be hampered.

In the US, the vast majority of lenders use something called a Fair Isaac Corporation score, or simply ‘FICO’. This ranges from 300 (bad), up to a maximum of 850 (excellent). In terms of assessing what your credit score should be, FICO will extract data from the main three credit rating agencies. This includes TransUnion, Equifax, and Experian.

Ultimately, the higher your score is, the more chance you have of being accepted for credit-based products. Moreover, you’ll also benefit from better APR rates, and attractive credit-products like 0% interest credit cards that offer super long no interest periods on both balances and purchases.

What information do lenders report?

Often unknown to US consumers, each and every part of your credit journey is reported to the main three credit rating agencies. Whether that’s applying for a new credit card, repaying your monthly balance, or taking out a debt consolidation loan – if it’s based on credit, it gets reported.

Here’s a breakdown of what gets reported.

💳 Applying for Credit: First and foremost, when you apply for a new credit product such as a loan or credit card, the application might be reported to the main three credit agencies. The reason we say ‘might’ is that this depends on a couple of key factors.

Firstly, a lot of loan and credit card providers will allow you to engage in a ‘soft credit application’, meaning that the initial phase of the application is not reported. However, if you decide to proceed with your pre-approval rates, and thus – take out the credit product, then this will be reported.

💳 Repayments: Once you have obtained a new credit product, your entire payment performance is likely to be reported. This not only includes whether or not you made your repayment on time, but how much you paid. For example, if you have $5,000 outstanding on your credit card, but you only pay the minimum of $25 each month, then the credit rating agencies will be able to see this.

As you’ve probably guessed, paying such a small amount off in relation to the outstanding debt won’t go in your favor when it comes to your FICO score.

💳 Missed/Late Payments & Defaults: On top of reporting your on-time payments, lenders will also report late and missed payments. This is where your credit score can take a major hit, especially if the late payment turns into a missed payment. This is why you are best advised to set-up an automatic debit agreement, so that you can be sure that you always make your repayments on time.

Breaking down my FICO score

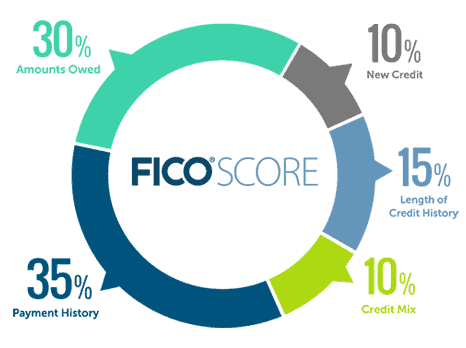

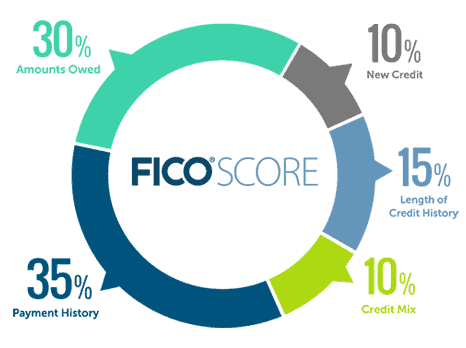

Attempting to evaluate how our credit score id determined used to be a difficult task, not least because FICO did not make this information public. However, the good news is that we now know how they assess what score to give us – based on five key factors.

1. Payment History – 35%

With a weighting of 35%, the largest chunk of your FICO credit score is determined by your payment history. In a nutshell, this includes each and every credit payment that you have ever made. This includes everything from credit card payments, loan payments, and even utility bill payments.

Essentially, FICO will look at your credit profile favorably if you have a consistently long track-record of always meeting your repayments on time. In other words, your credit profile has little, if any, missed or late payments at all.

2. Amount of Debt Utilized – 30%

With a weighting of 30%, the second most important metric that FICO will look at is the amount of debt that you currently have outstanding, in relation to your available credit limits. For example, if you have a credit card with a $10,000 credit limit, and you currently have $9,000 outstanding, then this indicated that you have utilized the vast majority of your available debt.

Ultimately, although there isn’t a benchmark percentage that we know of, your score will look less favorable if you are constantly maxing out your available credit – especially on your credit cards and overdrafts.

3. Length of Credit History – 15%

The next thing that the credit rating agencies will look at is the length of your credit history. At a weighting of 15%, the longer the relationship you have had with credit, the better your score will be. This is why younger people are often unable to obtain the best financing products, as they don’t have a long enough track-record to illustrate how responsible they are with credit.

The great news is that this particular FICO metric is super easy to improve. There is a range of instant approval credit cards that will offer you a card irrespective of your FICO score. By paying for everyday purchases with your card, and then clearing the balance in full each and every month, you will be increasing the length of credit history that rating agencies have on you.

4. New Credit – 10%

As we briefly mentioned earlier, FICO will also look at how many new credit applications you make. In effect, by constantly applying for new credit cards, loans, and other financing products – you are demonstrating to the main three credit agencies that you are in dire need of credit. This will, of course, have a negative impact on your credit score.

We would suggest that you only apply for financing products as and when you need them.

5. Credit Mix – 10%

The final metric that FICO will look at is your credit mix. This is potentially the most opaque factor, not least because FICO does not make it clear what sort of credit mix they prefer.

Nevertheless, the general consensus is that credit rating agencies like to see a wide range of credit products such as loans, credit cards, overdrafts, and a cell phone contract – as it shows that you are able to handle different financing options.

How often is my FICO score updated?

In the vast majority of cases, lenders will report repayment performances on a monthly basis. This will include all material information that they have on your outstanding agreement, such as:

✔️ When you made your payment

✔️ How much you repaid

✔️ How much you have outstanding on your debt

✔️ What your credit limit is

✔️ Whether you have applied for any other financing products (such as an extension on a loan)

However, some lenders are significantly more active in how frequently they forward their reports, with some entities doing this every five days. Ultimately, as long as you always meet your repayments on time, then the sooner this is reported, the better.

How do I check my credit score?

It is absolutely crucial that you keep tabs on what your FICO credit score is. For example, if your score is much lower than what you initially anticipated – but you are unaware of this, then you won’t have the ability to actively improve it. Furthermore, there is always the chance that there is some inaccurate information on your credit report that you are unaware of. This could be having a negative impact on your FICO score, which again, illustrates the need to regularly check your score.

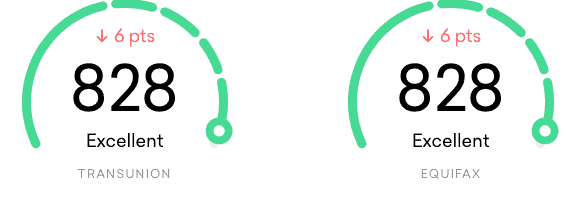

❓ With that being said, you should keep an eye on your credit profile at least every 3-6 months. To do this, you typically have two options. You can either obtain your credit report from one of the main three credit reporting agencies directly, or use a third-party entity.

Option 1: Go direct with one of the main three credit bureaus

TransUnion – $24.95 per month

As one of the big three US-based credit reporting agencies, TransUnion will hold a significant amount of data on you. If you decide to obtain your credit report from TransUnion directly, it will set you back a whopping $24.95 per month.

As such, this option will only suffice if you are actively looking to improve your credit score, and need direct, instant access to your score on an ongoing basis. This could be useful if you are in the process of applying for a mortgage.

Here’s what you get for your $24.95 per month:

✔️ Unlimited score and report access – with daily updates

✔️ Email notifications when there is a critical change to your score

✔️ Assistance in improving your score via CreditCompass

✔️ Fraud protection email notifications when a new credit product is applied for

✔️ $1 million ID theft insurance

Experian – $19.99 per month – 30 Day Free Trial

Much like in the case of TransUnion, Experian will also be in possession of a significant amount of your credit-related data. Don’t forget, when lenders report your repayment performances, they often do this with all three agencies, so it’s likely that each agency has much of the same information on you.

Nevertheless, Experian also offers a monthly subscription, which comes in at a slightly cheaper $19.99 per month. However, the agency does offer a rather tempting 30-day free trial. This gives you access to the same features available within the paid plan, so this is most definitely worth exploring.

Here’s what you get for your $19.99 per month:

✔️ Access to your full Experian report

✔️ View credit scores from all three agencies

✔️ FICO score simulator to find ways of improving your score

✔️ Daily score tracking

✔️ Identity theft insurance

✔️ Dark web surveillance

✔️ Payday loan monitoring

Equifax – $19.95 per month

At a monthly price of $19.95, Equifax is just about the cheapest of the main three credit reporting agencies. Unfortunately, unlike Experian, Equifax does not offer a free 30-day trial. However, you can cancel your plan at any time without being locked in, which is great.

By going with Equifax, you’ll be accustomed to much of the same information that is held by both TransUnion and Experian. This is because, as noted earlier, lenders will typically report your performance to all three agencies, as opposed to singling out one provider.

Here’s what you get for your $19.95 per month:

✔️ Access to your full Experian report

✔️ Assess your score across all three agencies

✔️ Automated credit score monitoring

✔️ Social security number tracking

✔️ Submit a dispute if the information on your report is incorrect

Option 2: Use a third-party provider

Credit Karma – Free, simply become a member

Credit Karma is a hugely popular online platform that offers free advice on all-things credit. This includes a range of credit card and loan reviews, as well as tips on how to handle credit-based products. With that being said, it is now possible to obtain either your Experian or TransUnion credit report from Credit Karma for free. All you need to do is become a member, which doesn’t require any payment details or fees.

In even better news, as Credit Karma is owned by TransUnion, you also have the ability to file disputes directly on the Credit Karma website.

Here’s what you get with Credit Karma

✔️ Free credit report with both Experian and TransUnion

✔️ File TransUnion disputes directly on the website

✔️ No payment details needed – completely free

✔️ Monitor your score 24/7

✔️ Native mobile app available on Android and iOS devices

Credit Sesame – Free Credit Score Monitoring

Credit Sesame offers a similar level of service to Credit Karma. However, the platform has no affiliation with any of the main three credit agencies, which could be a benefit. Nevertheless, by simply registering an account, you can access your Equifax credit report. Your score is updated on a weekly basis, which is more than sufficient to keep tabs on your credit profile regularly.

Moreover, you can either use the platform via the main website, or by downloading its native mobile app. On top of receiving your free credit score, you’ll also have access to personalized credit card offers – which are tailored specifically to your individual credit profile. This is actually beneficial, as you can avoid applying for credit cards that you are unlikely to be approved for.

Here’s what you get with Credit Sesame

✔️ Free credit report with Equifax

✔️ Your score is updated on a weekly basis

✔️ No payment details needed – completely free

✔️ Critical email notifications

✔️ Native mobile app available on Android and iOS devices

✔️ Personalized credit card offers based on your individual score

FAQs

What is a FICO score?

How can I check my credit score?

Is it worth paying a monthly fee with a credit reporting agency?

Which credit bureau has the most information on me?

What if I find incorrect information on my credit report?

What credit score do you start on when you turn 18?