Small business loan approvals at mainstream banks hit a new record in September 2019, a report from Biz2Credit Small Business Lending Index shows.

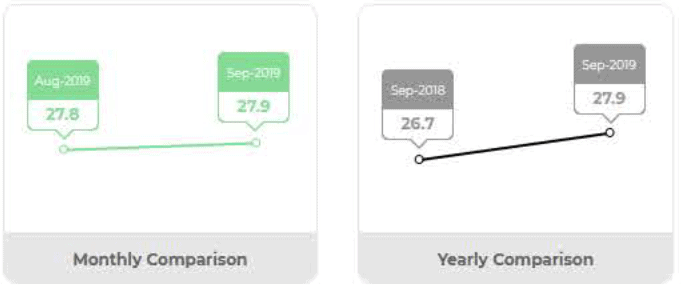

According to the report, the approvals for small business loan applications at big banks went up to 27.9 percent, which is an increase in both monthly and yearly comparisons. At the same time, approval percentages at small banks remained above 50 percent in the same period.

In yet another similar development, the Labor Department’s report dated October 4 shows that nonfarm payroll employment went up by 136,000 jobs in September while the unemployment rate was at a 50-year low of 3.5 percent. According to the U.S. Bureau of Labor Statistics, healthcare, business, and professional services were the leading sectors in terms of employment.

Approvals at Small Banks

Small bank approvals of small business loan applications remained relatively constant in September. In August 2019, small banks recorded 50.3 percent in terms of small business loan approvals, the same figure they did in September 2019.

However, for annual comparison, there was an increase given that small banks scored 49.9 percent in September 2018.

Speaking about the improvement, Biz2Credit CEO Rohit Arora said:

“Traditional bank loans and SBA loans are available at smaller banks. Because of the overall strength of the economy, greater numbers of businesses qualify for funding. Having approval rates above 50% mark is indeed a good sign.”

Institutional Lenders Approval Rates

When it comes to institutional lending, the approval rates again increased by a tenth of a percent to 65.9 percent compared to the August record of 65.8 percent. On an annual comparison, there was a substantial increase in the institutional lenders’ approvals coming to 65.9 percent compared to 64.5 percent in September 2018.

The report also mentions alternative lenders and credit unions. For alternative lenders, there was a slight decrease in small business loan approval rates from 56.6 percent in August to 56.5 percent in September. At the same time, credit unions witnessed a slip in the approval rates from 40 percent in August to 39.7 percent in September.

Overall, Biz2Credit CEO maintained that all parties, including banks, alternative lenders, and institutional lenders, are actively involved in small business lending.

Get more information :

Further information on raising finance through loans or payday loans can be found here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account