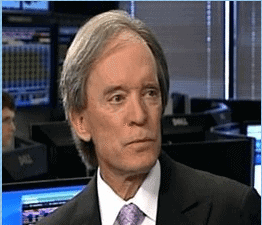

In a recent interview with Bloomberg’s Erik Schatzker and Stephanie Ruhle, Bill Gross said that PIMCO currently likes the 5 year treasury.

In a recent interview with Bloomberg’s Erik Schatzker and Stephanie Ruhle, Bill Gross said that PIMCO currently likes the 5 year treasury.

Why Most People Hate Treasuries Right Now

The large majority of investors and market pundits think that treasuries of all flavors are currently a terrible investment. So, when the world’s largest bond fund manager says that he likes the 5 year treasury, we take notice.

According to the treasury rates page here at Learn Bonds, the 5 year Treasury is currently yielding .80%. In addition to the fact that less than a 1% yield for the next 5 years is not very exciting, there are two other reasons that most people disagree with Gross that the 5 year is a good investment:

- The duration on the 5 year treasury is about 4.89. That means for every 1% move in the 5 year treasury rate, the value of the note drops by about 4.89%. So in order for you to wipe out your whole yield for the year, the interest rate on the 5 year treasury only needs to rise by about 16 basis points. (you can learn more about duration here)

- By visiting the CD Rates page here at Learnbonds, you can get a 5 year CD that currently pays 1.7%, or more than double the current rate on the 5 year treasury bond.

So why does Bill Gross like the 5 year treasury?

Two reasons:

The first reason is that he feels that the Fed is going to remain active on the shorter end of the yield curve, keeping shorter term rates low for a good amount of time to come. So, very simply he feels that the chances of rates rising significantly from here in the near term are slim.

The second reason is that Bill doesn’t plan on holding the 5 year treasury to maturity. By employing a strategy called rolling down the yield curve, he plans to increase the return that he earns on the 5 year to around 1.5% over the next year.

What is Rolling Down the Yield Curve?

Its when you buy a longer term bond and then sell the bond as it moves towards its maturity date. The strategy is employed when the yield curve is upward sloping meaning that longer term rates are higher than shorter term rates. Assuming rates stay relatively stable between the time you purchase the bond and the time that you sell it, the bond will increase in value as it moves towards maturity (this makes some assumptions like the bond is not trading at a premium for simplicity’s sake). This gives you more bang for your buck as you benefit not only from the interest payment on the bond but also from the price appreciation. You can learn more about rolling down the yield curve here.

Lets look at what Bill Gross is probably thinking:

On the day this article was written the 5 year treasury was yielding .78%. That same day the 4 year treasury was yielding .59%. So that is a difference of .19%. Now the 4 year treasury has a duration of around 3.9. So if you multiple .59 X 3.9 you get .74%. (don’t know what duration is? go here)

So if you buy the 5 year treasury today and sell it in 1 year then, assuming interest rates do not change, you earn the .78% yield on the bond + the .74% price increase in the value of the bond. That gives you a total return of 1.52%. (this again makes a few assumptions for simplicity’s sake).

While that’s still not as good as what you can get from a top paying 5 year CD, you do not have to lock your money up for 5 years.

Another top bond fund manager, Jeff Gundlach, thinks that the 10 year treasury may not be such a bad investment right now either. Learn why here.

For more on rolling down the yield curve go here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account