With the legalization of hemp in various countries, new opportunities have opened up with investors looking where to put their money. This comes after years of suppression and strict regulations around the Cannabis sector. It is worth noting that marijuana and hemp are the main segments of the cannabis plant family. The difference is that hemp is cannabis, which has 0.3 percent or less of the psychoactive chemical THC. On the other hand, marijuana contains a more significant amount of THC.

The hemp industry has massive potential for growth based on numbers. Research shows that hemp-based products might hit $22 billion by 2022. Major players in the hemp stocks are focusing on hemp-based products like skincare creams to dietary supplements. Most companies are recording impressive profits. If you want to invest in the cannabis sector, here are the 5 hemp stocks to buy in 2019.

Aphria (NYSE: APHA)

Aphria (NYSE: APHA) has built a reputation in the medicinal cannabis production sector with support from the Canadian government. The firm has a presence in over ten countries across five continents. As a prominent industry player, Aphria offers investors the perfect platform to join the hemp industry.

At the moment, Aphria is already a profitable company. In the latest quarter, the Canadian based firm posted a profit of CA$15.8 million, or CA$0.05 per share, for the three months. This profitability can be tied to market moves that are positioning Aphria for the future.

The firm has been focusing on expanding its global brand led by the recent acquisition of the German medical cannabis unit CC Pharma. This was huge for Aphria after the company posted a quarterly loss of CA$108.2 million, in the prior quarter. This came at a time Aphria received the maximum possible five licenses (of 13 issued) to undertake domestic cannabis cultivation in Germany. Note that out of the 79 companies that competed in the tender, only three received licenses.

Furthermore, Aphria recently completed a $425 million deal to acquire Nuuvera, a medical marijuana company setting base in Europe, Africa, and the Middle East. With the agreement, Aphria has one of the most significant global presence with increased technological proficiency in extraction, distillation, and processing cannabis.

On the other hand, Aphria has plans for the United States market ahead of the planned legalization of medical cannabis. Aphria is currently planning partnerships, acquisitions, and strategic alliances as it gears for the diverse American market.

The support from the Canadian government means that Aphria might be around for many years, making it a perfect investment platform. For investors, Aphria presents them with a growth opportunity. For example, the company has plans to launch premium products that will have healthy demand, and once the production capacity increases, we should see something new from Aphria.

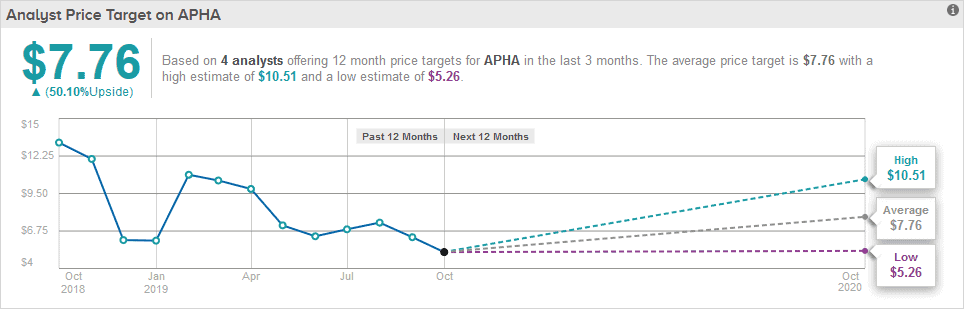

Analysts who offer a one-year price target on Aphria have predicted a $10 mark which is above the current price of $5.33. According to Simplywall.st, an intrinsic value based on the future cash flow model shows a higher cost of $29.35. In this case, the model assumes an 80% annual growth rate in earnings.

Furthermore, Aphria has a new management that has brought about stability, a corporate focus, and a new level of professionalism, giving the firm an edge over competitors.

Aurora Cannabis (NYSE: ACB)

Aurora Cannabis (NYSE: ACB) is another Canadanian based medicinal marijuana production company. The company has a history of having lucrative returns for investors despite missing the fourth-quarter revenue guidance that it had provided only a few weeks before its quarterly update. The fourth quarter prediction stood at CA$98.9 million, which came short of the predicted CA$100 million and CA$107 million. Despite the slump, Aurora Cannabis remains a leading investment platform in the hemp industry.

To increase the worth of its stock, ACB has been signing strategic partnerships and acquisitions across the pot market. The firm’s acquisition of MedReleaf in a $250 million all-stock deal, gives Aurora Cannabis an edge. Under the agreement, all operations have been consolidated to help in cutting costs and gain efficiency. Aurora and MedReleaf together expect to produce over 570,000 kilograms per year of cannabis through nine facilities in Canada and two in Denmark.

One of Aurora Cannabis’s strengths is its global presence that safeguards its stocks. Aurora has operations in 24 countries outside Canada with operations in Europe, Latin America and the Caribbean, Australia, and South Africa. Furthermore, the company holds a leading market share in Germany, which boasts the most significant legal, medical cannabis market outside of North America.

Just like any other firm, ACB is eyeing the American market awaiting the legalization of medicinal marijuana. Despite having one of the most significant international footprints among Canadian marijuana stocks to buy, ACB has strategic plans for the US. If U.S. legalization doesn’t quite happen, management has a backup plan because global weed use has grown 60% over the past decade, putting ACB in the top position.

Aurora also plans to improve its product through research going by recently issued Health Canada licenses for outdoor cultivation. The company will now have two sites located in Quebec and British Columbia. The sites are for cultivation research to develop new technology, genetics, and intellectual property to drive sustainable, high-quality outdoor production. Aurora purposefully chose outdoor sites because they represent two different growing environments. The sites aim to grow high-quality cannabis.

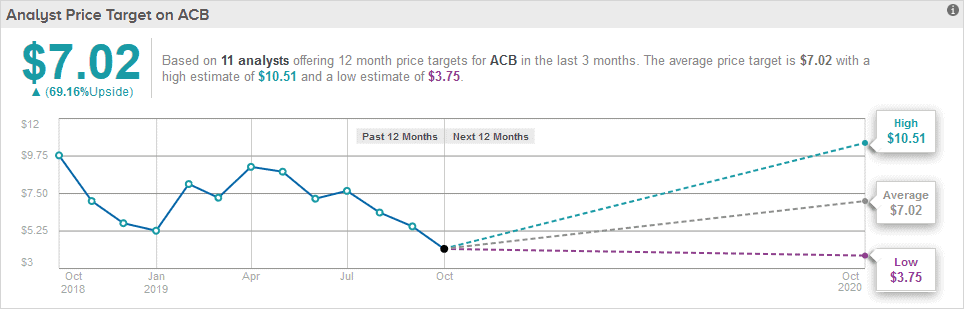

Currently, Aurora stock is trading at $5.82, and analysts predict that it is an outstanding long term investment plan. One year prediction shows that the shares are projected to have the average price target of $7.02.

Charlotte’s Web Holdings Inc. (TSE: CWEB)

Charlotte’s Web (TSE: CWEB) is a firm based in Colorado, and it is bound to benefit significantly if the pot is legalized in the United States. The company is known as a pioneer in creating whole-plant hemp health supplements. Charlotte’s Web is the leading producer of cannabidiol available both online and in stores.

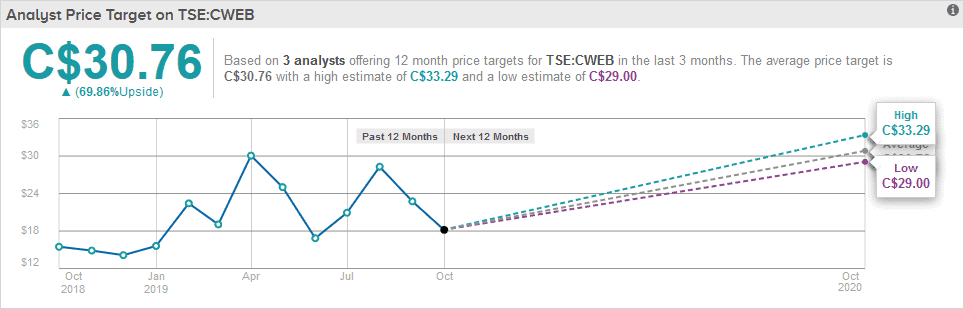

From an investment point of view, Charlotte’s Web had a great start to 2019 with an all-time high of $25.25. However, it has since gotten caught up in the significant volatility that affected the cannabis sector throughout the year. However, the stocks have dropped back to $ 13.86, presenting a high window of investment.

We have several catalysts that can spur the growth of CWBHF stocks in 2019. First, the increased production is a significant player. For example, in 2017, hemp production stood at 63,000 pounds, and within a year, the number had skyrocketed to 675,000 pounds. Recently, the firm revealed that it was expanding its cultivation, production, and research and development to support forecasted sales growth from $125.9 million in 2019 to $454.19 million in 2021. Already, a facility is under construction to meet the projected demand.

With more distribution outlets, the stocks should rise. Additionally, the largest retailers like Kroger or The Vitamin Shoppe coming on board to sell Charlotte’s Web products. Charlotte’s Web’s products are currently sold in 8,000 retail locations across the United States. According to projections, chain retailers will make up 64% of the $22 billion hemp-CBD markets by 2022, amounting to $14.1 billion in sales.

Furthermore, the company is increasing its product portfolio with the introduction of extract-infused CBD gummies that come in three flavors.

Investors have more reason to put their money is CWBHF considering that Charlotte’s Web is among a few cannabis companies that remain profitable. CWBHF is expected to earn $0.19 per share this year, followed by $0.69 in 2020 and up to $1.07 by 2021.

In terms of regulations, actions taken by the U.S. Food and Drug Administration (FDA) might play a role in the future of CWBHF. The agency’s rules on CBD products would hurt the company. From a positive view, CWBHF will have a clear picture of what is required to do once the precise regulations is in place.

Charlotte’s Web will remain at the forefront since it enjoys a healthy head start. The firm already cultivates 300 acres of hemp plants, thanks to Farm Bill legislation that permitted pilot programs for research purposes.

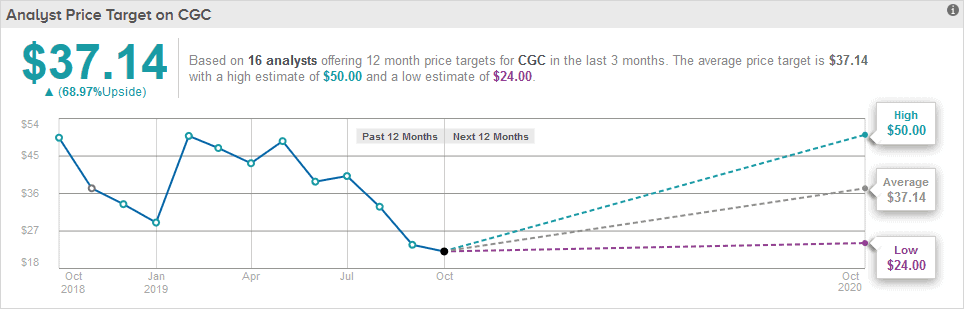

Canopy Growth (NYSE: CGC)

Canopy Growth (NYSE: CGC) was the first cannabis company to list on the New York Stock Exchange. It boasts of a $13.6 billion market value. The cannabis company focuses on producing and selling marijuana in the recreational market in Canada. Its core brands are Tweed and Bedrocan. Tweed is a licensed producer of medical marijuana.

Notably, one factor that can drive Canopy Growth stocks higher is its expansion plans and a new range of products. Canopy has already filed for U.S. trademarks for potential brand names, including CBD Simplified, CB-Tea, Hemp Break, and Hemp Burst. According to company management, by the end of 2019, its presence in the United States should be advanced.

Furthermore, Canopy Growth has access to expertise in building successful brands in the U.S. Constellation Brands, which owns a 38% stake in Canopy Growth, is partnering with the company to develop and market cannabis-related products. Constellation’s Corona and Modelo brands rank at the top of the U.S. premium beer market.

Investors have more reason to put their money in Canopy Growth because the company bounced back by 16.3% in September after a brutal sell-off over the past few months. Furthermore, a report from the Canadian cannabis market share shows that Canopy Growth is dominating the market.

In future, Canopy Growth stocks will get a boost from Canada’s ‘2.0 market’ in cannabis. The 2.0 market is a plan by Canada to let pot producers add popular vapes, edibles and infused beverages to be sold legally before the end of 2019. At the moment, only dried cannabis flowers, oil, and sublingual’s sprays are legal for sale in Canada.

Just like notable brands, Canopy realizes the power of bringing onboard influencers to help push the supply of its products. The firm has signed a deal with celebrities like better-living guru Martha Stewart and actor Seth Rogen. The company also have an agreement to eventually buy Acreage Holdings, a U.S. cannabis company backed by former House Speaker John Boehner. This deal will give Canopy Growth an upper edge in the US once marijuana is legal on a federal level. Furthermore, the company has a plan to produce hemp, most specifically CBD in New York state.

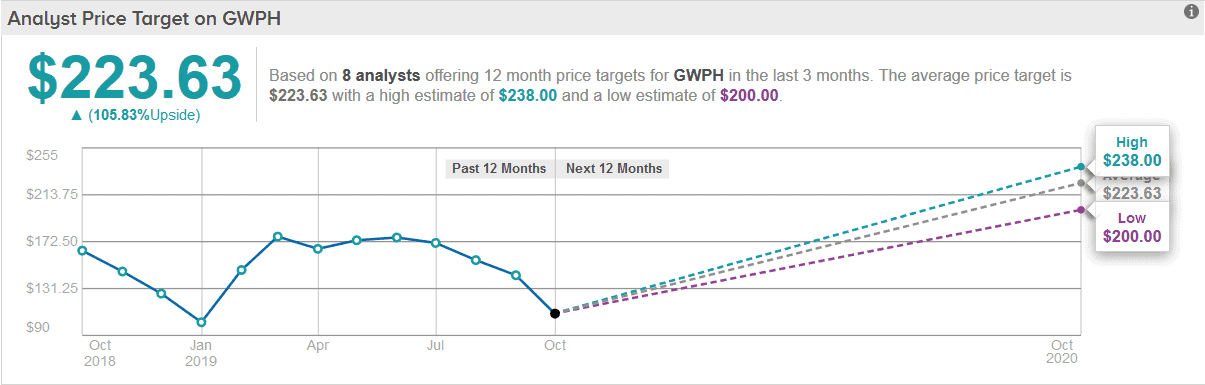

GW Pharmaceuticals (NASDAQ: GWPH)

GW Pharmaceuticals (NASDAQ: GWPH) is a British biopharmaceutical company known for its Sativex product which was the first natural cannabis plant derivative to gain market approval. Another cannabis-based product is known as Epidiolex, which was approved for the treatment of epilepsy by the US Food and Drug Administration. The company has a deep pipeline of additional clinical-stage cannabinoid product candidates under development with a specific focus on neurological conditions.

For investors, GW has a long runway of growth. In the second quarter of 2019, Epidiolex generated net sales of $68.4 million, which is 204% higher than the drug’s sales in the first quarter. Overall, GW’s Q2 revenues were $72.0 million, 2,080% higher than a year earlier.

Recently, GW got approved to launch Epidiolex to treat two rare forms of epilepsy in the U.K. and the rest of Europe. This is another milestone for the company’s future. As a result, the company has strategies for the European market where the company will be selling cannabis-derived products in France, Germany, and the U.K.

It is worth noting that GW’s expenses are high, and its revenues are low; something can be positive for the investors. In the first half of 2019, the firm had an operating loss of $80.7 million, 46% lower than in the same period in 2018.

Over the last five years, GW Pharmaceuticals witnessed a revenue shrink by about 20% per year. However, the stock has returned a 14%, compound, over the period. For investors, it is worth to check factors like profitability in a bid to try to understand the share price action. In some cases, it may not be reflecting the revenue.

GW Pharmaceuticals is also set to submit for FDA approval of Epidiolex in treating tuberous sclerosis complex (TSC) later this year. If the application is approved, the firm will expand the market for the drug to another 50,000. GW has already launched a patient enrollment in phase 3 clinical study evaluating Epidiolex in Rett syndrome, a disease that causes seizures.

With a market capitalization of about $4.6 billion, GW Pharmaceuticals’ Epidiolex will likely top annual sales of $1 billion at its peak in about five years. In real sense, the company’s valuation already reflects key growth expectations for the CBD drug. Analysts have remained optimistic about GW’s prospects by targeting the average price for GWPH stock at $223.63.

Conclusion

With the hemp industry growing, many players are coming into the picture. With many countries planning to legalize marijuana, it means that the sector might be crowded soon.

For investors, deciding on the right firm to invest in can be a challenge. However, with sufficient research and due diligence, one should be in a position to settle on the ideal company. Additionally, to make your investing easy and secure, make sure you choose a trusted stock broker for your operations.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account