Over the weekend, General Motors (GM), the largest US automakers, unveiled two electric vehicle models. 2021 is turning out to be a pivotal year for the company as it transitions from a predominantly ICE (internal combustion) engine carmaker to an automaker producing zero-emission vehicles.

On Sunday, General Motors unveiled the redesigned Chevy Bolt Electric model along with the new Chevy Bolt EUV (electric utility model). The Chevy Bolt was launched in 2017 and was hailed as a “Tesla-killer” by many.

General Motors launched new models

The revamped Chevy Bolt Electric would start at $31,955 which is more than $5,000 cheaper than the previous model. Notably, electric vehicle makers including Tesla have been lowering the vehicle prices to pass on the savings from lower battery costs to consumers.

While this helps in the increased adoption of electric vehicles it also shows competitive pressure in the electric vehicle industry where legacy automakers like GM and Ford are competing with pure-play electric carmakers to get a share of the booming electric vehicle market.

Chevy Bolt

The Chevy Bolt’s revamped model would have a more upright bumper cover and new interior seats that “more comfortable with a triangular geometric pattern and contrast color stitching providing a more upscale look and feel,” according to Jesse Ortega, executive chief engineer for the model. The model would have a range of 259 miles on a full charge which is lower than what Tesla Model 3’s base model offers.

It is worth noting that having a higher range in electric vehicles helps in lowering the range anxiety that potential buyers might have. Last month, Chinese electric vehicle maker NIO unveiled its ET7 sedan that would have a range of 621 miles with a 100 kWh battery.

General Motors launches Bolt EUV

Along with the revamped Bolt Electric, General Motors also launched the Bolt EUV. General Models launches Bolt utility vehicle that would start at $33,995 and would have a range of 250 miles. GM intends to launch 30 new electric vehicle models globally between 2020-2025 and these two models are part of the scheme.

Bolt has been General Motors’ flagship electric vehicle brand. “Since 2017, we have sold more than 100,000 Bolt EVs globally, and our owners have accumulated more than 1.2 billion miles of EV travel,” said Steven Majoros, Chevy vice president of marketing. He added, “Bolt EV has helped make Chevrolet the number two selling EV brand and current Bolt EV sales were up 26% in 2020.”

General Motors autonomous driving

Both the Bolt EUV and Bolt Electric would feature the Super Cruise semi-autonomous driving system. Both these models would be the first from General Motors to feature the autonomous driving system. Tesla has its own autonomous driving system called the Autopilot. The company has been gradually increasing the price of the FSD (full self driving) option and it now costs $10,000.

Tesla’s CEO Elon Musk expects the FSD price to eventually rise to $100,000. During the company’s fourth quarter earnings call, he tried to justify Tesla’s soaring valuations by pointing to its software capabilities.

Why 2021 is a pivotal year for General Motors

There has been a tectonic shift in the automotive industry. A few years back, electric models were just a passing mention in the product portfolios of legacy automakers. Fast forward to 2021, all legacy automakers see zero-emission vehicles as the future. Along with the push from governments, there has also been a higher demand for zero-emission vehicles from consumers.

General Motors is going zero emission

Earlier this year, GM said that it would sell zero-emission vehicles by 2035. While Ford has also committed billions of dollars to electric vehicles, General Motors became the first Detroit automaker to commit fully to a zero-emission future.

“General Motors is joining governments and companies around the globe working to establish a safer, greener and better world,” said General Motors’ CEO Mary Barra in a statement. She added, “We encourage others to follow suit and make a significant impact on our industry and on the economy as a whole.”

Cruise

Earlier this year only, Cruise, which’s backed by GM received an investment from Microsoft. In its fourth quarter earnings call, General Motors said that Cruise is now valued at an estimated $30 billion. The company has now started using autonomous technology in its vehicles which again makes a pivotal shift for the legacy automaker. Also, in 2021, for the first time, General Motors would invest more in zero-emission and alternate vehicles as compared to its ICE vehicles.

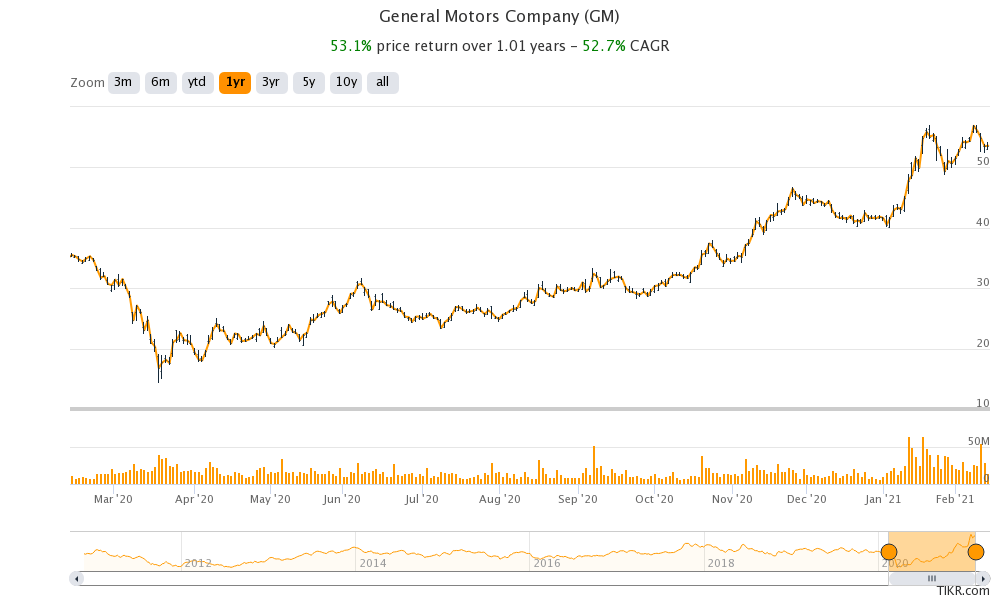

Stock markets have taken note of General Motors

Over the last few years, markets have been cold to legacy automakers like Ford and General Motors. Investors have instead preferred pure-play electric vehicle companies like Tesla and NIO.

Looking at the market capitalizations, with a market cap of nearly $800 billion Tesla is the most valuable automaker globally. Its market capitalization is more than the combined market caps of Toyota Motors, Ford, General Motors, and Volkswagen put together. Even the loss-making NIO, which sells only a few thousand vehicles every year, has a market capitalization of nearly $100 billion, ahead of GM.

Electric vehicles

That said, markets have now started to take note of the evolution of GM into a zero-emission automaker. The stock has gained 53% over the last year and 29% year to date. While the stock’s returns are nowhere near the 740% returns that Tesla delivered in 2020, it nonetheless shows that markets are finally warming up to General Motors stock after years of a cold shoulder.

Should you buy General Motors stock?

GM stock trades at an NTM (next-12 months) price to earnings multiple of 10.4x which is nowhere near what Tesla trades at. As General Motors ramps up its electric vehicle and autonomous driving plans, it could see a valuation rerating.

During General Motors’ fourth quarter earnings call, RBC Capital Markets analyst Joseph Spak asked the management about plans for unlocking value. Notably, many analysts have been contemplating that the company would separate the electric vehicle business to unlock value.

General Motors could see a valuation rerating

Responding to the question, General Motors CFO Paul Jacobson said “I would say is that there’s tremendous opportunity here to help the market understand that we’re really transitioning from what I would say has been historically kind of an old-school industrial-type mindset for the market to a real technologically savvy, growth-oriented company that’s really going into a lot of new markets.”

He added, “And as we see those continue to develop and we continue to ratchet success stories like Cruise and what I believe BrightDrop will be as well as the EV portfolio, I think there’s a lot of opportunity here to drive value for our shareholders.”

You can buy General Motors stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account