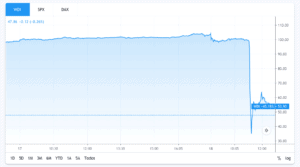

Wirecard shares plummeted more than 66% on Thursday morning after the German payments group said its auditor had found a €1.9bn (£1.71bn) black hole in its accounts.

The fintech firm said there were indications a Wirecard a trustee had tried to “deceive the auditor and create a wrong perception of the existence of cash balances” through various bank accounts.

The group said in a realease: “There are indications that spurious balance confirmations had been provided from the side of the trustee respectively of the trustee’s account holding banks to the auditor in order to deceive the auditor and create a wrong perception of the existence of such cash balances or the holding of the accounts for to the benefit of Wirecard group companies”.

Wirecard (WDI) shares made some gains and were 45% down later on Thursday afternoon, with the stock trading at around €53.9, down from yesterday’s closing price of €103.30 per share.

Wirecard’s chief executive Markus Braun (pictured) added: “It is currently unclear whether fraudulent transactions to the detriment of Wirecard AG have occurred. Wirecard AG will file a complaint against unknown persons”.

If the company fails to provide audited financial reports, conducted by Ernst & Young, by Friday it could face the termination of around €2bn in corporate bank loans, a move that could lead to an immediate default or even bankruptcy.

Investors are already calling for an in-depth revision of the company’s leadership amid the scandal, especially since Wirecard had already been under suspicion of potential fraud and false accounting after a report from KPMG was released last month saying that the firm was unable to verify roughly €1bn in revenues recorded on its books.

The Aschheim-based digital payments processor is also the subject of a long-running investigation into potential market manipulation from German’s financial watchdog, Bafin, based on allegations of collusion with short sellers to manipulate the price of the company’s shares.

Here is a link to the company’s full press release on the matter: Wirecard’s press release.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account