Germany’s financial crime unit handed police “only two” of a 1,000 reports it had about suspicious trading activity at Wirecard before the payments firm collapsed in June.

The Financial Intelligence Unit (FIU) passed on only a couple of reports about the former fintech champion before June, according to the Munich public prosecutor on Tuesday.

Wirecard filed for insolvency in June with debts of €4bn, after the discovery of a €1.9bn accounting black hole that auditor EY said was the result of “sophisticated fraud, involving multiple parties around the world in different institutions with a deliberate aim of deception.”

Munich police have arrested former chief executive Markus Braun and two other board members over the fraud. The company’s chief operating officer Jan Marsalek has fled to an apartment in the west of Moscow. They face a range of charges including fraud, breach of trust, misrepresentation and market manipulation.

Witheld reports

The FIU reportedly received 1,000 reports on Wirecard, around 100 of which contained information about suspicious transactions at the online payments firm, according to broadcaster NDR and Süddeutsche Zeitung.

A spokesman for the Munich public prosecutor said “only two reports from the FIU were received” before June 2020, both of which had triggered investigations.

The FIU has gone back to its previous Wirecard reports and is rechecking them for evidence of falsification of accounts, fraud, embezzlement, market manipulation and insider trading.

Police have previously criticized the unit for delaying or withholding money laundering reports.

Left Party politician Fabio de Masi said the FIU is a “security time bomb,” and that “it urgently needs to be clarified whether it withheld information that would have allowed the criminal investigators in Bavaria to recognize the scandal earlier.”

Prosecutors say from 2015 key figures at the Munich-based firm began to inflate the company’s balance sheet by falsifying income, making it more attractive to investors and helping it to join Germany’s prestigious Dax 30 index two years ago.

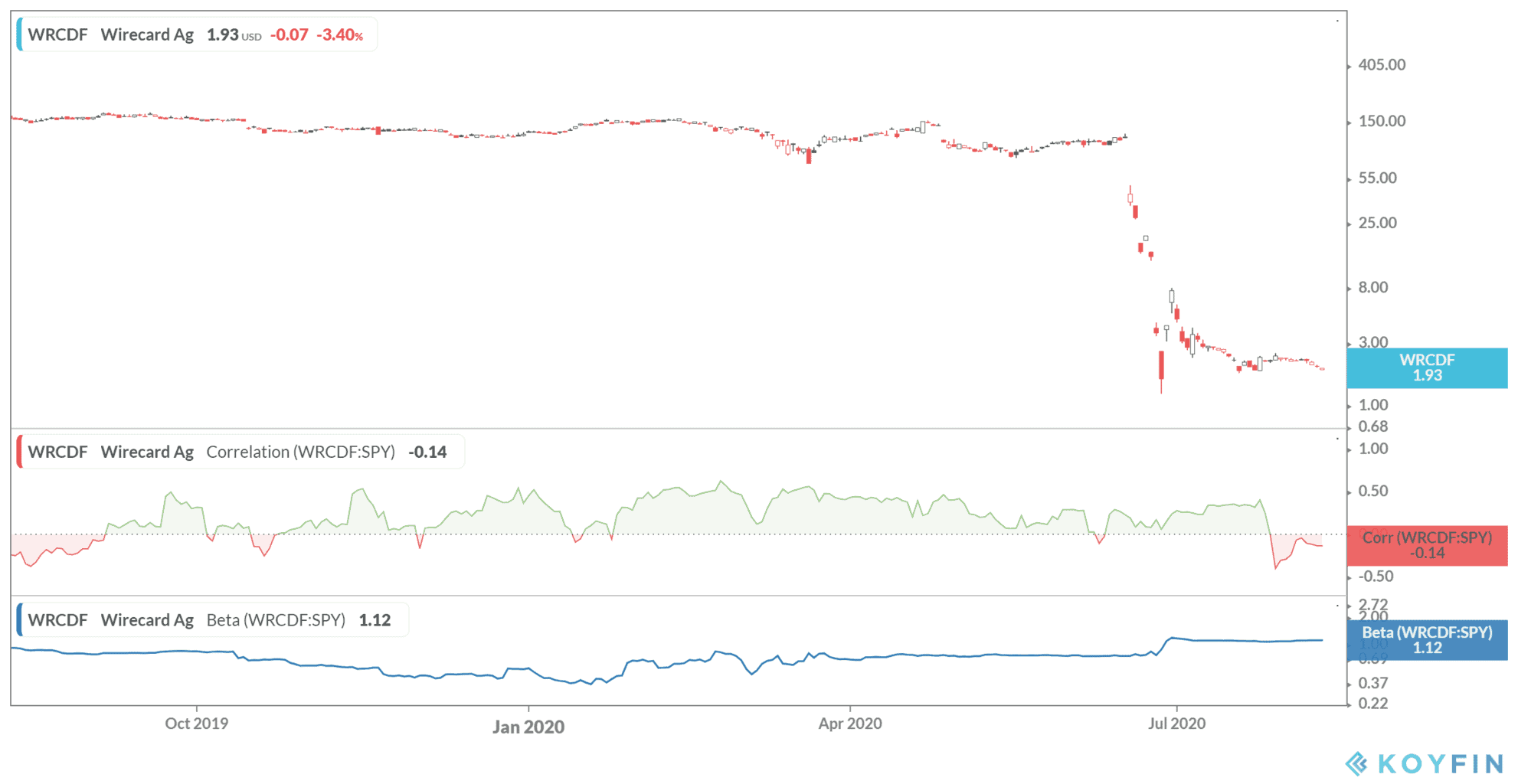

Wirecard shares collapse

“The company was to be presented as financially strong and attractive to investors and clients, so that loans could be obtained from banks and other investors on a regular basis, as well as keep it generating its own income,” Munich prosecutors said.

“In reality, it was clear to the suspects that by the end of 2015 at the latest, that Wirecard was losing money overall with its actual business.”

The firm’s shares have crashed 99% to €1.58 over the last 12 months on the Xetra index.

Wirecard had been fighting whistleblower allegations of accounting fraud for more than 18 months. A forensic audit by audit firm KPMG, commissioned by Wirecard’s supervisory board failed to allay concerns when its findings were published in April.

You can check out a list of recommended stock brokers if you want to invest in stocks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account