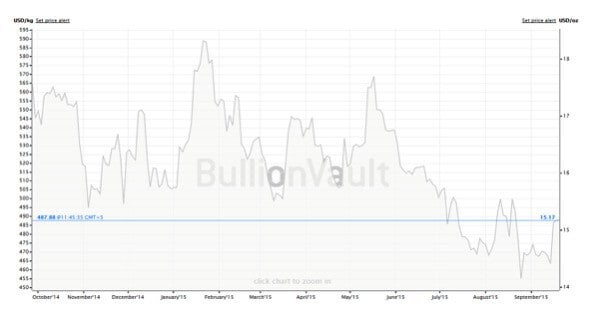

Following the Fed’s decision not to hike interest rates, citing inappropriate timing before seeing further improvement in the labor market and inflation, silver has reached its highest price at $15.22 per ounce, trading in blunt contrast to the $14.31 closing price of September 11. Yet, the messages from the precious metals market are mixed. According to some precious metals analysts, an interest rate hike would boost silver prices further, leading to a long-term rally. Although, the Fed’s decision not to raise the rates lowers the value of the US dollar, thus making the precious metals market bullish, analysts estimate that investors will start selling sooner than expected in anticipation of the long-awaited rate hike.

Gold-to-Silver Ratio, An Indication Of Investment

Experienced investors take into account the Gold-to-Silver ratio, which indicates the amount of silver it takes to purchase one ounce of gold. Gold-to-Silver ratio determines the proper timing to buy or sell precious metals, while considering the broader economic environment. When the stock market goes wild, large-scale investors turn to precious metals as an effective portfolio diversification technique. Additionally, in periods of economic uncertainty, the Gold-to-Silver ratio is used as a hedging strategy against inflation.

At the time of this article, the Gold-to-Silver ratio is 75.09 to 1, which means that it takes 75.09 ounces of silver to buy 1 ounce of gold. A manual method to calculate the ratio is dividing the gold spot price by the silver spot price: 1,139.90 USD / 15.18 USD = 75.09.

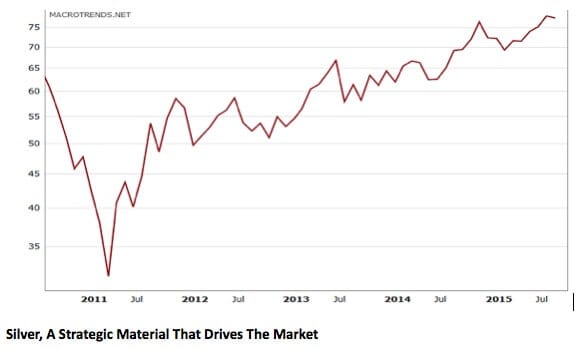

The only setback is that the ratio is susceptible to sharp fluctuations, thus making it challenging for novice investors to read the signals and capitalize on its moves (the chart below justifies it).

Silver, A Strategic Material That Drives The Market

Silver is a highly volatile commodity with discrepancies between its investment role as a trading instrument and its industrial role as a precious metal. Unlike gold, silver is subject to sharp price fluctuations (as shown in the chart below), and while it trades in the same direction with gold in terms of investment demand as indicated in the second chart, its industrial supply does not follow the market fundamentals. This happens because the price of silver is not affected by its store of value, but rather by how widely it is used.

Silver is primarily mined for industrial use and then as a means of exchange in the commodity markets. Having hundreds of industrial and medical applications, its use has exponentially increased over the past twenty years to include a wide array of products. The majority of the world’s silver comes from nations that are troubled from political disorder, labor unrest, poor infrastructure and undeveloped economies such as Mexico and Peru, the largest producers of silver in the world. Conversely, the leading demand for silver comes from China and India, two giant markets where populations have shown a remarkable appetite for silver. The rise of a middle class in the emerging markets, which lack the level of efficiency in securities regulation compared to the advanced economies, yet they influence the global economic situation, has created an explosive demand for industrial items that require silver, thus making it a desirable commodity. Eventually, silver has become a strategic material that drives the market more than what gold does.

Where Is Silver Heading?

The current Gold-to-Silver ratio is a strong impetus to invest in silver. A high ratio suggests that silver is underpriced relative to gold, thus allowing growth potential for buying in the silver market. Conversely, when the ratio is low, analyst consensus favors gold, and sophisticated investors are trading silver for gold as the ratio drops.

Based on the Silver Institute’s estimates, in 2015, silver is expected to be in a deficit of 57.7 million ounces due to contracted mine supply and growing demand. On the other hand, with nearly 60% of silver demand for industrial use, the Gold Fields Mineral Services (GFMS) estimates 2% growth in industrial applications for silver in 2015. On the investment demand, retail investors are expected to indicate a long-term positive interest in silver.

What The Future Holds?

Silver is widely used in electronics, medical and industrial applications in small quantities, therefore, its price does not affect its viability. People will not stop using silver, even if its price skyrockets. In contrast, its demand will continue to grow as the middle class in the emerging markets of the East keeps on growing. On the supply side, miners are on the quest to sustain existing deposits, while finding new resources to meet demand. As it all points to a potential shortage of silver, it is a great time to invest. Commodities gain value against a declining dollar and silver is an excellent hedge against the stock market’s poor performance.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account