Crypto-lottery platform Lucky Block is gearing up for launch on PancakeSwap, after a successful presale phase that saw the allotted tokens sell out two weeks ahead of schedule. Alongside exciting use cases, Lucky Block also offers investors a myriad of benefits, simply for holding LBLOCK tokens.

To help explore these benefits further, this article will discuss what Lucky Block is and then highlight the numerous reasons investors may wish to hold Lucky Block crypto over the longer term.

Lucky Block – What is it?

First, let’s briefly touch on what Lucky Block is. Lucky Block is an upcoming crypto-lottery platform hosted on the Binance Smart Chain that will transform and improve on traditional lottery draws.

By making these draws using blockchain technology rather than traditional ‘offline’ systems, Lucky Block aims to significantly increase transparency and fairness. What’s more, since anyone in the world can enter the daily lotto draws, Lucky Block will offer larger and more frequent prize pay-outs to the platform’s users.

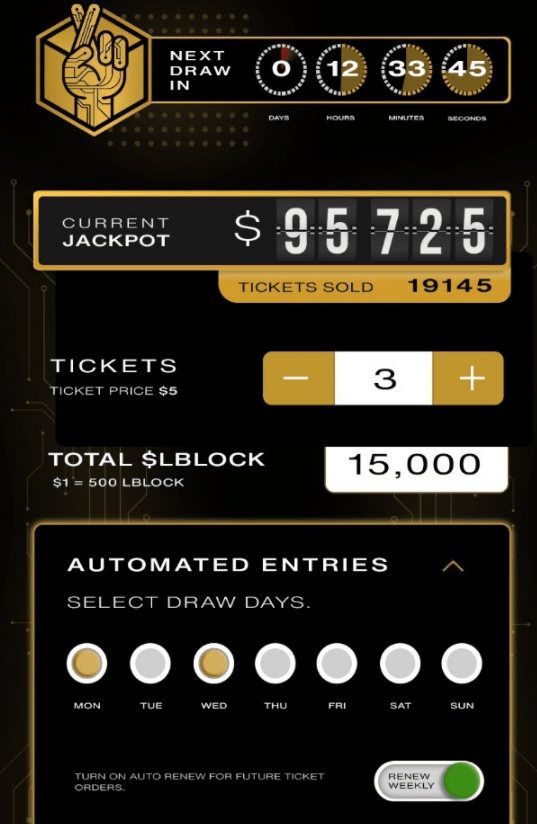

The platform’s native token, LBLOCK, plays a vital role in the Lucky Block ecosystem. Lotto tickets are purchased using the token, with prizes also paid to winners in LBLOCK – allowing for rapid jackpot pay-outs.

As noted above, Lucky Block’s presale sold out much quicker than anticipated, leading the developers to move the token’s PancakeSwap listing up by two weeks to Wednesday 26th January. Now that Lucky Block has over 19,000 members in its Telegram group, there’s likely to be significant buzz once the token goes live.

Why Invest in Lucky Block Crypto?

From an investment perspective, Lucky Block’s developers have built in numerous benefits, which make holding LBLOCK a great way to generate a return over the long term. As noted in the Lucky Block whitepaper, 10% of each jackpot will be distributed back to token holders as a ‘reward’, another 10% will be donated to charity, and 10% will go to Lucky Block for marketing and expanding the project.

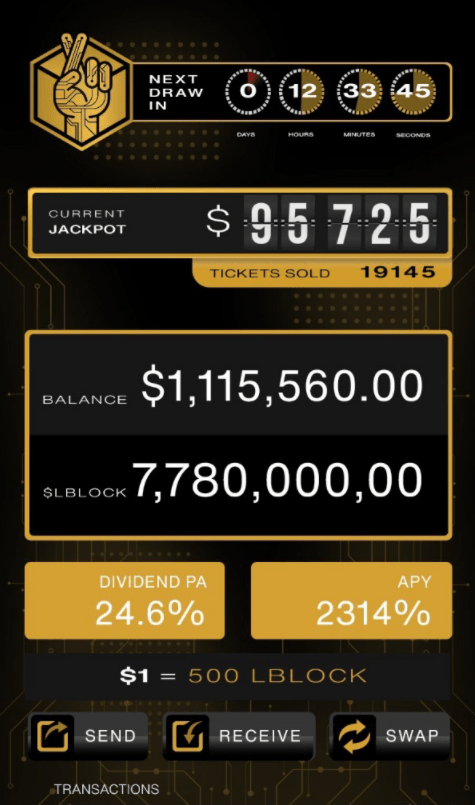

Lucky Block users who hold LBLOCK in a crypto wallet connected to the Lucky Block app will automatically receive rewards directly through the app – meaning the process requires no manual input from token holders!

These rewards are much like dividends, which are payments distributed by companies to shareholders as a ‘thank you’ for holding the company’s shares. Lucky Block’s developers will offer LBLOCK holders similar payments, which will increase as the number of people playing each lottery increases.

Ultimately this is one of Lucky Block’s main priorities – to drive up the number of people that enter the platform’s lotto draws to increase jackpot amounts and boost dividend pay-outs for LBLOCK holders.

To help drive the platform’s user base, Lucky Block’s developers have set their sights on LBLOCK being listed by major centralised exchanges (CEXs) in the future. These include OKEx, Crypto.com, KuCoin, and even Binance!

Once LBLOCK goes live on PancakeSwap on 26th January, the increased liquidity will offer investors an easy way to buy Lucky Block from the comfort of their own home. Lucky Block’s developers anticipate a daily trading volume of $150,000 by the end of January, which is undoubtedly doable considering the token’s strong community backing and mentions from mainstream media outlets such as The Herald.

Furthermore, the developers also estimate that between 25,000 and 50,000 people will hold LBLOCK by the end of March 2022 – providing a solid investor base that will help boost jackpots and dividend pay-outs.

How Do Lucky Block Dividends Work?

As noted above, Lucky Block’s dividends will be one of the major attractions for passive income investors. Dividend amounts will be based on the daily jackpot amount, which is itself derived from the percentage of token holders who purchase a lotto ticket and the amount of money spent on lotto tickets.

To provide an example of how this would work, let’s assume a conservative amount of 25,000 LBLOCK holders by the time that Lucky Block’s lottery officially launches on 25th March 2022. Say 50% of token holders buy one ticket per day for $5, with the addition of the 4% of transactional tax added to the lottery pool from the expected $400,000 a day trading volume at the time of lottery launch

This will result in a daily jackpot (70% of pool) of $54,950, a daily charity donation (10% of pool) of $7,850, and a 19.1% dividend PA via jackpot distribution to holders

Lucky Block Dividends – Bottom Line

Another great thing about Lucky Block’s dividends is that users will receive payments regardless of whether they’ve purchased a lotto ticket or not. Assuming Ben holds $1000 worth of LBLOCK in his wallet (0.07% of the total LBLOCK held on the platform) and buys a $5 ticket to a daily lotto draw worth $54,950, based on the amount designated for LBLOCK holder rewards, he’d receive a dividend payment of $0.52 from that draw alone.

If Ben were to simply hold this amount of LBLOCK for the entire year, he’d earn a return of 19.5% on his holdings – far higher than anything a bank would offer. This return could even grow further if more people hold LBLOCK tokens and enter the daily lotto draws.

If the market price of LBLOCK increases, Ben’s daily dividend pay-out would also increase – which has scope to significantly offset the amount spent on lotto tickets and potentially even result in free entries. Finally, there’s also still the chance that Ben may win one of the daily lotto jackpots, providing an added incentive to hold LBLOCK and purchase lotto tickets!

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account