Facebook Inc announced Tuesday that it has redesigned its most iconic product, the Like button. The social networking giant also announced two new Chrome extensions to help people improve their sharing and saving experience. In other news, Needham & Co. Senior Analyst Laura Martin warned that there’s risk to some big tech players including Facebook in the wake of Britain’s vote to leave the European Union.

Improved Social Buttons

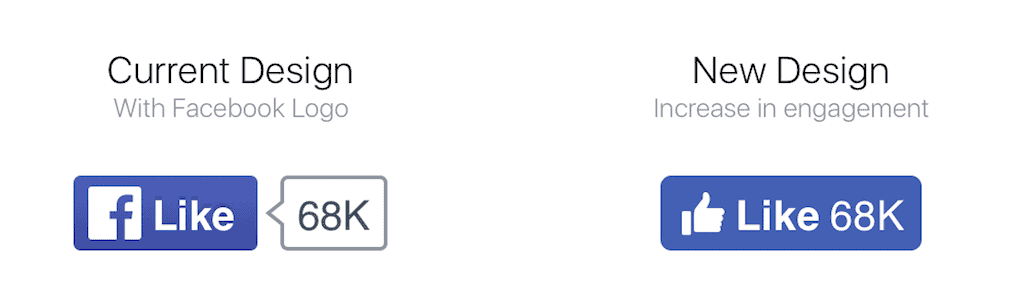

The social networking company said that it has decided to replace the Facebook “f” logo in the Like button with the thumbs up icon.

“Our hypothesis was that more people would understand the thumbs up icon on the Like button, so we conducted qualitative and quantitative tests to measure them side-by-side. The results revealed an increase in engagement, so we are switching the Like button from the Facebook “f” logo to the thumbs up icon,” the company said in a statement.

The social networking giant said in a blog post that the Like button is “one of our most iconic products with over 10 billion views each day across millions of websites.”

To make it easier to share and save content on its website, the social networking company is also introducing two new Chrome extensions including Share to Facebook and Save to Facebook. More 300 million people currently use the Save on Facebook feature every month, according to the company.

Brexit Risks

Laura Martin, analyst at Needham & Co., warned that Facebook could see monetization hurt overseas, Barrons reported.

“For our Internet names, Brexit adds risk and uncertainty to their revenue growth rates, profit projections & valuation multiples,” writes Martin in a note.

“Of Facebook’s 1B daily users, only 200mm are in the US. Brexit adds risk to monetization fundamentals outside the US, especially when translating those revenue streams into a strengthening US dollar. Valuation multiple risk: Because FB trades at 12x 2016E revenue, as revenue estimates fall owing to European demand slowing OR currency translation issues, this has a heightened negative impact on FB’s valuation.”

Europe is the second-largest market for Facebook Inc . According to a report from Bloomberg, U.S. tech companies may grapple with multiple data privacy rules. The EU may be tougher on US firms without UK influence.

“After the vote in the U.K., we are obviously entering a moment of some uncertainty and concern,” Facebook public policy executive Joel Kaplan said at the Computer and Communications Industry Association’s Transatlantic Internet Policy Reception in Washington.

Unless the UK harmonizes with the new EU rules, U.S. companies will lose the ability to process European consumer data in the UK, according to Jane Finlayson-Brown, a partner at the law firm Allen & Overy in London.

Belgian Police: Stay Away From Facebook ‘Reactions’

As we reported earlier, the social networking company is becoming the focus of activists and authorities. The company appears to be under the scanner of activists and authorities. Some issues may not be going to disappear in the short term. The recent accusation about a bias in ‘Trending Topics’ sparked an outcry on social media, prompting a U.S. Senate inquiry into the company’s practices. CEO Mark Zuckerberg stressed that he takes the accusation very seriously. He said that the company is conducting a full investigation to determine the veracity of the reports. Also, Zuckerberg pointed out that there is so far no evidence to support the story.

Belgium’s Police warned Facebook users against using six new ‘Reactions’ introduced by the company this year. “The icons help not only express your feelings, they also help Facebook assess the effectiveness of the ads on your profile,” according to a post on Belgium’s official police website.

Shares of Facebook Inc were up 3.42% during the after-hours session. The stock has gained over 6% year-to-date. The stock isn’t yet a ‘Short.’

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account