Berkshire Hathaway, run by legendary billionaire investor Warren Buffett, made a 13F filing with the U.S. Securities and Exchange Commission, disclosing its long equity positions held at the end of the second quarter of 2017.

Institutional investors are required to disclose their long positions via 13F filings once every three months. These filings are important for average investors, who can learn about legendary investors’ bets and get investment ideas. However, it is important to make a complete survey before buying or selling any securities. Simply following renowned investors would be a catastrophic mistake for ordinary investors.

Buffett, one of the most successful investors in the world, continues to his bet on Kraft Heinz Co (NASDAQ:KHC), Wells Fargo & Co (NYSE:WFC), Apple Inc. (NASDAQ:AAPL), The Coca-Cola Co (NYSE:KO) and American Express Company (NYSE:AXP).

Let’s discuss each of these stocks in a detailed way.

1# Kraft Heinz Co (NASDAQ:KHC)

Buffett remains a believer in the prospects of Kraft Heinz Co (NASDAQ:KHC), one of the world’s largest food and beverage companies.

Buffett, through his firm Berkshire, reported holding around 325.63 million shares of Kraft Heinz, with a reported value of nearly $28 billion. The stake remained unchanged over the quarter and accounts for more than 17% of Berkshire’s portfolio.

Kraft Heinz reported a significant increase in its profit and earnings per share (EPS) for the second quarter. The food and beverage company posted a 50.5% year-over-year increase in net income to $1.2 billion and a 49.2% increase in EPS to $0.94. However, the company’s total sales were dropped by 1.7% to $6.7 billion in the quarter.

Shares of Kraft Heinz are down over 3% so far this year. The stock has lost nearly 6% of its value during the last 12 months.

2# Wells Fargo & Co (NYSE:WFC)

Buffett held around 468 million shares of Wells Fargo & Co (NYSE:WFC) at the end of June. The reported value of the holding was $25.9 billion. The investor sold 11.72 million shares during the second quarter to bring its ownership stake in WFC down to 10%.

Wells Fargo hit hard by a scandal last year over the creation of unauthorized customer accounts by the company’s employees in a bid to achieve sales targets and earn bonuses. Investigations revealed that 2 million unauthorized accounts were created by WFC’s employees.

Despite the scandal, Buffett backed Wells Fargo and called it a “great bank.” He stood by the bank and called it an “incredible institution” that had made a “terrible mistake.“

Wells Fargo’s shares are down more than 5% so far this year. During the last 12 months, the stock has surged nearly 7%.

3# Apple Inc. (NASDAQ:AAPL)

Buffett is bullish on Apple Inc. (NASDAQ:AAPL), in which the investor raised its share ownership by 834,854 shares to 130.19 million shares in the second quarter. The stake was valued at $18.8 billion at the end of June.

Buffett, who does not own an iPhone, started building his stake in Apple in early 2016. It was an important move as the legendary investor had shown almost zero interest in technology stocks.

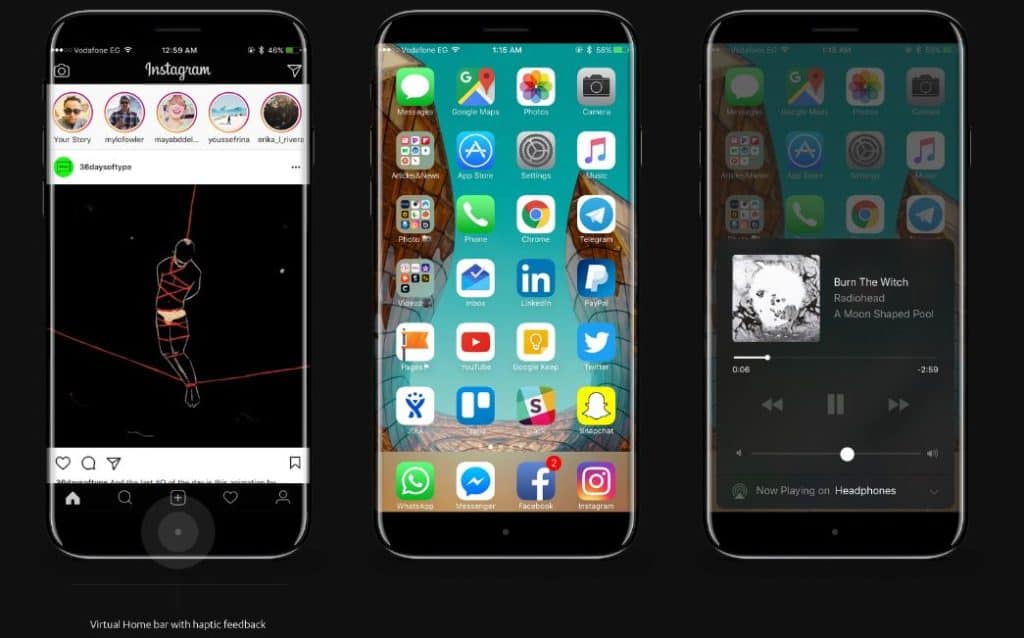

Apple Inc. (NASDAQ:AAPL) is expected to release the latest version of its mobile device, dubbed the iPhone 8, in September. Tech experts believe that the iPhone 8 will be a massively hit device, featuring wireless charging, an OLED screen, and augmented reality capabilities. Analysts believe that this year’s iPhone model will set sales records. A release date has yet to be announced.

Shares of Apple Inc. (NASDAQ:AAPL) are up over 38% so far this year. The stock has surged over 47% during the last 12 months.

4# The Coca-Cola Co (NYSE:KO)

Buffett held 400 million The Coca-Cola Co (NYSE:KO) shares, worth $17.9 billion, as of June 30. Buffett loves Coke as a company as well as a beverage.

For the second quarter, Coca-Cola reported impressive earnings and revenue that topped analysts’ expectations. The company reported earnings per share: of 59 cents compared to an estimate of 57 cents, while revenue arrived at $9.70 billion compared with a forecast of $9.65 billion.

“Our second quarter results demonstrate continued progress against the strategic priorities we have laid out to accelerate the transformation of our business into a total beverage company with balanced growth across a consumer-centric portfolio,” President and Chief Executive Officer James Quincey said in an earnings release.

Shares of The Coca-Cola Co (NYSE:KO) are up over 10% since the start of 2017. The stock has increased 4.34% during the last 12 months.

5# American Express Company (NYSE:AXP)

Buffett reported owning 151.61 million shares, worth $12.8 billion, of American Express Company (NYSE:AXP) at the end of the second quarter.

The stake remained unchanged over the quarter.

Buffett believes that American Express, also known as AmEx, is a better position than its rivals for winning wealthy customers. In an interview with Fox Business Network, the investor AmEx reported a strong growth in new cardholders and customer spending for the first quarter. Answering a question regarding increased competition from JPMorgan Chase, Buffett said that AmEx is “quite a castle.”

Shares of American Express Company (NYSE:AXP) are up nearly 15% so far this year. The stock has surged over 30% during the last 12 months.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account