Virginia Mason Medical Center, based in Seattle, has just issued $136M in new 30-yr taxable corporate bonds. Currently a few secondary bond market platforms appear to inaccurately list the bonds as call protected, while the bond’s prospectus describes an optional make whole redemption:

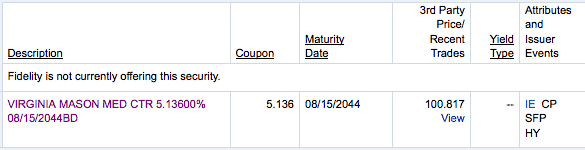

Notice the “CP” and “SFP,” these attributes indicate the bonds are both call protected and do not have a sinking fund. However the prospectus states:

Redemption

The Bonds are subject to mandatory sinking fund redemption at a price of the principal amount to be redeemed, without premium, plus accrued interest to the redemption date. The Bonds are also subject to optional redemption by Virginia Mason prior to maturity, on any Business Day, in such order of maturity as directed by Virginia Mason, at the Make-Whole Redemption Price, as further described herein. See “THE BONDS – Redemption.”

The error in the listing likely results from an inaccurate transcription by the firm that provides listings to the brokerages. I realized the error when I spoke to Virginia Mason Medical Center’s Senior Vice President, Craig Goodrich, this afternoon.

The error in the transcription makes these bonds look more attractive to investors, who may be looking for call protected bonds. Though a make whole call is satisfactory to many bond investors, they obviously need to know what they are getting into. Given historically low interest rates, the new Virginia Mason Medical Center corporate bonds have a fairly high coupon of 5.136%, in fact the listing pictured above shows “HY” for high yield, which is commonly associated with junk bonds.

Some listings for these bonds show no Moody’s rating, and an S&P rating of BBB, though the prospectus does show a Moody’s rating of Baa2 on the bonds. Moody’s recently changed the rating outlook on Virginia Mason Medical Center from positive to stable.

Know Your Bond Prospectuses!

There are two important resources bond investors should be aware of, first: know your prospectus, and second, do not hesitate to pick up the phone and call the issuer’s treasury. Most treasuries are happy to field questions on both new and old bond issues, if the prospectus is not online many treasuries will overnight it.

Mr. Goodrich at Virginia Mason Medical Center provided a link to the prospectus / offering memorandum. I simply called the Center, asked to speak to the treasury, and explained to the operator my question regarded new bonds. If you do not explain, some organizations will inadvertently transfer you to their billing department, thinking you are a customer / student or patient, depending on the type of business.

I left a message stating I wanted to know:

- If the organization’s most recent annual report and / or the bond’s prospectus is available

- The use of the funds being raised

- and why the Medical Center chose to issue taxable bonds instead of municipal bonds

When Mr. Goodrich called back he asked for my e-mail, and sent the link while we were on the phone. This is a good thing to do, since it is easy for a letter in an e-mail address to be omitted or misheard. When Mr. Goodrich first tried to send the e-mail it did not work, for a simple reason; when I repeated my e-mail, the message went through nearly instantaneously.The prospectus states:

Use of Proceeds

Virginia Mason will use the proceeds of this offering for general corporate purposes, including financing the costs of constructing and equipping the Jones Pavilion, financing capitalized interest for the new money portion of the Bonds, financing the costs of issuance of the Bonds, and refinancing of certain outstanding commercial indebtedness. See “PLAN OF FINANCE” and “ESTIMATED SOURCES AND USES OF PROCEEDS.”

Mr. Goodrich then answered the third and final question, as to why Virginia Mason issued taxable corporate bonds:

We found the rates to be compressed between taxable and tax exempt… taxable gave us more flexibility for debt service…

Since these bonds are taxable, they may be more appropriate for an IRA; though many investors hold taxable corporate bonds in non-IRAs also. Depending on the tax bracket of the investor, the income generated may be sufficient. This entirely depends on the investor’s objectives.

A Look At Virginia Mason’s Form 990 & Most Recent Financials

The medical industry can be very difficult for investors to navigate. I have talked to investors who work on Wall Street who won’t touch medicine, since the material requires specialized knowledge. Additionally, you may have noticed there have been several reforms in the works in the past few years, resulting from President Obama’s Patient Protection & Affordable Care Act (Obamacare).

Since Virginia Mason is a nonprofit, its Form 990 tax filings are available to the public. This is another important tool at investors’ disposal. One way to access the Form 990s of 501(c)(3) organizations, for free, is through guidestar.org. Currently the most recent form available is Virginia Mason’s 2011 tax form, filed last year. When searching through Form 990s be sure to double check to make sure you have the right organization, for instance Virginia Mason Medical Center has a few affiliates; they file their own Form 990s, such as the Benaroya Research Institute at Virginia Mason and the Virginia Mason Institute.

From the 2011 Form 990 I can tell:

- The Medical Center had $318M in net assets in 2011

- Program service revenue was over $863M

- Investment income was about $14.8M

- Salaries, compensation and employee benefits was over $506M (this includes $370M program service expenses and $55M management and general expenses)

- Salaries, compensation and benefits went up over $28M from the prior year.

- Revenue went up $44M from the prior year

- Virginia Mason also reported $4.5M in bad debt (for instance patients who do not pay)

- Fees paid to the top 5 highest paid independent contractors included $15.7M to two different staffing service companies

Currently Virginia Mason is trying to raise over $100M, with the new bond offering, so an understanding of the financial information reported to the IRS (which is only available in detail since Virginia Mason is tax-exempt) may help guide investors. Since a bond investor can get an idea for how well, or poorly the organization manages itself, and an idea for the success or reduction of services, that generate revenue.

Though the most recent Form 990 is not yet on file, you may be able to locate more current financial info. in a financial statement or annual report. Virginia Mason’s most recent financial statement shows total net assets increased by more than $25M to $344M. This statement shows the Medical Center is home to 400 medical doctors, up from 387 in 2011. As well “other employees” increased from 4,195 in 2011 to 4,392 in 2012. Average hospital beds in service currently stands around 254 and percentage occupancy appeared on track to be over 90% in 2012 compared to 80% in 2011.

Virginia Mason Sounds Socially Responsible

Many investors wish to “make a difference” by engaging in socially responsible investing, which can be as tricky as finding a successful medical investment. The idealistic thought process is: As an individual, or organization our investment dollars could go to fuel noble causes and provide returns; this is easier said than done. Without a very strong ability to recognize profitable businesses (or sustainable nonprofits), many investment dollars have been lost.

This is why Virginia Mason stands out, in my opinion. It is common to find municipal bonds related to strong community projects, though there are only a handful of taxable bonds related to top U.S. institutions involved in socially responsible causes. What stands out primarily with Virginia Mason is their promotion of the Virginia Mason Production System, a lean management system based on Toyota (automotive) Production System. This is the mission of the Medical Center’s affiliate, Virginia Mason Institute. Additionally Virginia Mason is involved in researching immune system diseases through Benaroya Research Institute.

An investment in Virginia Mason Medical Center taxable bonds does not go directly to support these institutes; however, my thought is the Center is in good company. This is not to say that their corporate bonds are not risk free, just like any business there is the possibility something could happen that would stress the organization’s finances. Worst case is always the potential an issuer could default; based on my reading of the Form 990 the current revenue levels support the massive expense for employees, however, a major reduction in revenue could create distress, easily.

While the stock market struggled for a few years after the major downturn in late 2008 and early 2009, many socially responsible funds seemed to take greater hits. Though as the market has rebounded, so have well composed funds including those focused on socially responsible investing. Calvert Social Index Fund (CSXAX) has a 4.75% front-end load, therefore many investors would be dissuaded from investing, though it serves as a good example. Calvert Foundation, co-founded by Calvert Investments, also offers near-term taxable corporate bonds, to give you a point of comparison in researching the concept of social responsibility.

Think About Allocation

Keep in mind the fact these Virginia Mason Medical Center bonds have a 30-year maturity, and a sinking fund provision. Each year, up until 2038, presuming there is no early optional redemption, the issuer will pay a total of $6.9M to bondholders. Beginning in 2038 a portion of the bonds will be redeemed as follows:

| amount being redeemed | |

| 2038 | $14M |

| 2039 | $14.7M |

| 2040 | $15.5M |

| 2041 | $16.3M |

| 2042 | $17.1M |

| 2043 | $28.4M |

| 2044 | $29.8M |

| total | $136.1M |

Individual bondholders will probably notice a reduction in their holdings during this period, though often fractions of bonds are not redeemed. So there is a degree of uncertainty, however, some larger investors (like mutual funds) may be searching for long-term holdings, that have precisely this sort of redemption schedule. Slightly over 10% of the bonds could be redeemed annually until 2043, when the bulk of the remainder is slated to begin redemption.

These bonds have minimum increments of $1,000, so a bond holder who just has one or two, may not know precisely when their bond will be redeemed. As well, it is possible the Center could refinance at some point, and redeem all of the bonds early, this is why the error in the listing is important to understand. Whereas call protected bonds, generally can not be redeemed early, unless there is a loophole, such as redemption provisions for extraordinary circumstances like changes in the tax code.

The Virginia Mason Medical Center 2044 5.136% coupon bonds are the sort of investments individuals with profit and a long-term time frame, may wish to consider in moderation. Foundations and mutual funds searching for 5% fixed income yield, from medical / health care investments, may also wish to consider these. Investors interested in the field of health and medicine may also consider if these bonds would work in conjunction with a portfolio of dividend paying pharmaceutical company stocks, and health / medical mutual funds, such as Fidelity Select Medical Equipment & Systems (FSMEX) or T. Rowe Price Health & Sciences (PRHSX).

If you have any thoughts on the new Virginia Mason Medical Center taxable bonds (CUSIP: 927847AA1) please leave a comment below.

Disclaimer: This article is not a recommendation to buy or sell, please consult a financial adviser to determine proper allocations (if any) to meet your financial objectives. I am considering a long-term investment in the new Virginia Mason Medical Center corp. bonds. I am long FSMEX.

Click here to learn more about best forex brokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account