British drugmaker GlaxoSmithKline (NYSE: GSK) said it will buy a $250m stale in Vir Biotechnology to advance the US firm’s potential treatments for coronavirus, a disease that killed almost 75,000 people and infected more than 1.3 million people across the globe.

GSK said cash will be used to accelerate Vir’s very “promising antibody candidates” , VIR-7831, and VIR-7832 in Phase II clinical trials “within the next three to five months”.

GlaxoSmithKline disclosed that they will bear 72.5% of the antibody program cost, 27.5% of the vaccine development program, and both companies will share half of the development costs related to the functional genomics program.

“Vir’s unique antibody platform has precedented success in identifying and developing antibodies as treatments for multiple pathogens, and it is highly complementary with our R&D approach to focus on the science of immunology,” Hal Barron, GSK’s chief scientific officer and president of R&D, said in a statement on Monday.

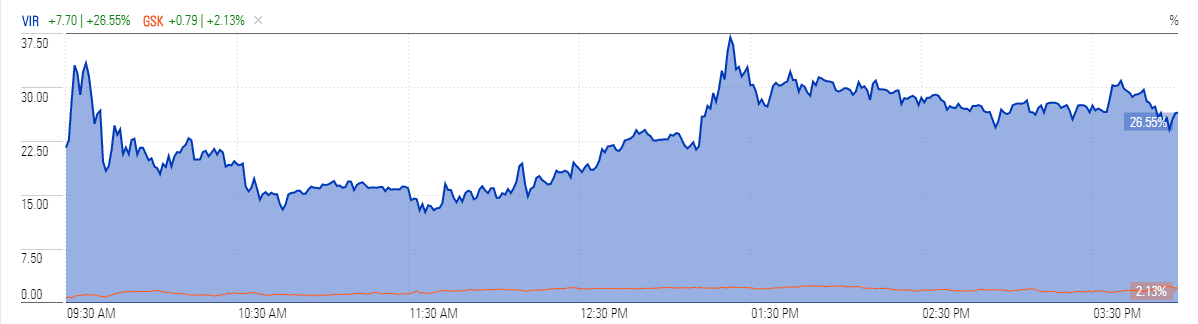

San Francisco-based Vir’s stock price jumped 26% after the news as investors appreciated the collaboration between both companies. GlaxoSmithKline stock, on the other hand, liftedonly 2% because of its big size when compared to Vir Biotechnology.

GlaxoSmithKline stock price currently trades around $37, down from a 52-weeks high of $48 a share. It had generated year over year revenue growth of 8.5% in the latest quarter while the full-year sales increased 10% year over year to £33.8bn. The company has generated net cash flow from operating activities of £8bn and the free cash flow stood around £5.1bn.

“In 2020, our first priority remains Innovation, to progress our pipeline and support new product launches. Recent data readouts underpin our decision to further increase investment in R&D and these new products. At the same time, we are again focused on operational execution,” Emma Walmsley, GSK chief executive officer said.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account