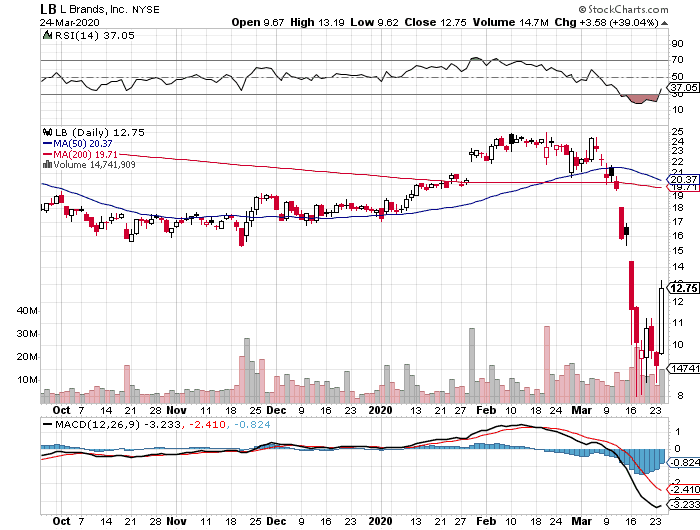

L Brands (NYSE:LB) stock jumped almost 40% as the fashion group behind Victoria’s Secret saw markets rebound after the US Senate agreed a $2trn relief package to combat the coronavirus outbreak.

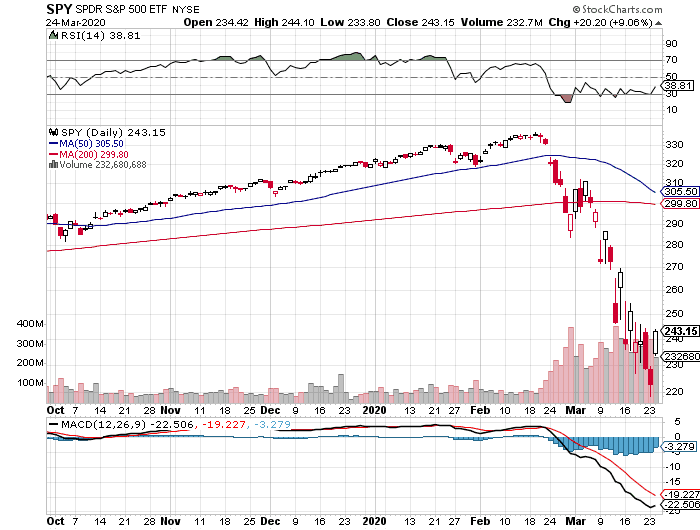

The S&P 500 closed up more than 9% on Tuesday after the measures were passed, its highest one-day gain in 12 years. The Dow Jones Industrial Average rose more than 11%, notching up its biggest advance since 1933. L Brands, which also owns Pink, and Bath & Body Works, closed up 39% at $12.75 on the S&P 500 where it is traded.

Many companies have made by double-digits gains over the last two days, while central banks have taken steps to encourage commercial banks to lend, allowing firms to keep trading.

L Brands said last week it would suspend part of its e-commerce business to focus on the production of soaps and hand sanitizers amid the ongoing pandemic. The Ohio-based group said it would continue with its Bath & Body Works online business with a priority on cleaning and health products where it has seen a sharp increase in demand.

Victoria’s Secret is the group’s largest brand, accounting for $6.8bn in sales last year with Bath & Body Works registering revenues of $5.2bn over the same period. However, Bath & Body Works is the faster growing of the two businesses.

The group has withdrawn its first-quarter guidance for this year, as it, like other retailers, waits to determine how the health emergency will impact the business.

Like many businesses, L Brands has seen its share price fall substantially over the last month. In February of this year, L Brands was trading near $28 per share, and over the last six weeks, it has traded under $10.

The company also opted to draw down a $950m credit facility from JPMorgan Chase, which left it with around $2bn in cash. L Brands is continuing to pay its 80,000 employees as they work from home.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account