US airlines accepted a $25bn government rescue package to avoid potential bankruptcies and employee layoffs as the coronavirus pandemic has devastated the industry.

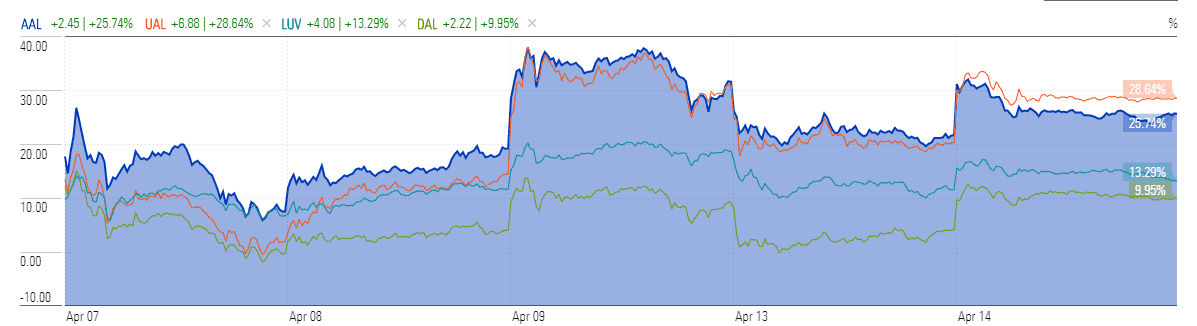

Alaska Airlines (NYSE: ALK), American Airlines (NASDAQ: AAL), Delta Air Lines (NYSE: DAL), Southwest Airlines (NYSE: LUV), United Airlines (NASDAQ: UAL), and others agreed a deal with the Treasury Department. The stock prices of all US airlines soared after the news of the agreement, which also sees the government takes equity stakes in the firms.

The treasury department has approved $5.8bn in assistance for American Airlines including a $4.1 billion grant and $1.7 billion in a low-interest loan. Dallas-based Southwest is likely to receive a $3.2 billion out of $25bn relief package, while Delta said it will get $5.4bn.

“This is an unprecedented accomplishment—a truly workers-first stimulus that keeps people connected to their jobs and provides stability and hopes to millions of aviation workers and sets a template we must now work to extend to every worker,” said Sara Nelson, president of the Association of Flight Attendants.

Airlines for America, an industry lobbying group, said that as of April 9, U.S. airlines had idled 2,200 aircraft and that passenger volume was down 95% from a year ago. Global passenger revenues are expected to fall by $314bn this year, a 55% decline from last year, the International Air Transport Association, a global industry group, said on Tuesday.

The terms for government relief package include a requirement of returning 30% of the funds along with providing an equity stake to the government. The government will hold a 3% stake of American Airlines, 1.3% of JetBlue, 2.3% of United Airlines, 1% of Delta Air Lines and 0.6% of Southwest Airlines.

Despite the largest relief package for the airline industry, Cowen’s analyst Helane Becker says the demand will take three to five years to return back to 2019 level. “We believe US airlines will be 30% smaller at the end of his year than they were at the start of the year. Also, we expect there will be between 100K,000 and 200,000 fewer employees at the end of the year than there were at the beginning of the year,” Cowen analyst said.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account