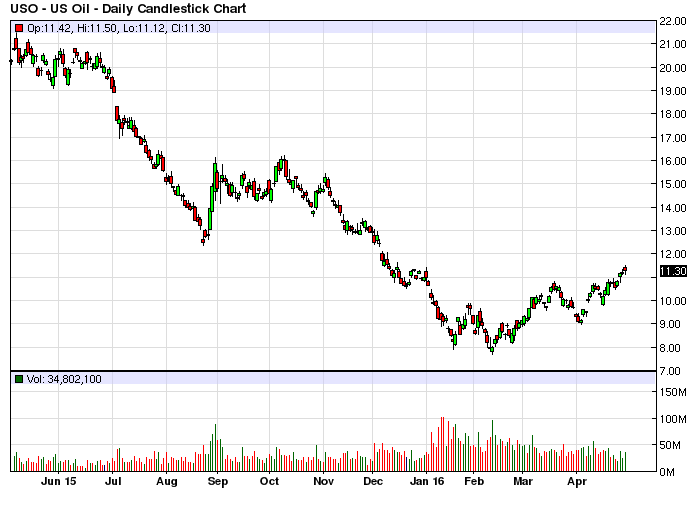

United States Oil Fund LP (ETF) indicates that the short term upside in crude is capped, according to one top trader, who has a record of correctly forecasting the commodity’s price action.

Crude oil has impressively risen since hitting a low of $26 a barrel in February. But Todd Gordon of TradingAnalysis.com reckons that given the current technical layout, prices are unlikely to scale $50.

United States Oil Fund LP (ETF) Paints Bearish Crude Picture

United States Oil Fund LP (ETF) Paints Bearish Crude Picture

Gordon uses the United States Oil Fund LP (ETF) to determine the demand-supply scenario in crude. And his analysis suggests that two counter trend indicators are hinting at an imminent decline in price.

“The rally that we have seen into the 200 period moving average has been $20.40…(which is) the total traveled distance from the $26 low to current price,” the analyst said on CNBC. “Notice the distance traveled in the prior counter trend swing – $20.55. So we have some very interesting symmetry here.”

To add to the bearish outlook is the retracement in the weekly charts that point to a strong resistance around the $48-$50 zone.

“This is your textbook retracement…the 61 percent retracement of the July decline down to the $26 low,” Gordon added. “That 61 percent retracement is going to fall in at $47.70…(as such) we have a mountain of resistance between $48 and $50 in crude oil.”

Gordon had said in November that crude could fall to $26 a barrel.

Oil Fundamentals Also Look Weak

Besides the technicals, crude oil fundamentals also look weak, with some analysts arguing that the continued high levels of supply could drive prices lower once the current positive sentiment surrounding the commodity fades.

“Supply and demand are way out of balance, and if you look at stock piling, we are floating in oil right now,” Gina Sanchez, CEO of Chantico Global, told CNBC.

The weakening dollar, and expectations of a demand surge during the coming summer months, have pushed crude prices higher. But Sanchez maintains that after a couple of months have passed, investors will realize that demand is nowhere as strong as is currently projected.

“You’re getting more enthusiasm in the markets…that’s been holding oil up,” she noted. “But when we get out of the driving season come August or September, you’re still going to see that we’re going to be floating in oil.”

Oil prices were down in early Monday Asian trade, with U.S. crude dipping 28 cents from their last settlement to $45.64 a barrel. Brent was also trading lower.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

United States Oil Fund LP (ETF) Paints Bearish Crude Picture

United States Oil Fund LP (ETF) Paints Bearish Crude Picture