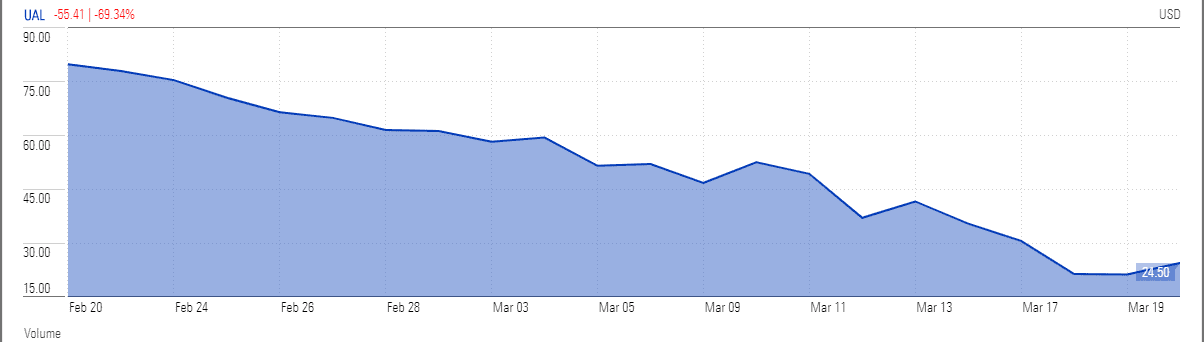

United Airlines (NYSE: UAL) stock price has experienced some relief from a turbulent four weeks as Congress weighs up a $58bn bailout to help the airline industry cope with collapsing travel demand from the coronavirus pandemic.

Rivals Southwest Airlines is cancelling more flights, while Delta Air Lines suspended its dividend and share repurchase program hours after US President Donald Trump said he wants a ban on stock buybacks for companies receiving federal aid on Friday.

United, which is traded in New York, is facing billions in losses after domestic and international flight suspensions amid coronavirus outspread across the world – it has cancelled close to 90% of its international flights for April.

Chicago-based United saw its stock jump 15% on Friday, as investors bet lawmakers would spend the weekend finalizing a bailout they expect to be announced later this week.

United Airlines’ stock has fallen more than 70% over the last month; the shares are currently trading at their lowest level since 2013. Although the company is heading to post big losses this year, it had reached a goal of generating earnings per share of $11 to $13 in 2019 – a full year ahead of schedule.

United Airlines currently employs 96,000 workers, but chief executive Oscar Munoz (pictured) has said the firm will be forced to start laying off staff in less than two weeks unless lawmakers approve the aid package. Fitch rating agency dropped United Airlines outlook to negative from stable on Sunday amid slowing economic growth.

“If Congress doesn’t act on sufficient government support by the end of March, our company will begin to take the necessary steps to reduce our payroll in line with the 60% schedule reduction we announced for April. May’s schedule is likely to be cut even further,” said chief executive officer Oscar Munoz.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account