Uber (NYSE: UBER) stock price experienced a huge selloff during the second half of 2019. Although Uber share price bounced back slightly in the past month, the shares are still trading well below the 52-weeks high of $47.

The market analysts are suggesting investors Buy Uber shares following a price selloff. They believe Uber’s financial decipline, revenue growth and a move towards profitability are likely to support shares in the coming quarters.

Uber stock price is currently trading around $35, up from a 52-weeks low of $25 that it had hit two months ago. The company’s latest results are helping in enhancing investor’s sentiments. Moreover, the substantial improvement in financial numbers is likely to contribute to bullish sentiments.

Financial Numbers are Supporting Uber Stock Price

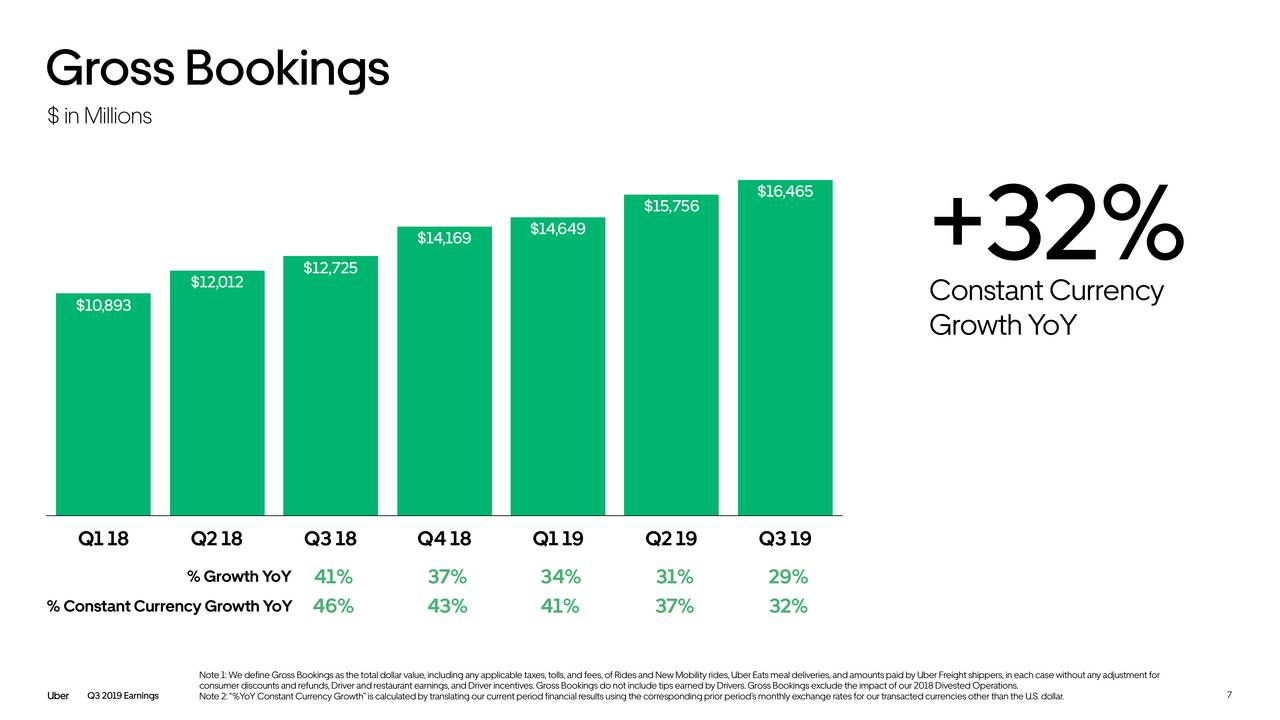

Uber reported third-quarter revenue of $3.8 billion, representing a growth of 30% from the year-ago period. In addition, its gross bookings rose by $3.7 billion year-over-year to $16.5 billion, down slightly from the consensus estimate for $16.7 billion. Its Rides and Eats ANR take-rates improved at a high double-digit rate in Q3.

Dara Khosrowshahi, CEO said, “Rides Adjusted EBITDA is up 52% year-over-year and now more than covers our corporate overhead. Revenue growth and take rates in our Eats business also accelerated nicely. We’re pleased to see the impact that continued category leadership, greater financial discipline, and an industry-wide shift towards healthier growth are already having on our financial performance.”

The company reported a loss of $585 million for the third quarter. However, it experienced a solid improvement in the rides segment. Consequently, its loss improved by $79 million from the year-ago period.

Analysts are Positive About Future Fundamentals

The market analysts are expecting Uber to show sustainable growth in financial numbers along with expansion in new markets. The pricing policy would also help in boosting margins. The market pundits are expecting Uber stock price to hit $50 level in the following months. Therefore, buying and holding this stock appears like a good investment idea.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account