Twitter (NYSE: TWTR) stock price surged more than 5 per cent after beating fourth-quarter revenue estimates. The high double-digit boost in users helped in enhancing investor’s sentiments in TWTR share price. The outlook for the first quarter stands in line with the analysts’ estimates. TWTR share price also received higher price targets from several market pundits.

Twitter stock jumped to $38 level for the first time in the past five months. TWTR share price traded in a tight range of $29 to $33 in the past few months. The stock had hit the highest level of $45 at the end of the third quarter of 2019.

Fourth Quarter Revenue Beat and User Growth Boosted Twitter Stock

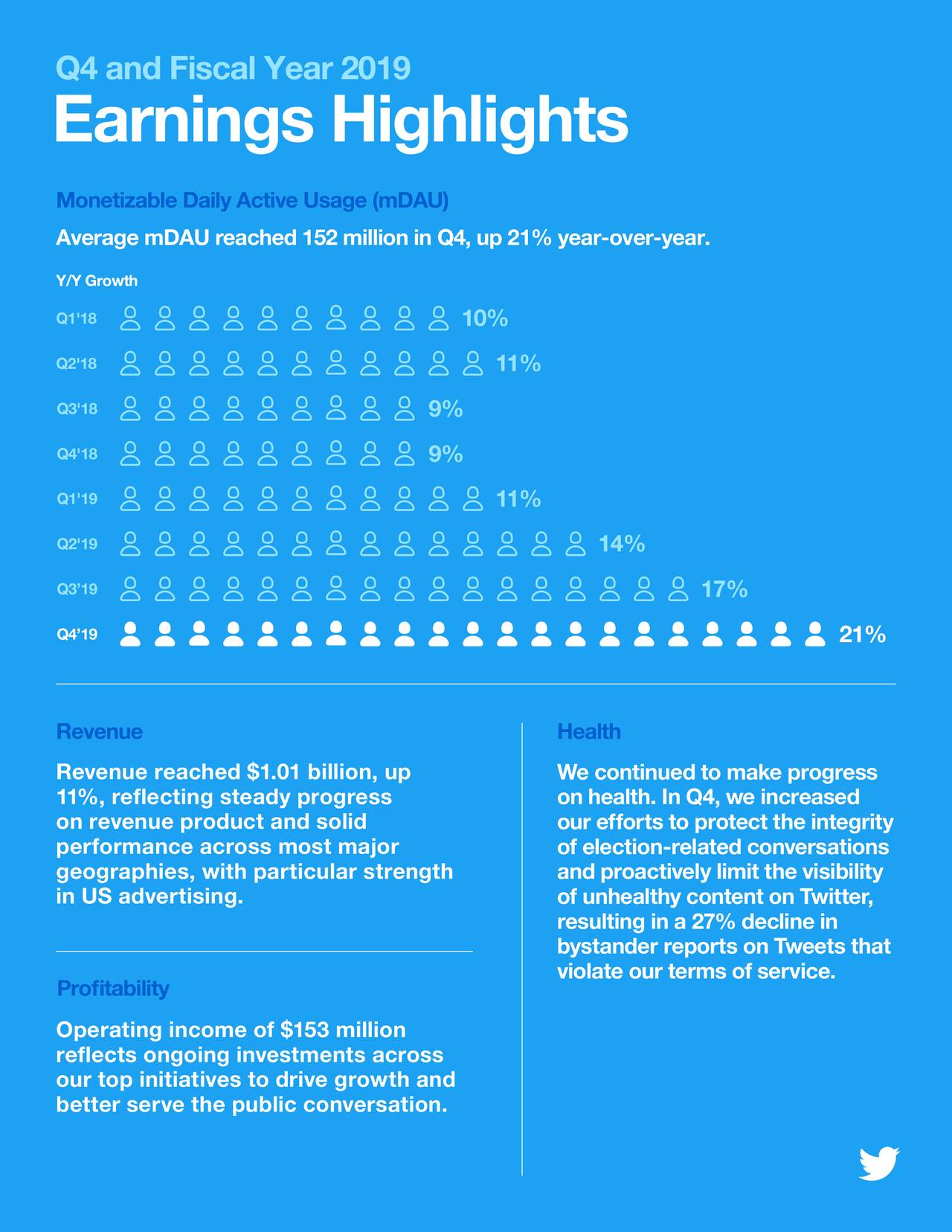

The Internet Content & Information Company generated more than $1bn in quarterly revenue for the first time in history. Its fourth-quarter revenue of $1.1bn increased $12.45ml compared to analysts’ estimates. Its revenue grew 10.8 per cent year over year in the fourth quarter. Twitter added 7ml users in the fourth quarter relative to the previous quarter, up significantly from the 2M net add estimate.

“We reached a new milestone in Q4 with quarterly revenue in excess of $1 billion, reflecting steady progress on revenue product and solid performance across most major geographies, with particular strength in US advertising,” said Ned Segal, Twitter’s CFO.

The consolidated revenue for fiscal 2019 came in at $3.46bn, representing growth of 14% year-over-year. The company also reported a considerable increase in earnings when compared to the previous period.

The Market Pundits are Optimistic

Susquehanna raised the TWTR share price target to $47 with Positive ratings. The firm is showing confidence in healthy ad results along with revenue growth due to events like the Olympics and 2020 elections. BofA sticks to a Buy rating with the price target of $43. The market pundits believe Twitter’s strategy of providing a more personalized service for both consumers and advertisers is likely to help in sustaining the financial growth momentum.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account