The summer temperatures continue to rise, and so is the global economy as it recovers from the backlash of the pandemic. Can this bullish sentiment continue as variants of the coronavirus keep spreading? Investing in the best stocks is a great way for long-term investors to yield positive returns.

We’ve rounded up a handful of the top stocks to invest in that can deliver long-term profits. So, keep reading below as we reveal the best shares to invest in August 2021 right now.

Best Stocks to Trade Right Now – Top 10 List

- Lemonade – Insurance & Tech Company With Huge Potential

- Imax – This NYSE-listed stock’s second-quarter sales rose by 473.1%

- ERP Properties – REIT With Impressive Portfolio of 350+ Properties in US and Canada

- Moderna – Biotech company saw stocks surge as it rolled out its Covid-19 Vaccine

- AGNC Investment Corp. – This REIT is a Top Dividend Stock that’s gaining traction

- US Bancorp – this popular dividend stock achieving a 1.6% ROA

- Unilever – Consumer Goods Company with strong financials

- Broadcom – Continues positive growth with its 5G infrastructure rollout plans

- NextEra Energy – Electric Utility Company with 2% Yield

- Green Brick Partners – Nasdaq-listed homebuilder has one of the largest gross margins in the sector

You can trade all these top shares on our recommended CFD broker Skilling.

Lemonade (NYSE: LMND)

Since the beginning of the year, this insurance start-up company has experienced a rollercoaster of upward trends of 70% as well as drops of over 50%. This is partly due to the uncertainty surrounding the company. Put simply, Lemonade is both an insurer and a tech company.

Lemonade’s best selling point is implementing a better connection between its business incentives and its customers’ needs. As such, Lemonade has huge potential to stick around for years to come, because it is remodelling the financial incentives so that it can offer instant payments and better customer service.

63% of retail investor accounts lose money when trading CFDs with this provider.

Imax (NYSE: IMAX)

If you’re looking for a long-term stock that outperforms the rest in the movie theater sphere, Imax is the best option. Imax staged a strong second-quarter rally with sales of more than $50 million, soaring by 473.1% compared to the previous year. 90% of all Imax cinemas have resumed business, pushing its gross profit margin back above the 50% mark, up from a -87% drop reported in the coronavirus-burdened Q2 of 2020.

63% of retail investor accounts lose money when trading CFDs with this provider.

EPR Properties (NYSE: EPR)

As we move further into August, one growth stock many investors are monitoring vigilantly is EPR Properties. This real estate investment trust has an impressive portfolio of properties including ski resorts, golf attractions, waterparks and more. EPR Properties has over 350 properties in 44 states in the US and across Canada.

All in all, EPR recently resumed its monthly dividend payments as its tenant base has slowly stabilized, with the stock now yielding just under 6%.

63% of retail investor accounts lose money when trading CFDs with this provider.

Moderna (NASDAQ: MRNA)

Moderna has had a great year, thanks to the speedy development of its mRNA-1273 COVID-19 vaccine, which has proved crucial in combating the spread of the coronavirus. Moderna’s stock has more than quadrupled in the last year as a result of the vaccine’s effectiveness, giving the rising biotech star the chance to become a part of the S&P 500 Index.

63% of retail investor accounts lose money when trading CFDs with this provider.

AGNC Investment Corp (NASDAQ: AGNC)

Mortgage real estate investment trust (REIT) AGNC Investment Corp. is guaranteed to turn heads when it comes to high-yield dividend stocks. It’s not every day that you come across a company that pays a stable 9.1% dividend and has averaged a yield above 10% for more than a decade.

63% of retail investor accounts lose money when trading CFDs with this provider.

US Bancorp (NYSE: USB)

Another top dividend stock to look out for in August 2021 is the banking giant US Bancorp. Bear in mind that bank stocks are cyclical and experience the best results during bouts of economic expansion. Historically, the US economy spends more time expanding than it does contracting. This means that bank stocks are set to gain from rising interest rates and deposit activity in the long-term. In Layman’s terms, as the economic resurgence gathers speed, wider expansion and increasing interest rates are bound to push profits higher for major bank stocks such as US Bancorp.

63% of retail investor accounts lose money when trading CFDs with this provider.

Unilever (LSE: ULVR)

Unilever, the leading global consumer goods company, has experienced some of the most stable share prices in the world recently. For its robust performance over the past pandemic-ridden period, many investors are putting Unilever near the top of their watchlists. Unilever’s financials have performed well recently, as the company makes a push for the e-commerce sphere. Furthermore, Unilever’s valuation at 20-times earnings is very appealing to investors and market analysts alike.

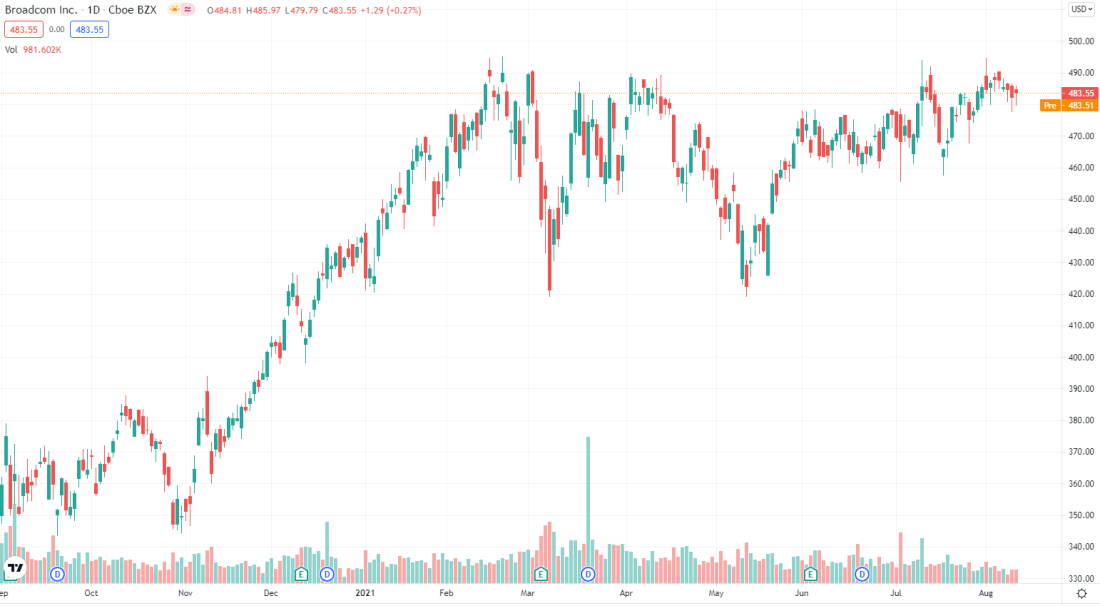

Broadcom (NASDAQ: AVGO)

For over ten years, the global chipmaker giant Broadcom has been classified as a buy opportunity. It’s sustaining a 12-year bull run, and that’s expected to be the case for investors looking to open long positions for long-term investments. The most obvious catalyst driving the chipmaker’s success is the ongoing implementation of its 5G wireless infrastructure. In the tech sphere, Broadcom is perhaps the best dividend stock to invest in August 2021. Within a decade, Broadcom’s quarterly dividend payout has skyrocketed from $0.07 to $3.60 representing a rise of 5042.86%.

63% of retail investor accounts lose money when trading CFDs with this provider.

NextEra Energy (NYSE: NEE)

The penultimate best share to invest in August 2021 is the electric-utility company NextEra Energy. Despite its dividend yield being just 2% it’s still 70 basis points higher when compared to the current dividend yield of the S&P 500 index. By 2022 NextEra Energy wants to invest over $50 billion in research and development of renewable energy projects. Currently, NextEra Energy is America’s biggest producer of electricity from renewable energy sources.

63% of retail investor accounts lose money when trading CFDs with this provider.

Green Brick Partners (NASDAQ: GRBK)

The repercussions of the financial crisis can still be felt in the US economy, especially in Wall Street’s sentiment towards homebuilders. There is ongoing debate as to whether we are experiencing a housing bubble at the moment. But, there may be other more important questions to ask.

The question we need to be asking is: What can be done to make up for the lack of investment in the housing sector? The simple answer is to build more housing. As such, this could be a prime opportunity to invest in GRBK shares. Within just five years, Green Brick Partners’ earnings per share are up by roughly 480%.

63% of retail investor accounts lose money when trading CFDs with this provider.

Best Shares to Trade Now – Expert Verdict

Now that we’ve covered the top 10 best shares to invest in 2021, you will need to choose a trusted broker that offers low fees and a secure trading platform. But with so many online brokers saturating the search engine results pages, how do you pick the right one for your trading needs?

We’ve found that Skilling is the best trading platform to buy and sell more than 700 CFD shares with leverage of up to 5:1. Skilling also facilitates commission-free stock trading, which means that the only trading fees you have to pay are the tight market spreads. With a range of platforms, a demo account and supported payment methods, Skilling is ideal for beginner traders looking to invest in the best shares for the first time.

So, to get started right now simply follow the link below and open an account with Skilling in minutes!

Skilling – Overall Top Broker to Invest in the Best Shares in 2021 with 0% Commission

63% of retail investor accounts lose money when trading CFDs with this provider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account