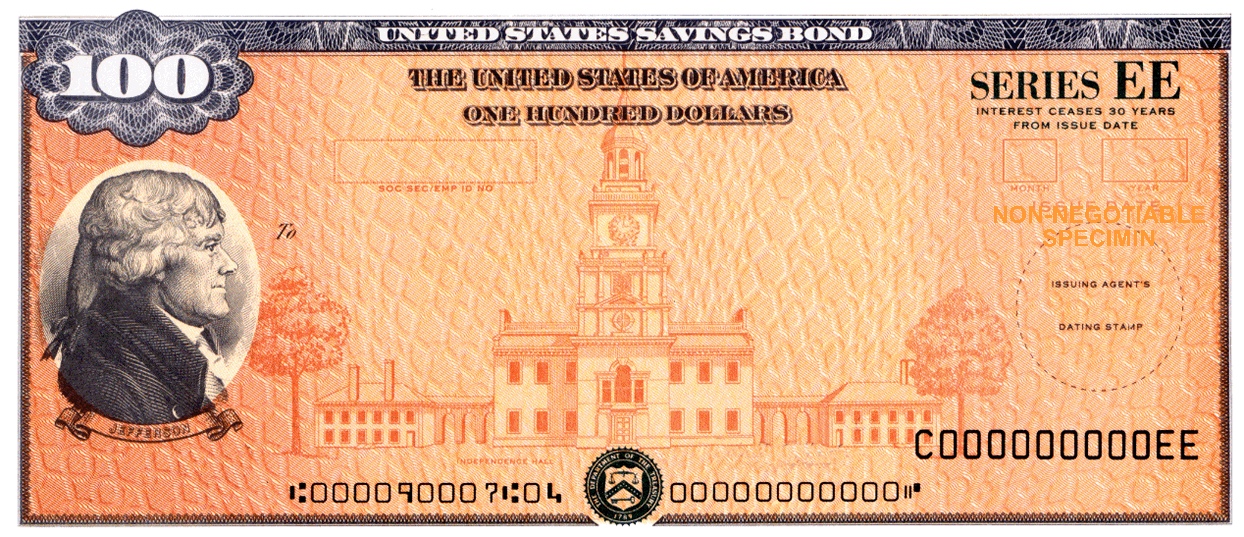

While paper savings bonds are no longer available as of 1/1/12, the savings bond certificate for paper savings bonds which have been issued in the past is full of interesting information including:

Face Value

In the Upper Left Hand Corner, there is an amount of money listed. This is known as the bond’s face value.

For I bonds, this amount is the same as the purchase price. For EE Series, the amount is half the face value of the bond. At the maturity date for EE Series paper bonds, the value of the bond is at a minimum equal to the face value. Since 2003, the maturity for EE Series bonds has been 20 years. Between 1980 and 2003, the maturity dates have ranged between 8 and 18 years. See below for maturity dates on EE Bonds.

The face value of a savings bonds is not the same as its current value. Click here to find the current value of your savings bonds.

Series & Issue Date

In the Upper Right Hand Corner, there is a Series Number and Issue Date. If the current date is more than 30 years after the issue date, your bond has stopped earning interest and you should redeem it. Using the Series and Issue date you can find out the current value of the bond using this site’s Savings bond Calculator.

Serial Number

In the Lower Right Hand Corner, there is a serial number. Should you wish to convert your paper bonds into electronic bonds, you will need to use this number.

To

In the center of the savings bond is the name of the owner. If you have inherited the saving bond and therefor are not the listed owner, you will need to fill out some paperwork. For instructions, click here.

|

Issue Date |

Original Term |

| 1/80 – 10/80 | 11 years |

| 11/80 – 4/81 | 9 years |

| 5/81 – 10/82 | 8 years |

| 11/82 – 10/86 | 10 years |

| 11/86 – 2/93 | 12 years |

| 3/93 – 4/95 | 18 years |

| 5/95 – 5/03 | 17 years |

| 6/03 – present | 20 years |

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account