Tesla (NASDAQ: TSLA) stock price crossed the psychological $600 level for the first time in history. TSLA share price bounced more than 13% after a fourth-quarter beat, extending the six months rally to 140 per cent. The company also announced a ramp-up of its Model Y production in the following quarters.

The potential improvement in production and deliveries is among the biggest catalyst for TSLA share price in the analyst’s view. The EV maker is well set to hit 1 million overall delivery vehicle mark in the next couple of years, according to Wedbush analyst Dan Ives.

Fourth Quarter Beat Extended Tesla Stock Bull Run

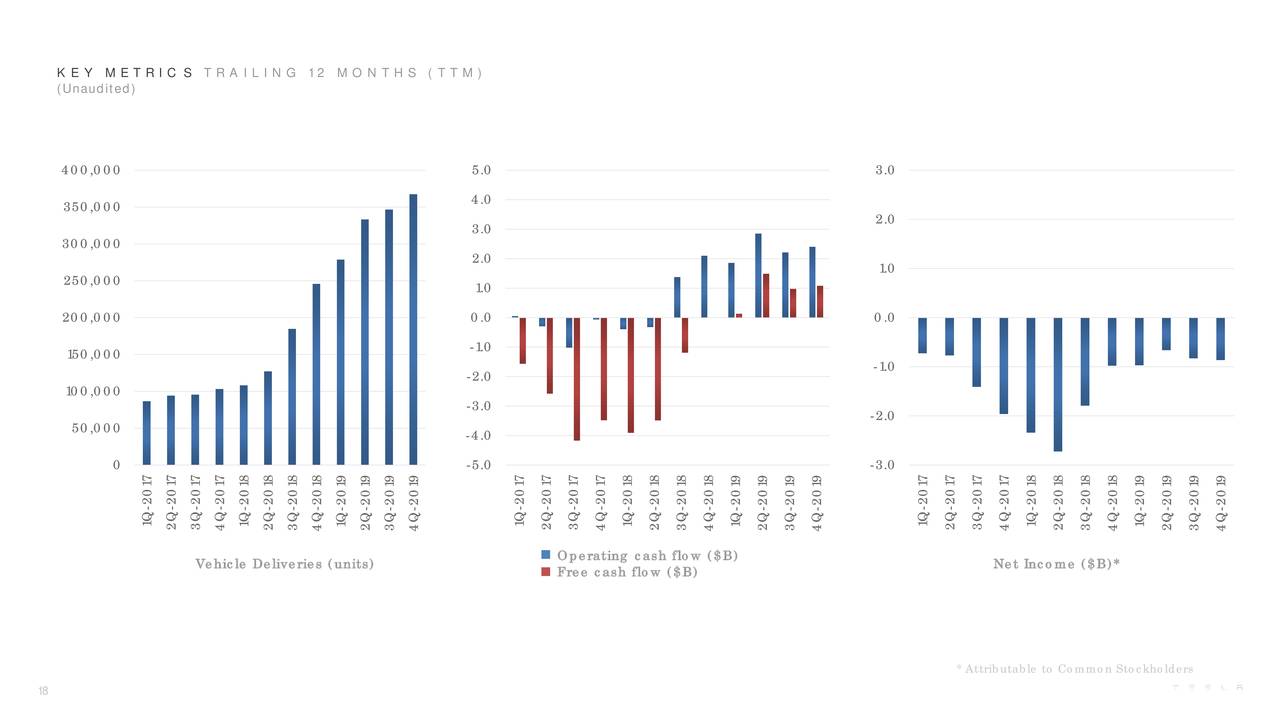

The EV maker reported fourth-quarter revenue of $7.32bn, beating the consensus estimate by $300ml. The company also reported positive earnings for the second quarter in a row. Its Q4 earnings came in at $2.14 per share, up $0.38 per share from the consensus estimate.

The company highlighted several milestones in earnings call that they had achieved in fiscal 2019. For instance, they pointed Tesla’s turn to profitability in the second half along with a full-year free cash flow generation of $1bn. The cash and cash equivalents stood around $6.3bn by the end of the fourth quarter.

Deliveries Could Double in the Following Years

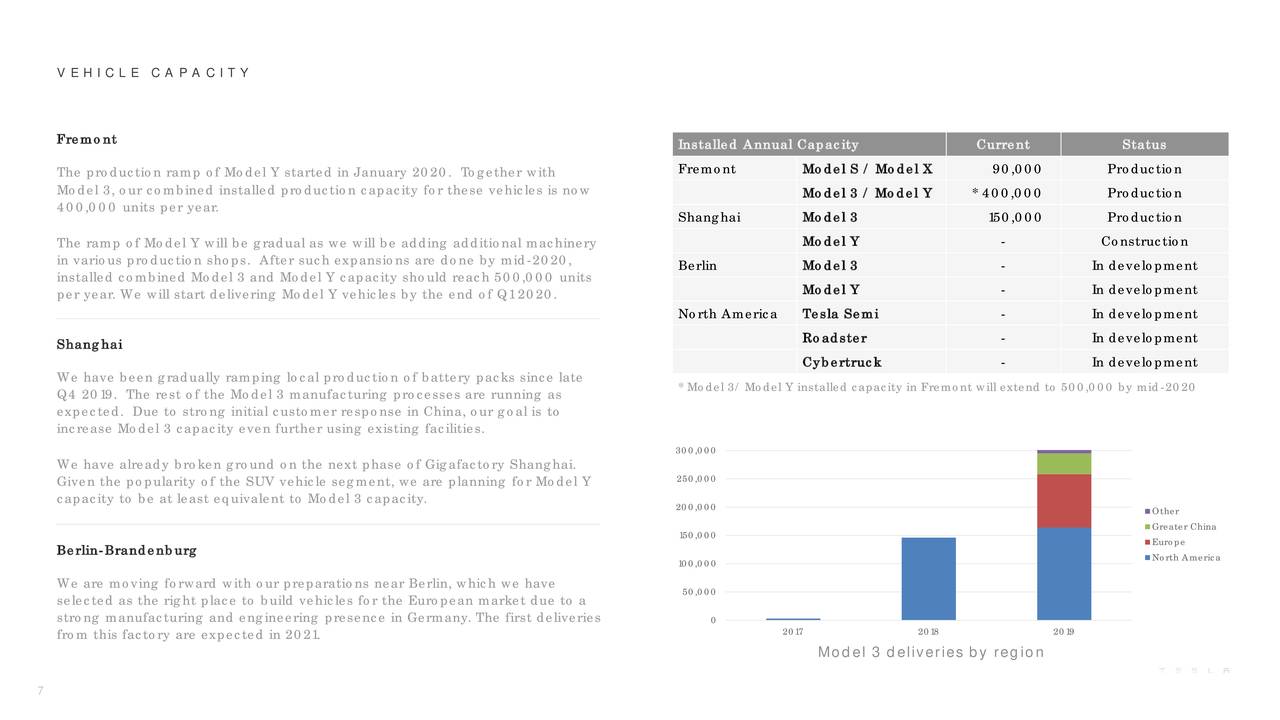

Tesla stock is also receiving support from its improving production potential. The EV maker is expecting to reach a combined Model 3 and Model Y capacity of 500,000 units this year. It is planning to start the delivery of Model Y vehicles by the end of this quarter.

Wedbush analyst raised the Tesla stock price target to $900, citing massive production growth in the coming years.

“We believe hitting the important 500k delivery threshold for FY20 is well within reach as now based on our Chinese demand scenario analysis that Tesla has the potential to hit the elusive 1 million overall delivery vehicle mark potentially two years ahead of our original 2024 projections given this current trajectory aiming now at 2022,” Wedbush analyst Dan Ives said.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account