Tesla (NYSE: TSLA) stock price surged almost 20% in after-hours trading as the world’s largest electric vehicle maker delivered 88,400 vehicles worldwide in the first quarter, down 21% from the last three months of 2019. But this quarter’s figure easily topped analyst’s first-quarter consensus estimates of 78,100 deliveries.

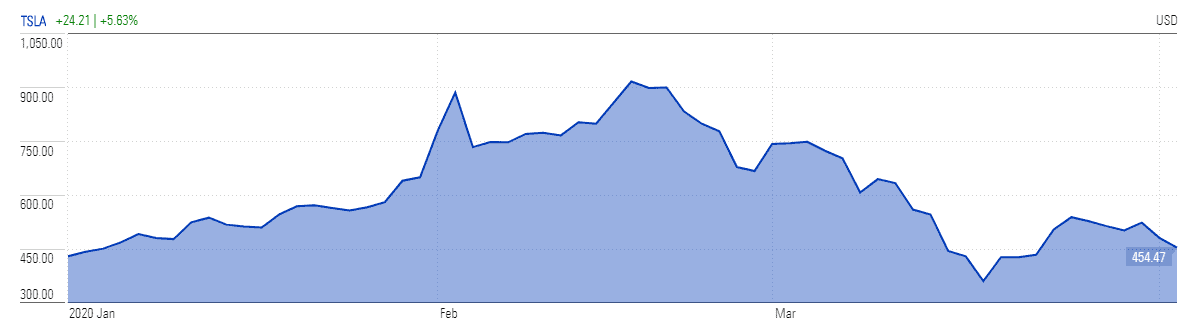

While Tesla has highlighted its strong operational and production abilities in the latest quarter, market pundits predict tough time ahead for the electric vehicle maker because of lockdowns and slowing demand trends across the world. Tesla stock price surged above $500 level in post-market trading, with the shares are still substantially down from an all-time high of $950. The stock closed 5.6% higher at $454.47 on Thursday.

The company has recently closed its facilities in New York and San Francisco Bay Area to safeguard its employees from coronavirus outspread. Also, Tesla plans to cut its 75% of the Nevada facility workforce in the wake of slowing demand, the workforce was engaged in the production of electric motors and battery packs.

The vehicle sales in the US are likely to stand around 11.2 million in 2020 compared to domestic vehicle sales of 17.1 million last year, according to ALS forecast. The slower vehicle sales forecast is blamed on the prolonged economic downturn, on-going social distancing, increased unemployment throughout 2020 and predictions of limited out-of-home activity this summer.

Bernstein analyst Toni Sacconaghi claims that Tesla will definitely miss its second and third quarter production targets but the largest vehicle marker has a strong balance sheet to survive in the short-term. Tesla expects to deliver more than 500,000 vehicles this year.

The forecast for a year-on-year revenue decline of 20% in 2020 could also hurt Tesla’s profit enhancement strategies, in the broker’s view. Tesla expects to generate earnings per share in the range of $4.62 for 2020 with positive free cash flows. “The company’s pain is likely to extend through the second and third quarters as the economic weakness wrought by the coronavirus pandemic could dwarf anything seen during the Great Recession,” Sacconaghi warns.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account