Tesla stock was trading sharply lower in US premarket trading today extending its over 8% decline in regular trading yesterday. Many have blamed the recent fall in bitcoin prices for the fall in Tesla stock. But it is not as simple.

Earlier this month, Tesla announced a $1.5 billion investment in bitcoins and also said that in the future it intends to accept the cryptocurrency as a mode of payment. The news catapulted both Tesla and bitcoin prices to record highs.

Tesla invested in bitcoins

In the statement reporting its purchase of bitcoin, Tesla said: “In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity.”

It added, “We may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future.”

Markets were apprehensive over the investment

Some observers expressed apprehension when Tesla announced the investment in bitcoin. “It will add volatility to the stock due to exposure to bitcoin,” said King Lip, chief strategist at Baker Avenue Wealth Management. “This is better for bitcoin than it is for Tesla,” added Lip whose company has been holding the company’s shares since 2015.

“Elon Musk has exposed Tesla to immense mark-to-market risk,” said Peter Garnry, head of equity strategy at Saxo Bank. Gary Black, former chief executive of Aegon Asset Management also announced that he has sold his shares after Tesla invested in bitcoins. “$TSLA has always been higher risk, but investing $1.5B in #Bitcoin makes it more risky,” tweeted Black.

Bulls see value in Tesla’s investment in bitcoins

However, as has always been the case with Tesla, some analysts saw the investment in bitcoins as a wise move. Brett Winton, ARK Invest’s director of research, said the electric vehicle maker’s bitcoin investment was an “appropriate use of cash.” He added, “We are comfortable with the way in which we are forecasting the positions we are putting our clients in front of,”

Graham Tanaka, president and chief investment officer of Tanaka Capital Management said “I’ve been following this company a long time and … they make the big decisions right.” His company owns Tesla shares.

Bitcoin tumbles

Meanwhile, bitcoin prices tumbled on Monday and are continuing their slide today after Musk hinted that it may be getting overstretched. Incidentally, Musk has a long history of influencing asset prices with his tweets. Some of his tweets like the one that mentioned that he was taking Tesla private, got him into trouble with the US SEC and he eventually had to quit his position as Tesla’s chairman.

How Musk justifies Tesla’s valuation

Notably, last year, Musk had tweeted that he finds Tesla stock too high. His tweet led to a sell-off in the stock. While Tesla stock soared multi-fold from those levels, in less than a year Musk tried to justify the elevated valuation.

Using a hypothetical example Musk said that it can generate as many revenues from Robotaxis and FSD (full self-driving option) as it is making from selling cars. He also said that all these revenues would be almost gross profit and would add to its net income.

Taking the example of annual revenues of $60 billion, Musk said, “So — and the pace you get 20 PE on that, it’s like $1 trillion and the company is still in high-growth mode. So, I think there is a way to sort of like justify the valuation of the company where it is using just the cars and nothing else, the cars with FSD.” He added, “And I suspect at least some number of investors are taking that approach.”

Is bitcoin only to blame for the slide in Tesla stock?

Tesla stock is now below the price level at which it was added to the S&P 500 last year. The company has lost over $120 billion in market capitalization while its investment in bitcoins is only about 1% of that. Clearly, the crash in bitcoins is not the only reason behind the slide in Tesla stock.

Notably, there has been a broad-based sell-off in all the companies in the green energy ecosystem. This includes electric car companies, fuel cell stocks, as well as charging infrastructure companies.

NIO stock has also fallen

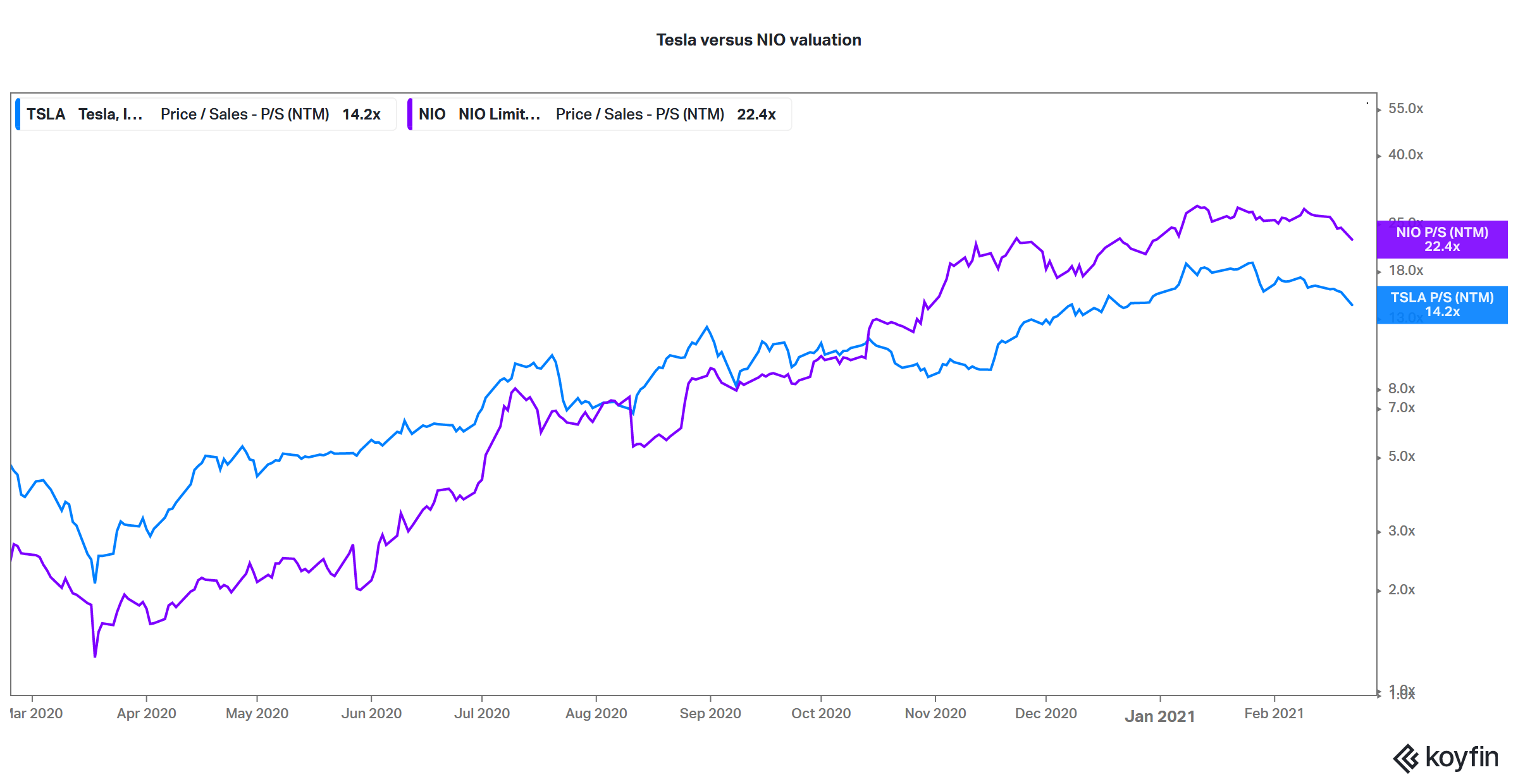

Even NIO stock has fallen almost 25% from its 52-week highs and is down over 8% in premarkets today also. There is little denying that electric vehicle stocks were getting overheated. This especially holds true given the increasing competition in the market.

Legacy automakers have also committed themselves to a zero-emission future and General Motors expects to stop selling internal combustion engine cars by 2035. Pure-play electric vehicle makers have also planned a flurry of new models for the next two years which would add to the competition.

Tesla’s profitability

Even after the crash, Tesla stock trades at an NTM PE multiple of 14.2x. Here it is worth noting that while Tesla has posted profits in all quarters since the third quarter of 2019, its profitability is quite dismal.

Looking at 2020, Tesla made $1.58 billion from the sales of regulatory credits, a year-over-year rise of 166%. The credits directly flow to the company’s bottomline and were more than double of its 2020 GAAP income. Think of it this way, Tesla would have posted a net loss in 2020 on a GAAP basis had it not been for the carbon credits.

The recent crash in electric vehicle stocks shows that markets are now weighing their risk-reward ratios amid soaring valuations and rising competition.

That said, a section of the market is optimistic about Tesla and it is seen as the next trillion-dollar company. Gene Munster of Loup Ventures expects Tesla’s market capitalization to rise to $2 trillion by 2023. Munster had correctly predicted Apple’s market capitalization reaching $2 billion so there is every reason you should take his views seriously.

You can trade in Tesla and other electric vehicle stocks through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account