The world is in short supply of lithium-ion batteries. Well, it is where Tesla Inc is concerned. There is an untapped buyer base just waiting for more battery products and services. No need to fear though. TSLA is here, and its billion-dollar battery plant in Nevada.

Tesla is among the foremost in battery pack technology according to experts at Zacks. The company’s efforts have not gone unnoticed. News arose late last week about a bid to build the biggest lithium-ion battery on the planet.

Elon Musk’s energy business climbs into bed with Aoem, an Australian power giant. The success of their latest venture will also have TSLA provide emergency power for an entire state down under. Although the company does all things on an mega scale lately, the Aoem project is a massive endorsement.

You might have also heard about the mass market Model 3 being launched this month. This electric sedan is the most affordable vehicle ever produced by the firm. It has a ton of fan fare behind it too, and will allow a lot more TSLA fanatics to finally own a Tesla of their own.

The first Model 3 just rolled off the assembly line. It belongs to none other than CEO Elon Musk. He acquired first place in the queue after a Tesla employee gave up his number one spot as a birthday gift. Musk would have waited considerably longer otherwise.

Tesla Inc has over 400,000 people in line for its newest vehicle. Deliveries should start at the end of July and the first year of production is entirely sold out. The Model 3 goes for around $35,000 at is most standard.

“The real winner here is the Tesla Inc (TSLA) battery pack business.”

Analysts like Gene Munster believe that Tesla Inc will propel the adoption of electric cars. The firm will ensure that nearly half a million people drive around in affordable Model 3’s by 2018’s closing. That doesn’t account for Model S and Model X deliveries either.

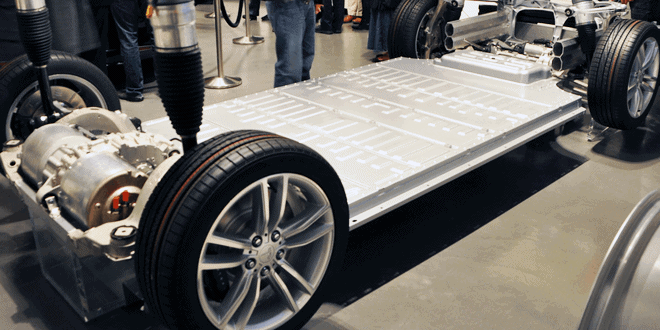

However, the real winner here is the TSLA battery pack business. Whether consumers get Powerwalls for their homes, a Solar Roof or purchase any Tesla EV, they acquire a product enabled by the company’s battery technology.

Australia in not alone in trusting Tesla’s battery expertise. Last year had Japan’s Panasonic invest $1.6 billion in the Elon Musk energy business. The company believes that when demand takes off, Tesla will be seen a superpower among rivals. “The world will be changed” by Tesla, says Panasonic’s President, Kazuhiro Tsuga, especially once “the electric vehicle becomes mainstream…”

From this perspective, the argument that Elon Musk leads a battery business masquerading as a carmaker is hard to overlook. That is more matter of perspective though. In any case, the company secures favor in the auto scene and energy market, securing numerous awards and endorsements on both fronts.

Lithium-ion batteries are the EV market’s go-to choice. Just ask Volvo, Ford, BMW, Navistar or GM among so many others. These automakers all rely on lithium-ion battery packs for their electric vehicle ventures. But the use of the lithium powered batteries is did not begin with the auto market. The batteries on our laptops, smartphones and other rechargeable electronics are powered by lithium too.

Tesla holds an advantage right now by appealing to both car buyers and home dwellers. There are others though who are making headway with the same element which empowers Tesla Inc’s success. Consider these two lithium rivals.

Lithium batteries take center stage

Albemarle Corporation specializes in chemical production. The company makes premium-level substances like bromine, lithium and a other chemicals. Just recently, the company became the biggest producer of lithium. This happened once the company secured Rockwood Holdings nearly two years ago. The total contribution Albemarle makes to the world’s lithium production is estimated to be 35 percent.

ALB is rooting itself in a fast-growing industry. Its position stands to rise with the booming EV market, which relies on the lithium batteries. Shares are expected to climb 21.20 percent by year-end 2017, up to around $4.33.

Arotech Corporation is making headway in electrifying military. The company has two major business units, Battery and Power Systems and Simulation and Training. The prior business creates and sells zinc and lithium batteries along with smart chargers for private defense corporations and military organizations.

Right now, Arotech’s Battery and Power Systems division finds itself in a great position. Its year-to-date sees it gaining more than 18.5 percent.

Stock surges like those of the above two and Tesla Inc reflect the fruition of the lithium industry. The consumption of lithium-ion batteries doubled over the last 5 years. That is according to Frost & Sullivan, which depicts a nearly 100 percent climb in lithium consumption since 2012. Where the market was worth $11.7 billion back in 2012, it was worth $22.5 billion in 2016.

Invest in lithium, Invest in Tesla batteries

This rise is driven by ordinary consumer goods along with the electrification of the auto industry. In fact, the auto industry’s adoption of lithium powered cars rose to 25 percent from 14 percent in 2012.

Lithium will find itself a lot more valuable in years to come. Battery consumption is poised to rise along with the electric car scene. With around 2 million more Teslas set to be sold over the next five years, and automakers like Volvo moving entirely to electric powertrains, Lithium will soon become a highly prized commodity. As a battery giant, Tesla Inc appears to be worth the investment.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account