The price of Sundial Growers shares is rising today in pre-market stock trading action after the company released its financial results covering the fourth quarter of 2020 along with its results for the full-year ended on December 2020.

According to the press release, Sundial’s net revenues during 2020 dropped 4%, ending the 12-month period at CAD $60.92 million as a result of lower prices resulting from “industry-wide price compression”.

The firm stated that its gross selling price moved from $6.24 per gram in 2019 to $5.05 per gram last year. Sundial also anticipates that downward price pressures should continue as competition in the cannabis sector continues to surge.

Meanwhile, gross profits for Sundial by the end of the year dropped 46% at CAD $9.18 million as a result of lower pricing and a shift towards the production of high-cost products.

As a result, Sundial posted a wider loss of $206 million during the year, representing a 45% jump compared to the $142 million the firm lost in 2019.

During such period, the company booked a $79 million impairment charge along with approximately $64.5 million in inventory write-downs – accounting for around 70% of the firm’s losses.

However, the company managed to stockpile cash during the period, with the amount of unrestricted cash surging to $719 million by 15 March as a result of its latest share offerings.

Meanwhile, FactSet estimates for the fourth quarter pointed to revenues landing at CAD $11.1 million for Sundial, which means that the firm beat the market’s expectations for the period as it booked CAD $13.6 million in sales during the three-month period.

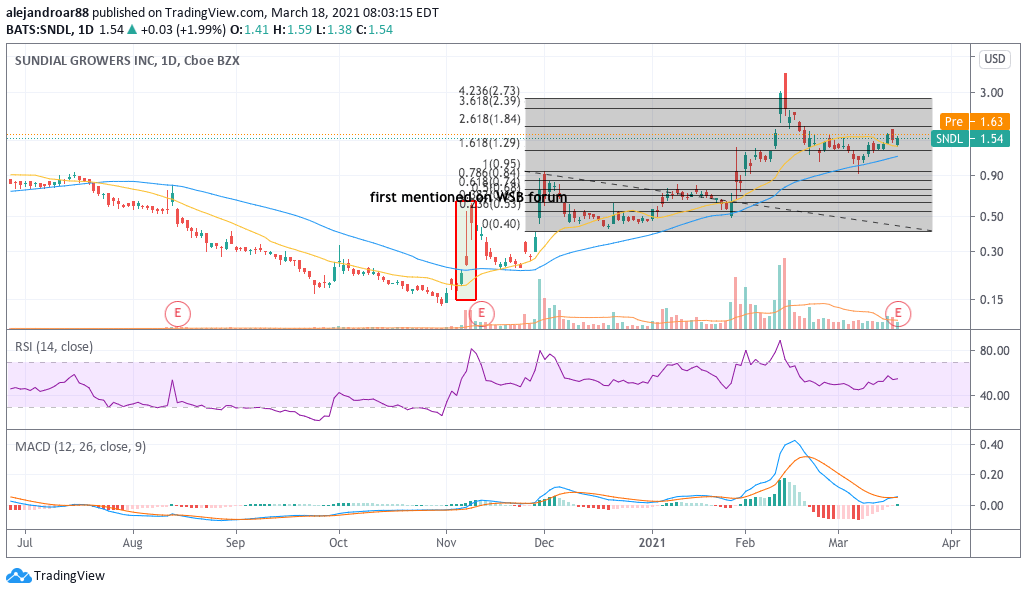

Investors seem to be reacting positively to the news, as Sundial Growers shares are jumping 5% in pre-market action this morning at $1.62 per share following another 2% uptick seen yesterday.

Perhaps the management team’s upbeat tone is contributing to this pre-market jump, as the firm’s Chief Executive, Zach George, stated that the company has “redefined its strategy” while making important adjustments within the organization including the repayment of an important portion of its debt, the simplification of its business model, and a reduction in its cost structure.

These goals seem to have been achieved during the previous year, as the company paid off more than $200 million in corporate debt while cutting its operating expenses by 20%, primarily through a reduction of its workforce.

For now, the market seems to remain focused on how the company plans to deploy the important amount of cash that it has hoarded as a result of its stock’s dilution, possibly eyeing a strategic acquisition that can help the firm in steering its business model towards retailing and away from cultivation.

In this regard, the firm stated that it continues “to explore strategic opportunities to deploy capital with a focus on maximizing shareholder value”.

It added: “This strategy may include a potential merger or other business combination, direct or indirect investments in other cannabis companies both in Canada, in the United States and internationally”.

What’s next for Sundial Growers shares?

If Sundial’s share price holds on to these pre-market gains once the bell rings, the firm’s market capitalization would surge to around USD $1.79 billion. If we deduct the amount of cash at hand reported by the company, that would result in a price-to-sales ratio of around 20 times the firm’s last year sales, which is not too far from the industry’s average yet it is quite stretched for a company whose business model is still in the works.

At this point, the most important catalyst for Sundial would be its strategic approach in regards to how these funds are deployed. If the firm were to dump the money in unproductive investments and minor deals, chances are that investors will shun the stock as it will lose its current shine.

On the other hand, landing an attractive deal with a company that has a strong presence in the retail space in the United States or Canada could boost its valuation.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account