Sundial Growers shares lost almost a quarter of their value yesterday after the company filed to list up to $1 billion in different securities only days after successfully placing a total of $74.5 million in newly issued shares.

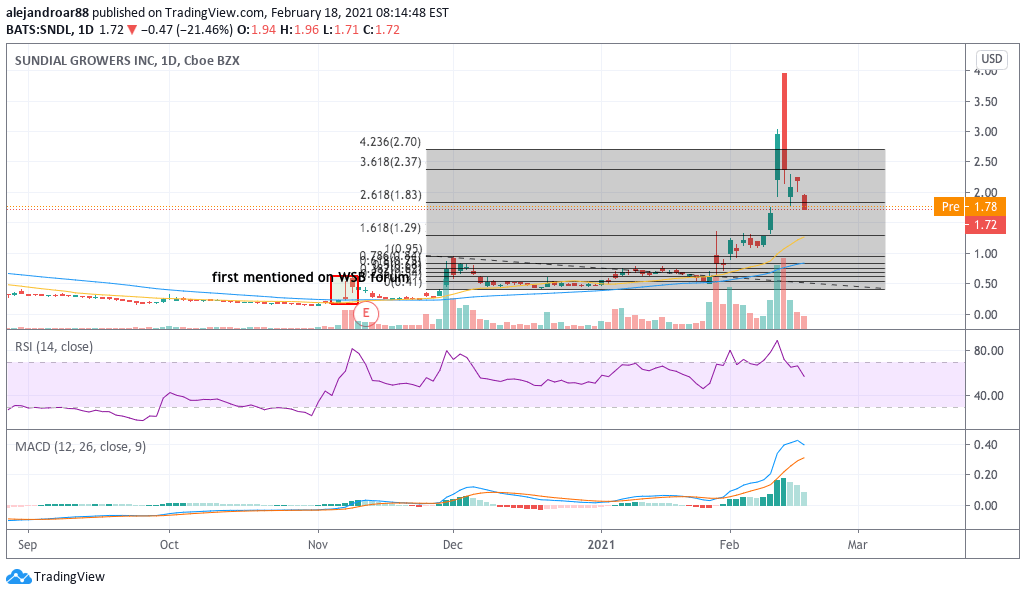

The stock headed down since early stock trading action, moving from $2.19 to $1.72 by the end of the session, effectively losing 21.5% of its value while closing the day at the session’s lows.

According to the filing, the $1 billion offering could be comprised of multiple instruments including common shares, preferred shares, warrants, rights, and units, although the exact amount to be issued per instrument and the date on which they will be issued was not disclosed.

However, the registration reflects the company’s willingness to seek further external financing shortly, even after the completion of a $74.5 million share offering closed on 4 February, with the firm reportedly sitting in a $610 million cash pile by then.

This move from Sundial could be aiming to take advantage of its stock’s recent compliance with the Nasdaq’s minimum bid price rule, which allows the shares to continue being listed in the stock exchange as long as the price remains above $1 for a period of ten consecutive days.

The strong drop in the price of Sundial may have been the result of investors’ expectations of a lower valuation extended to the firm if it were to sell more common shares since Series A shares were sold at $1 per share during the latest share offering.

In other news, Sundial made a $22 million investment in Canadian producer of recreational cannabis Indiva Limited through a private placement that gave the company exclusive rights to buy 25 million common shares of Indiva at $0.44 per share.

The transaction, according to the company’s press release, should give Sundial exposure to the “rapidly expanding cannabis edibles category”.

What’s next for Sundial shares?

As of 11 February, Sundial Growers had a total of 1.56 billion shares outstanding according to this latest SEC filing.

If the firm were to issue a total of 1 billion shares at $1 per share, the price of the stock would be diluted to $1.72 per share based on the 16 February closing price, which is exactly the price at which the stock ended yesterday’s session.

Based on those estimates, it seems that investors are expecting a share offering, even though the company could move to list other instruments that might enjoy a more favorable valuation. So far today, the price of Sundial shares is ticking 4% higher in pre-market action at $1.79.

According to the Fibonacci scale shown in the chart, Sundial Growers shares are still heavily extended, although the price just moved below the 2.618 Fibo extension yesterday.

At this point, traders should wait a few days to see how the market reacts to the news, as investors could end up seeing this move as a positive one to keep strengthening the firm’s capital, taking advantage of the tailwind provided by the US government’s favorable stand toward the legalization of marijuana on a federal level.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account