The start of the overnight trading session on Wednesday evening registered a sharp spike in futures contracts tied to the major U.S. stock indexes. Hours after the Nasdaq Composite clinched its 25th record close for 2020, stock futures

Dow Jones Industrial Average futures climbed 50 points at the start of the overnight session, which can result in an opening gain of 0.3% when regular trading resumes on Thursday. S&P 500 and Nasdaq-100 futures pointed to similar opening climbs of 0.3% each.

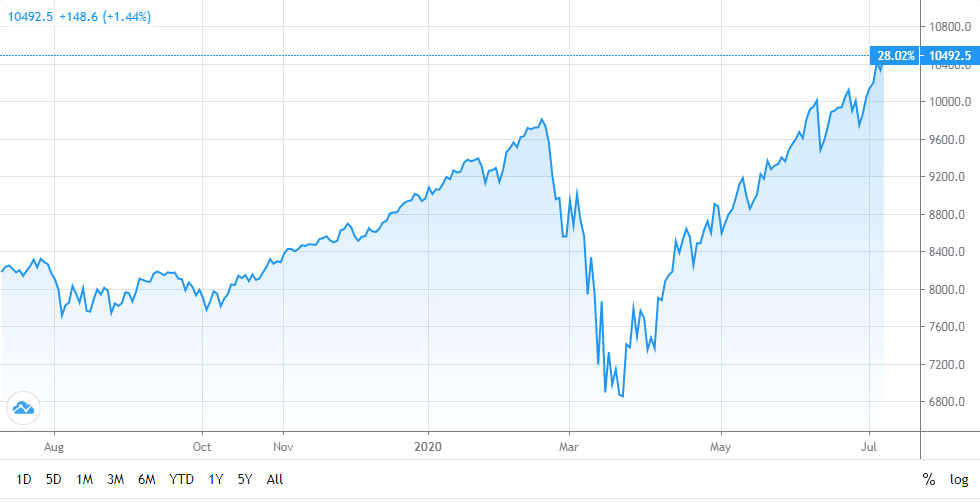

The Nasdaq rose 1.44% in part supported by a 2.3% rally in Apple, a 2.7% rise in Amazon and a 3.49% climb in Nvidia. The index closed at a record high 10,492.50.

The S&P 500 registered a more modest 0.78% gain on Wednesday while Microsoft and Goldman Sachs helped push the Dow up 177 points, or 0.68%

Since last week’s close, the S&P 500, Dow and Nasdaq Composite have climbed 1.28%, 0.93% and 2.79%, respectively. The Nasdaq has climbed 29.68% over the last three months.

The market’s reaction and increase in the value of stock futures come ahead of the latest iteration of the Labor Department report on weekly jobless claims, which will be released Thursday morning.

The weekly figures provide Wall Street with critical insight on the current state of the US economy, the recovery of business and consumer sentiment as well as the number of Americans who continue to collect unemployment benefits, known as continuing claims.

“We do recognize that bond-like and secular growth stocks (e.g., mega-cap tech, indices such as Nasdaq 100) are already at new all-time highs. Crowding in these stocks indeed reached elevated levels,” JPMorgan strategist Marko Kolanovic wrote in a note Wednesday. “This is in part the result of long-short trades where portfolio managers are buying mega-cap tech and momentum stocks while shorting smaller cyclical and value stocks.”

The after-hours moves Wednesday evening comes after a positive regular session on Wednesday for both stock futures and company shares. All major indexes did not react to news of a record daily increase in new U.S. Covid-19 cases. Big Tech continued to carry the broader market higher on during regular trading with some of the biggest winners being Twitter, Norwegian Cruise Line, Costco and Chinese electric car maker NIO. These shares along stock futures allowed the Nasdaq Composite to outpace the S&P 500 and Dow industrials.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account