Webull Review for 2021

Considering the sheer number of stock brokers available online, finding one that works for you can be a challenge.

Webull is a fairly recent player in the sector and you might be wondering whether it is the best brokerage firm for you. To help you make an informed decision, we have undertaken a thorough review of this stock broker.

Read on to find out everything there is to learn about Webull and assess its suitability to your trading and investing needs.

-

-

Our Recommended Stock Broker - 0% Fees

Our Rating

- 0% Commission on Stocks

- Trade Stocks, Forex, Crypto and more

- Only $200 Minimum Deposit

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.What is Webull?

Founded in 2016, Webull is a stock broker that is a member of the Securities Investor Protection Corporation (SIPC) and the (Financial Industry Regulatory Authority) FINRA. It is also licensed and regulated by the Securities and Exchange Commission (SEC).

Aside from providing zero-commission trading, it also offers real-time market data, news feeds, and analysis tools for free to all of its traders. On May 30, 2018, it launched its mobile app. The app can be downloaded on iOS and Android devices.

It is simple and easy to create an account on Webull. Applications are generally approved within an hour after submitting all the required details. After signing up, you can use ACH bank transfer to fund your account. Unlike other stock brokers, Webull has no minimum deposit requirement, but if you wish to switch from a cash account to a margin account, you are required to fund your account with a minimum of $2,000.

Additionally, Webull makes sure that its traders’ funds are always safe. Traders get investor protection worth $500,000 as well as a $250,000 cash limit, which are requirements for SIPC member firms. Its clearing agent can also provide you with additional insurance cover of up to $37.5 million for individual securities and $900,000 for cash.

Pros and Cons of using Webull

Pros:

- Commission-free trades on stocks and ETFs

- No minimum deposit required

- Powerful mobile application

- Robust trading platform

- Plenty of technical indicators

- Account protection through SIPC

- Secure platform

Cons:

- Does not support options trading

- Only available for US residents

- No support for fractional shares

- Few account options

How to use Webull

Webull mainly works with individual taxable accounts and the minimum account balance for the cash account is $0.

For a margin account, $0 to $ 25,000 is required depending on the specific features you want to access. Its users can only trade stocks as well as exchange-traded funds (ETFs). Currently, there is no support for mutual funds, bonds or OTC stocks. However, the firm has promised to launch options trading in the future.

For all transactions, Apex Clearing is the clearing agent. You can transact during regular trading hours, pre-market hours and after-hours. The pre-market period according to Webull transaction hours is 4.00am to 9.30am while the after-hours period starts from 4.00pm and ends at 8.00pm (ET).

The value of one stock trade should be above $1 but not more than $10 million.

Getting Started on Webull

You must meet the following qualifications for you to open a Webull account:

- Be 18 years and over.

- Hold a valid social security number.

- Have a legal US residential address.

- Be a US citizen, holder of a US permanent residence permit or holder of a valid US visa.

If you meet all of the above criteria, opening a trading account should happen within a day. To get started, launch the web platform on your web browser or use the mobile or desktop platform.

The first step is to click the ‘Sign up’ button and then provide basic information such as your full name, date of birth and country of residence. You will need to submit a photo of a government-issued ID such as your passport or driver’s license. These are for identity verification purposes since this is a regulated platform.

Tradable Assets on Webull

Types of Accounts on Webull

Cash Account

Cash accounts are regular trading accounts wherein you can only trade using the available funds in your accounts.For example, if you only have $100 in your account, the value of your total trades can only be up to $100. There is no required minimum deposit for a cash account. Traders also do not incur account opening costs.

Margin Account

Using a margin account, you are allowed to borrow a loan of up to 50% of the securities purchase prices. These securities can be purchased on margin, making it possible to leverage your position and make higher profits than your holdings would typically allow.On this account, you can trade futures, short stocks and trade options. The minimum deposit for an account with short sale and limited day trading is $2,000. On the other hand, to access both short sale and unlimited trading, you would need to put up $25,000.

Both types of accounts can have a leverage of up to 2:1 for overnight positions and up to 4:1 for day trading. Short positions are also allowed for both. On the former, you can only have a maximum of 3 day trades weekly.

Webull IRA Offering

Webull recently launched the individual retirement account (IRA).Traders can choose and control their investments for the future through its innovative technology. To fund your IRA account, you can implement annual contributions, direct roll and roll-over as well as transfers from trustees. To access the IRA offering, you need to have a brokerage account.

Features of Webull

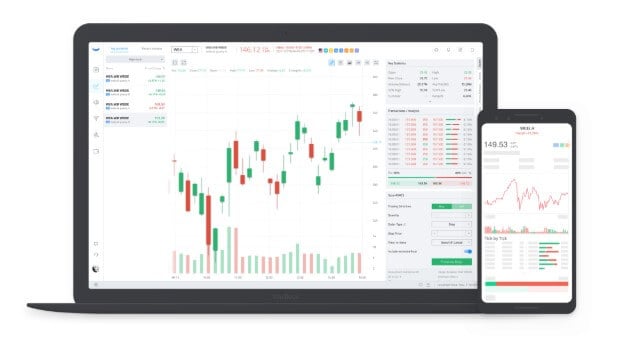

Powerful Trading Platforms

The Webull trading platform is excellent, featuring a sleek user interface with user-friendly features for both beginners and advanced traders. Its features are simple to use and highly customizable. You can choose to work from three platforms in Webull. These platforms are:

- Mobile

- Desktop

- Web

The platforms are available in both English and Chinese.

Web Trading Platform

The web platform is well designed with an easy to navigate layout. Tools are well organized on the intuitive interface.

Webull also provides a two-step login which you need to activate. To do so, access the advanced security settings, go to the settings menu and tweak things to your liking. You will get security codes every time you log in to your Webull account; this feature ensures that your account is tamper-proof. Users are encouraged to activate the two-step verification to strengthen account security.

Its search features are excellent. You can perform searches on the site by typing the company’s name as well as the choice of the asset. While typing the characters, the auto-suggestion will provide relevant results thereby reducing the tasks of searching for an item.

While in the Webull web platform, you can access a variety of order types. These are:

- Market

- Stop

- Limit

- Stop limit

- Bracket order

Order limits that can be used in Webull platforms are:

- Day

- Good ‘til Cancelled (GTC)

Mobile Trading Platform

Webull’s mobile platform is one of the best in the market. It offers a user-friendly interface and access to most of the important features on the web platform.

It also has two-step login and price alerts. The mobile platform is available on both Android and iOS devices. Here too, you will find an excellent search function, allowing you to find tradable assets using either the name of the company or the ticker.

Desktop Trading Platform

The Webull desktop platform is fully equipped with features as the ones on the web platform. It is just as user friendly, and the charts and workspaces are fully customizable.

Investors using the desktop trading platform can get a variety of order types. The design is seamless and allows you to set news alerts as well as price alerts. You can take advantage of the advanced control panel to customize the interface for easy navigation. Fundamental data and charts are easily accessible here.

Alerts and Notifications

You can set alerts and/or notifications for the stock of your desire. For you to perform this task, you will be required to search each stock then click on the bell function to set your price and other alerts on financial information.

While on the sidebar of the Webull web platform, you can access the fee reports as well as your portfolio.

Webull Virtual Portfolio Services

Webull offers virtual trading services for you to familiarize yourself with the services in the app. Using its paper trading feature, you get to sharpen your investment skills without any risk of loss.

To get started in the app, click on the paper trading icon. The demo account comes with $1 million for simulation trading. You can buy and sell stocks in the app just like in a real-life situation.

Webull Discussion Boards

Through Webull’s discussion forums, you can get more information on trading and investment. This feature makes it possible to draw from the know-how of more experienced traders and improve on your strategies. You could also initiate discussions and get insights on different topics from fellow account holders.

Webull Fees

One of the key highlights is the fact that it currently charges no commission for trading across the board. If you have a US bank account linked to your account, you will not pay any deposit or withdrawal fees.

However, when trading in ADRs, you will pay a fee of $0.01 to $0.03 per share. Currently, these are the market rates:

Amount in USD ARD interest rate in % 0 – 25,000 6.99 25,000.01 – 100,000 6.49 100,000.01 – 250,000 5.99 250,000.01 – 500,000 5.49 500,000.01 – 1,000,000 4.99 1,000,000.01 – 3,000,000 4.49 Over 3,000,000 3.99 Fees charged by regulatory agencies:

Charged by SEC FINRA Fees Min $0.01 Min $0.04 – Max $5.95 Rate 0.00207% 0.0119% Rule Sells only 0.000002078*Total USD Trade Amount Sells Only 0.000119*Total Trade Volume Deposits, Withdrawals and Supported Payment Methods

Your base currency for deposits and withdrawals is in USD only and Webull only supports the use of bank transfers for these transactions.

In case you opt for a wire transfer, be prepared to pay high fees, but you will incur no fee for ACH transactions, either deposit or withdrawal. If you are outside US territories, the only option is a wire transfer.

ACH does not charge Webull deposit fees. However, you will need to pay a fee of $8 if domestic wire transfer is used and an international wire deposit attracts a fee of $12.5.

Domestic wire withdrawals cost $25 while international wire transactions cost almost double, $45.

Research and Education

The Webull platform offers comprehensive research tools.

Its research tools are easy to use and will give you access to fundamental data and recommendations. Also, they are available on all trading platforms.

Using the analysis widget, you can track trading ideas on stocks. This will enable you to get information based on other traders’ opinions on selling, holding or buying an asset. You can also get price targets using the analysis tool.

The platform also offers fundamental data and information for various stocks and ETFs. Financial statements and information are available for as long as five years. Charting tools in the platform will enable you to make more informed decisions on trading on your stocks.

Additionally, Webull provides sufficient educational content for newbies using the following:

- Quality educational articles

- Provision of a demo account

The main feature that benefits newbies the most is Webull’s free demo account. Under this account, you can use almost all features that are available in the live account.

When it comes to educational articles, there is plenty of information that covers a wide range of subjects. However, the service is limited in terms of regular updates.

The FAQ section is a good place to find educational content that can provide basic knowledge of the brokerage activities. Additionally, you share your views with the ever-growing Webull community on the discussion forum. Investors share views and emerging trends in the market.

How Safe is Webull?

Webull offers highly secure trading platforms.

When you sign up, you can get investor protection of up to $500,000. This includes $250,000 for your cash. Furthermore, it is regulated by top financial organizations that ensure that it runs smoothly and accordingly. These authorities are FINRA and SEC. They can guarantee that stock brokers like Webull operate according to the required legal standards.

However, you should take note that all unregistered investment contracts, fixed annuity contracts, currency, unregistered limited partnerships and interests in commodities such as gold and silver are not covered in the investor protection scheme.

Customer Support

You will be able to get fast answers when you use the trading platform’s messaging center. However, the customer support on emails and phone is limited.

Generally, when you want to contact Webull’s customer support, you can do so via the following platforms:

- Trading platforms messaging center

- Telephone

Webull Review – The Verdict

Webull’s services are great. The free commission trades on US stocks, options and ETFs are a great plus for the site. The account creation process is also simple and fast.

Its trading platforms are easy to understand as the platforms are so well structured that both beginner and advanced users can use it with ease and be able to figure out how to maximize its features. Additionally, new traders can get free access to the virtual demo account before they decide to invest in a real trading account.

On the other hand, among the top limitations of Webull is that it covers only the US market and that it has a very limited portfolio. Also, it only supports one method of money transfer. Bank and wire transfers are very expensive due to the double charges on both ends.

Despite Webull’s downsides, it is still one of the best stock brokers in the world. It’s highly recommended that you should also give it a try.

Our Recommended Stock Broker - 0% Fees

Our Rating

- 0% Commission on Stocks

- Trade Stocks, Forex, Crypto and more

- Only $200 Minimum Deposit

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

Who are the owners of Webull?

cl is owned by Webull Financial LLC. It is a bonafide member of Securities Investor Protection Corp. (SIPC).

Is stock trading on Webull good for beginners?

Yes, Webull’s trading platforms are user-friendly for both beginners and advanced users. Newbies can also try the virtual demo account before they venture into actual trading.

Is it free to use Webull?

You will get commission-free trading on stocks and ETFs. There are no charges for maintaining a Webull account. However, FINRA, SEC and margin-trading fees apply.

Is it safe to use Webull?

Webull is very safe because it is regulated by both FINRA and SEC. These authorities provide investor protection of up to $500,000, including $ 250,000 for your cash. You are also protected by the SIPC investor-protection scheme.

Can Webull provide real-time market data?

Yes, Webull provides real-time global investor market data for free to all of its users. The Nasdaq Total View feature can be accessed by logging in to its trading platforms.

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Founded in 2016, Webull is a

Founded in 2016, Webull is a