Stellantis shares are soaring today during their first day of trading, as investors seem to have welcomed the merger between Fiat Chrysler and Peugeot with a positive tone.

The stock, which trades under the ticker FCA in Milan’s stock exchange and as STLA in New York and Paris, saw its value rise to €14.22 since the stock trading session started, as investors celebrated the completion of a deal that dates back to 2019.

The combined entity – now known as Stellantis – is an automobile behemoth with combined annual sales of nearly 8 million vehicles, which results in roughly €180 billion in revenue and €10 billion in operating profit based on the financial results reported by the two companies in 2019.

The merger was successfully cleared by more than 14 different jurisdictions in which the two companies have operations and the corporation will now serve as an umbrella for an ample portfolio of vehicle brands including Fiat, Alfa Romeo, Peugeot, Maserati, Open, and others.

As a result of the merger, Stellantis would effectively slash around €5 billion amid the positive synergies between the two automakers, while the firm’s head, Carlos Tavares, who led PSA Group prior to the merger, said the company would generate roughly €25 billion in additional value to Stellantis shareholders through different cost-cutting measures that won’t affect the company’s employees or its plants.

Meanwhile, credit rating agency Standard & Poor’s raised its rating for Stellantis to BBB- with a stable outlook, up from a previous BB+ the firm had assigned Fiat Chrysler.

The agency highlighted that the newly-emerged company has a “solid balance sheet” and a “large liquidity buffer”, which provides the group with enough solidity to withstand the temporary turmoil caused by the COVID-19 pandemic including the “mobility restriction risks” resulting from the health emergency.

What’s next for Stellantis shares?

The positive tone instilled by the completion of this long-dated merger to the price action could result in a new bullish phase for Stellantis shares, at least until the company starts revealing its first few trading updates and financial statements.

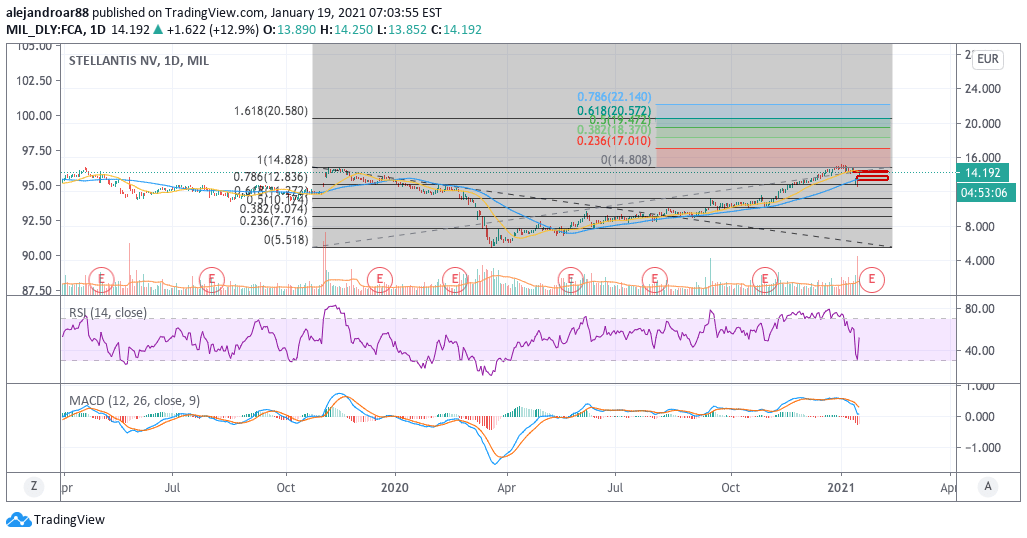

For now, the price is bouncing strongly off oversold levels in the RSI, while it is also struggling to fill a gap left behind on 13 January after FCA completed the distribution of a special €1.84 per share cash dividend that was contingent to the completion of the merger.

Meanwhile, today’s action is also leaving behind a large bullish gap, which could help sustain a bull run over the coming weeks if investors continue to be optimistic about the future of the automobile giant.

For now, a first target for Stellantis shares can be set at €17 euro per share based on the Fibonacci extension shown in the chart, mostly supported by today’s price gap. At this price, the firm would be valued at $63 billion or $11 billion higher than the $52 billion price tag of the merger.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account