Spotify (NYSE: SPOT) stock price rebounded sharply after reporting stronger than expected financial performance for the third quarter. It has topped revenue and earnings estimates for Q3. In addition, significant subscriber growth added to the trader’s sentiments.

The strong outlook for the final quarter of this year helped in generating significant gains after the earnings announcement. Spotify stock price surged close to 16% in a single day after Q3 surprise profit. The shares are currently standing around $140, down considerably from a 52-weeks high of $160 a share.

Financial Performance Created Bullish Trend for Spotify Stock Price

The company has topped third-quarter revenue and earnings estimate by €10 million and €0.65 per share, respectively. Its financial numbers also grew significantly when compared to the past year period. SPOT revenue of €1.73 billion grew 28% from the same period last year.

The company’s total monthly active users stood at 248 million in Q3, up 30% year over year. The growth is driven by Southeast Asia, which remains its fastest-growing region by generating 1400 bps Y/Y growth. The premium subscribers came in at 113 million, up 31% from the previous year period.

Its CEO said, “The business met or exceeded our expectations in 3Q19, with accelerating MAU growth, and better than expected (1) Subscriber growth, (2) Gross Margins, and (3) Operating Profit. For the 8th consecutive quarter, free cash flow was positive.”

The company generated positive earnings per share of €0.36 in Q3 compared to a loss of €0.42 in the year-ago period. Spotify appears in solid position to invest in growth opportunities considering its cash generation potential. Its operating cash flows stood at €71 million while it generated €48 million in free cash flow in Q3.

Outlook Shows Further Growth

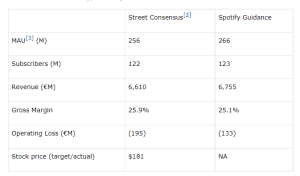

The company expects to generate similar growth in the final quarter of this year. It expects total monthly active users in the range of 255-270 million and total premium subscribers are likely to stand around 120-125 million. The guidance for fourth-quarter revenue is around €1.74-€1.94 billion. Overall, market analysts are optimistic about the Spotify stock price performance.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account