Splunk (NASDAQ: SPLK) stock price bounced more than 50% in fiscal 2019 to an all-time high of $140. But, analysts are suggesting investors hold their positions in the software company. The majority of market analysts are presenting a bullish outlook for Splunk amid its financial growth and strong demand for its products.

Splunk stock price is currently trading around $150 with the market capitalization of $23 billion. It offers software for machine log analysis. The company’s most prominent solution includes Splunk Enterprise, which is used across application management, IT operations, and security.

Solid Financial Numbers are Backing Splunk Stock Price

The company has topped third-quarter revenue and earnings estimates by a wide margin. In addition, its financial numbers grew significantly when compared to the previous periods. Its Q3 revenue of $626 million rose by 30% from the year-ago period. Its software revenue came in at $454 million, up 40% year over year.

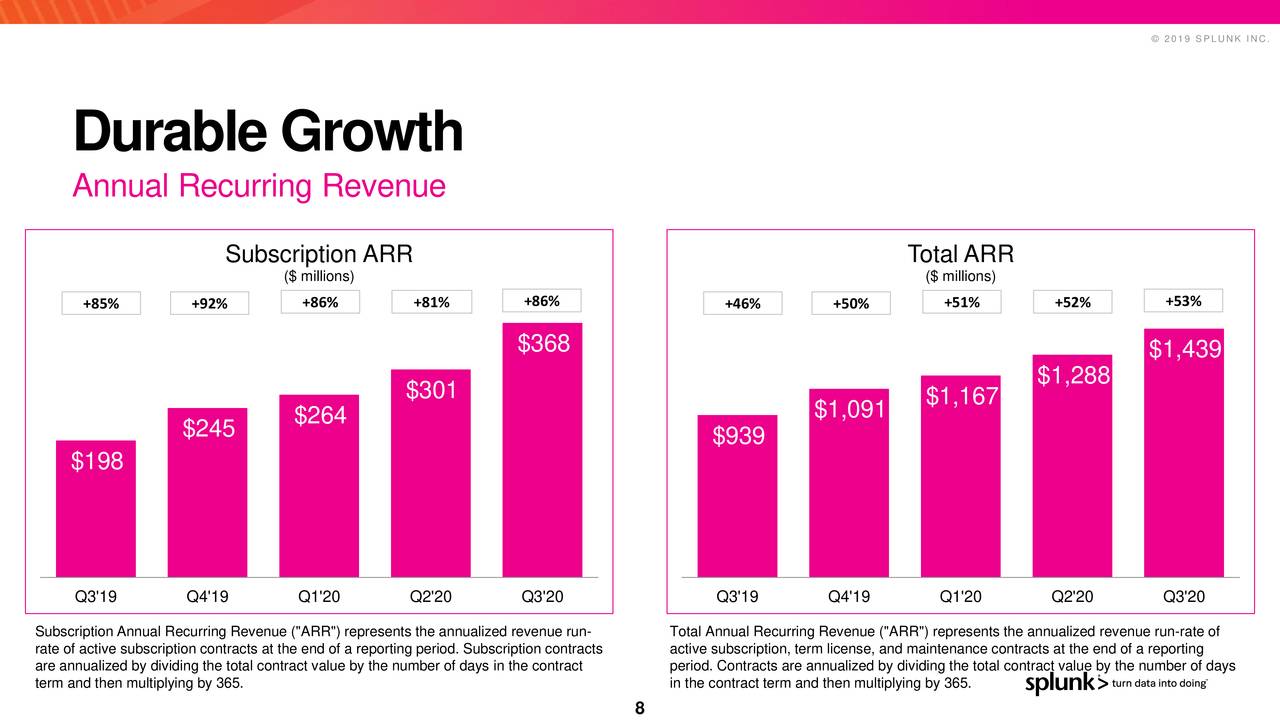

Its total ARR rose by 53% to $1.4 billion. In addition, the company signed 440 new enterprise customers during the third quarter. These customers include big names such as Airbus (OTCPK: EADSF), Anaplan (NYSE: PLAN), and Chegg (NYSE: CHGG).

Moreover, the company has increased its outlook for the final quarter and full year. Splunk expects full-year revenue to stand around $2.3B to $2.35B.

“Splunk continues to show the world how our Data-to-Everything Platform is uniquely positioned to bring data to every question, decision and action,” said Doug Merritt, President, and CEO, Splunk.

Analysts Raised SPLK Share Price Target

The majority of analysts are seeing the upside momentum in SPLK share price. For instance, Wedbush has provided a $180 price target with a Buy rating. Goldman Sachs also provided a $180 price target, citing the potential growth in free cash flows.

Cowen analyst is showing confidence in its latest product offerings. The analyst Derrick Wood says elevated sales turnover along with the new pricing structure could lead to profitability in the coming quarters.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account