Splunk (NASDAQ: SPLK) stock price has been under pressure over the last couple of months. SPLK shares are currently down almost 10% from 52-weeks high of $143.

Fortunately, analysts are forecasting significant upside potential amid robust growth in financial numbers. The stronger than expected third-quarter results added to the bull case.

The company has topped third-quarter revenue and earnings estimate. In addition, the company has increased its outlook for the full year. The investors are also showing confidence in free cash flow generation potential.

Analysts Raised Splunk Stock Price Target

The well-known market analysts have lifted SPLK shares target following third-quarter results. For instance, Morgan Stanley raised the price target to $169 from $140.

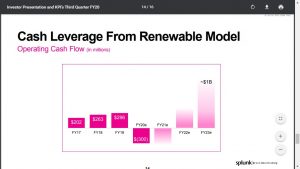

MS analyst Keith Weiss expects clarity in the recurring revenue model shift. The analyst estimates a durable +25% ARR growth along with the expansion of free cash flows to $1B in FY23.

Moreover, Jefferies and Needham have provided a Buy rating for SPLK shares. Jefferies set a price target of $157, citing a vast opportunity amid product portfolio growth and attractive valuation.

Needham says they are witnessing very positive feedback from partners and customers for Splunk’s products.

Q3 Beat and Higher Guidance Is Adding to Bullish Sentiments

Splunk’s third-quarter revenue of $626.34 million has beaten estimates by $21 million. Its Q3 revenue grew 30% from the same period last year.

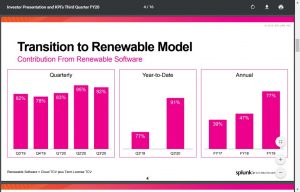

The revenue growth is driven by a 40% year over year increase in software revenues. Q3 software revenue was up 40% Y/Y to $454M. The total ARR came in at $1.4B, up 53% year over year.

Jason Child, the chief financial officer said, “With the shift to a renewable model largely complete, momentum in our term license and cloud offerings drove 53% growth in total ARR during the quarter.”

The technology company has raised the full-year outlook. The company expects fourth-quarter revenue to stand around $780 million. It expects full-year revenue of $2.35 billion, up from previous guidance of $2.3 billion. Overall, numerous catalysts and growth strategies are supporting the bullish trend for Splunk stock price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account