Both Sony Corp (NYSE:SNE) and Microsoft Corporation (NASDAQ:MSFT) talked a very big game when they set the stage for the current generation’s console war. They were both going to transform the world with their gaming machines, and, with Microsoft well in the hubristic lead, use the PS4 and Xbox One as the center of their electronics strategies.

At the time of the Xbox One and PS4 launches both Sony and Microsoft were electronic disasters. Now that the sales of the PS4 VS Xbox One are continuing to lean in the direction of the Japanese giant, absolutely nothing has changed. To understand why, you have to take a look at a few financial truths of the console war.

Every hardware sale isn’t a victory

An oft repeated fact about the current PS4 VS Xbox One battle is that the companies don’t have to sell their consoles at a profit because they’ll make up the difference in software sales later. This isn’t true, however. Microsoft lost an estimated $2 billion per year while the Xbox 360 was at the height of its powers.

It turns out that hardware is expensive to make, and it’s expensive to market. Blowout games developed by the platform makers, like Killzone or Halo are tech demos that end up costing, over the range of games developed, as much as they bring in or even more. Console sales only matter financially if third party software sales are incredibly high.

Gaming is not a profitable business

The reason that Microsoft wanted to make the Xbox One the center of the living room and Sony wants to use the PS4 to turn into a subscription service is because gaming just isn’t profitable. Sony hasn’t made a profit in a decade, and the company reckons it can return to profitability by the end of 2017, at the earliest.

Microsoft has probably made a cumulative loss off of its gaming business since initiating it with the Xbox at the turn of the century. In order to make a profit off of the PS4 and Xbox One, the company’s need to attract other business, selling TV and other subscription services through their hardware. That’s what the point of the Microsoft One Strategy was, and the derivative “One Sony” initiative that was announced last year.

PS4 VS Xbox One: The biggest loser

If neither company is able to turn its console victory into something more, the best they can do on the business is break even, or possibly make a small profit. With the billions invested, that’s not good enough for shareholders. For Sony Corp, which is underperforming almost everywhere, this isn’t much of an issue.

For Microsoft, however, billions spent on Xbox One with just pocket change in return is a lost investment. The company could be spending that money on much more profitable businesses.

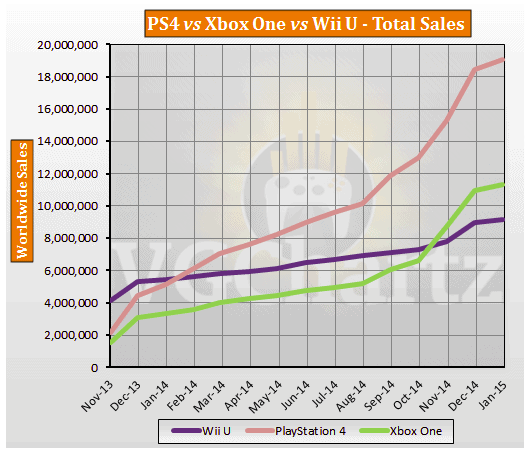

In financial terms the PS4 VS Xbox One battle is, for the time being at least, about who’s going to be the biggest loser. With Microsoft sales behind by a long shot, it seems that that company is the likely loser. Unless Sony is able to find a good way to turn PS4 sales into a profitable business, the company may be doomed to lose as well.

For shareholders the market driving the PS4 VS Xbox One competition is a losing one that no company has managed to figure out. From software makers like Electronic Arts to hardware makers, console gaming is financially desolate. Microsoft’s accountants have been trying to get that point across for years.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account