Snap (NYSE: SNAP) stock price topped the internet stocks and the broader market index by a wide margin in 2019. Its share price grew more than 195% in fiscal 2019. Meanwhile, the S&P 500 index surged 28% and the Nasdaq Internet Index jumped 29% in 2019. Snap’s share price performance also beat the 47% increase for the S&P 500 IT Index.

Snap stock price rally is supported by investor’s confidence in its financial performance and growth strategies. SNAP shares are currently trading slightly below from 52-weeks high of $18. The market pundits expect the extension of upside momentum in 2020 due to strong growth in ad revenue.

Analysts are Bullish About Snap Stock Price

JMP Securities lifted the Snap price target to $20 with Market Outperform ratings. Its analyst Ronald Josey believes the company has the potential to increase its user base at a massive pace.

On the other hand, Aegis Capital has provided a street high price target of $24 with a buy rating. The firm anticipates user growth, especially outside the U.S.

Its analyst said, “Snap should maintain high revenue growth, take ad share and keep narrowing the gap on average revenue per user between it and Twitter (NYSE: TWTR) and Facebook (NASDAQ: FB).” The analysts also forecast positive free cash flows and EBITDA in 2020.

Loop Capital increased the price target from $5 to $20. The firm is optimistic about strong ad revenue growth and user engagement improvement.

Financial Numbers Indicate Strong Growth

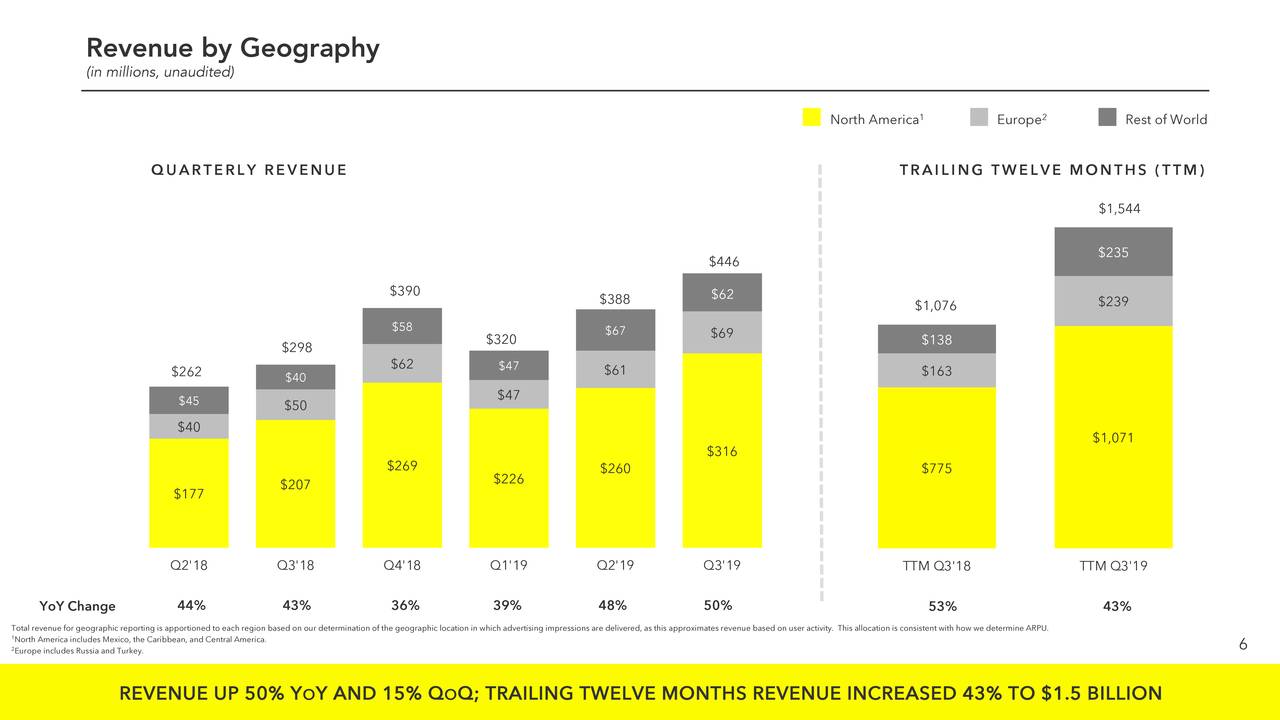

The company has generated robust financial and operational results in the latest quarter. Its third-quarter revenue grew 50% from the past year period. SNAP’s daily active users came in at 210M in the previous quarter, up 13% from the year-ago period. Moreover, the company also reported significant improvement in earnings and cash flows. Its net income improved by $98M in Q3 and free cash flow surged by $75M from the year-ago period. Overall, Snap stock price appears like a good stock for 2020.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account