America’s biggest mall owner, Simon Property Group, is suing fashion chain Gap, as tensions between landlords and retail tenants surge over unpaid rent.

The California-based retailer, which is among the largest tenants for Simon properties, has failed to pay nearly $66m in rent to the real estate company, as the coronavirus pandemic forced retail businesses to cut expenses while their stores remained closed.

Gap, which has 412 stores in Simon-owned shopping malls, had previously said it had stopped making rent payments on its closed locations, citing a debt of $115m with landlords by the end of April.

The retailer also said it anticipated potential legal conflicts from these unpaid bills. In an April filing with the Securities and Exchange Commission it said: “Although we believe that strong legal grounds exist to support our claim that we are not obligated to pay rent for the stores that have been closed … there can be no assurance that such arguments will succeed”.

“We remain committed to working directly with our landlords on mutually agreeable solutions and fair rent terms, just as our hundreds of industry and government partners have sat with us in good faith to shape the post COVID business landscape”, said a GAP spokesperson in an e-mail sent to CNBC related to the news.

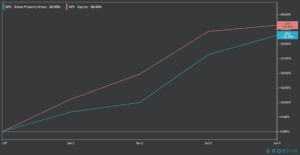

GAP (GPS) shares have been on a four-day rally since 29 May, gaining 36% after closing yesterday’s stock trading session at $12.14. However, the stock is down 3.7% during today’s pre-market trading after the company reported worst-than-expected quarterly results yesterday.

Shares of Simon Property Group (SPG) were surging up 7.2% this morning on pre-market trading after a four-day rally that pushed the stock to $76.73, posting a 33% gain during that period.

Industry experts have already warned that a host of retailers may face enforced claims for any unpaid rent during the pandemic, which means that Gap’s lawsuit from Simon could be the first of many to come.

Simon chief executive, David Simon said: “The bottom line is, we do have a contract and we do expect to get paid”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account