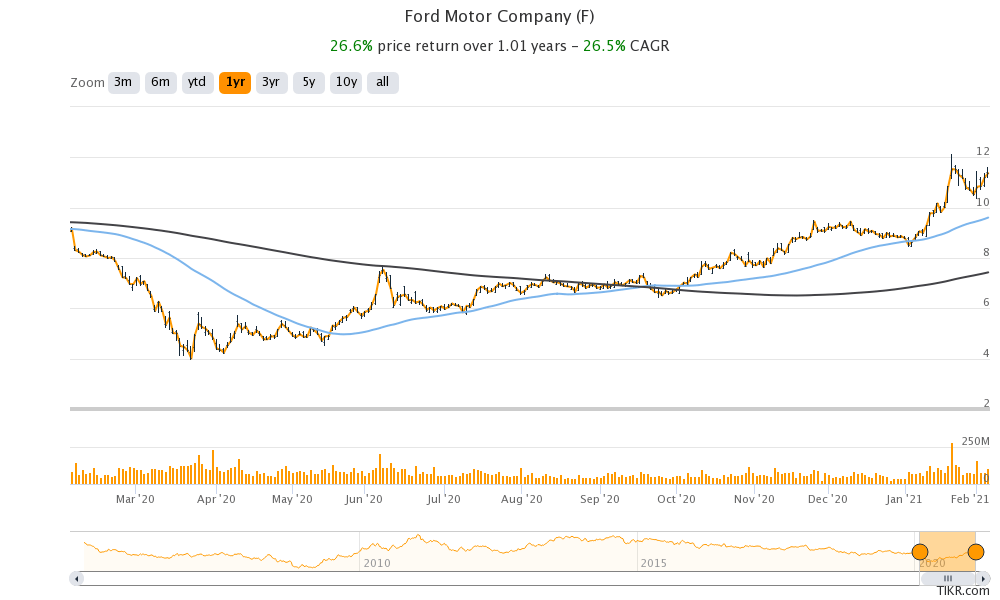

Ford stock has looked strong in 2021 and is trading higher in US premarket trading today after posting better than expected fourth quarter earnings. A turnaround seems underway in Ford. Should you buy it now and bet on a turnaround?

Let’s begin by looking at Ford’s fourth quarter 2020 earnings that were released after the close of markets on Thursday. The company’s revenues came in at $33.2 billion which were slightly lower than the $33.89 that analysts were projecting.

Ford’s earnings beat estimates

Meanwhile, while Ford’s revenues missed analysts’ estimates, its profits were far ahead of what analysts were expecting. The company posted a profit of $0.34 per share while analysts were expecting it to post a loss of $0.07 per share. It posted adjusted free cash flows of $1.9 billion in the quarter that looks encouraging.

But then, Ford’s story is not built on the topline but on an earnings turnaround. As part of a deliberate strategy, it is working on increasing profitability even at the cost of sacrificing revenues. The company has taken several decisions like exiting unprofitable markets to focus on profitability. Earlier this year, it called off an Indian joint venture also.

Ford pivots towards electric vehicles

The second pillar of Ford’s turnaround story is its pivot towards electric vehicles. It starting delivering the all-electric Mustang Mach-E to US customers in the fourth quarter of 2020. This year, it expects to start delivering the all-electric F-150 pick up truck to customers in 2021.

The F-150’s success would be crucial for Ford. The model has been America’s best-selling pickup truck for the last many years and accounts for a large part of Ford’s profits. The model would compete with Tesla’s Cybertruck that received strong preorders despite its unconventional design.

Ford expands investment into electric vehicles

Commenting on the earnings, Ford’s President and CEO Jim Farley said “The transformation of Ford is happening and so is our leadership of the EV revolution and development of autonomous driving.” He added, “We’re now allocating a combined $29 billion in capital and tremendous talent to these two areas, and bringing customers high-volume, connected electric SUVs, commercial vans and pickup trucks.”

General Motors also committed to an all-electric future

Last month, rival US automaker General Motors also announced that it plans to sell only electric cars by 2035. It was a major step by the company. “General Motors is joining governments and companies around the globe working to establish a safer, greener and better world,” said General Motors’ CEO Mary Barra said in a statement. She added, “We encourage others to follow suit and make a significant impact on our industry and on the economy as a whole.”

Ford’s guidance

Coming back to Ford, during the company’s fourth quarter earnings call, the company provides its 2021 guidance that looks quite strong. The company expects to post an EBIT (earnings before interest and taxes) between $8-$9 billion in 2021 that would include a $900 million non-cash gain on its investment in electric vehicle startup Rivian. Ford has been among the investors of Rivian that also received a big investment as well as a massive order from Amazon.

Ford expects to post adjusted free cash flows between $3.5-$4.5 billion in 2021 even as it cautioned on semiconductor supply. “The semiconductor situation is changing constantly, so it’s premature to try to size what availability will mean for our full-year performance,” said Ford’s CFO John Lawler. He added, “Right now, estimates from suppliers could suggest losing 10% to 20% of our planned first-quarter production.”

Ford mobility

Automotive companies see mobility as the future and legacy automakers are also expanding their efforts towards the business. General Motors’ Cruise has received an investment from General Motors that it says would help it commercialize self-driving vehicles. Ford has partnered with Google for connected vehicles. There has been a lot of interest in electric and autonomous vehicles from tech majors like Amazon and Apple. Apple is also reportedly planning to partner with Hyundai-Kia Motors to produce its electric cars.

Electric vehicle plans

“We are accelerating all our plans – breaking constraints, increasing battery capacity, improving costs and getting more electric vehicles into our product cycle plan,” said Farley in the earnings release. Taking an apparent swipe at the companies in the electric vehicle and autonomous driving ecosystem that are commanding high valuations despite not making any current revenues, Farley said “People are responding to what Ford is doing today, not someday.”

Ford stock price forecast

According to the estimates compiled by MarketBeat, Ford’s average price target if $10.21 which is 10.2% below the current stock price. Its highest price target is $14 while its lowest price target of $7.1. Of the 11 analysts surveyed by MarketBeat, only four recommend a buy while two recommend a sell on Ford stock. The remaining five analysts recommend a hold on the stock.

Should you buy Ford stock

Ford is a turnaround candidate and analyst target prices do not reflect that. Incidentally, almost all the companies in the electric vehicle ecosystem are trading at a massive premium over their target prices.

Ford stock could see better days ahead as the adoption of its electric vehicles grows. While markets are valuing pure-play electric vehicle stocks at an exorbitant premium, they have largely been cold towards legacy automakers like Ford and General Motors. With an NTM (next-12 month) PE multiple of 14.4x, Ford looks like a good way to ride the vehicle electrification wave.

You can trade in Ford stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account