Shopify (NYSE: SHOP) stock price crossed $500 level after beating fourth-quarter revenue and earnings estimates. The substantial revenue growth in 2019 along with a strong outlook for fiscal 2020 is among the biggest contributors to SHOP share price rally. Market analyst’s chatters regarding the potential merger and acquisition activity have also been supporting SHOP share price upside momentum.

Shopify stock price soared sharply in the past couple of quarters. SHOP share price surged 34 per cent in the last six months, extending the twelve months gains to 180 per cent. Recently, CNBC’s Jim Cramer speculated about M&A activity for SHOP. Cramer claims that he met with two companies who want to Buy Shopify.

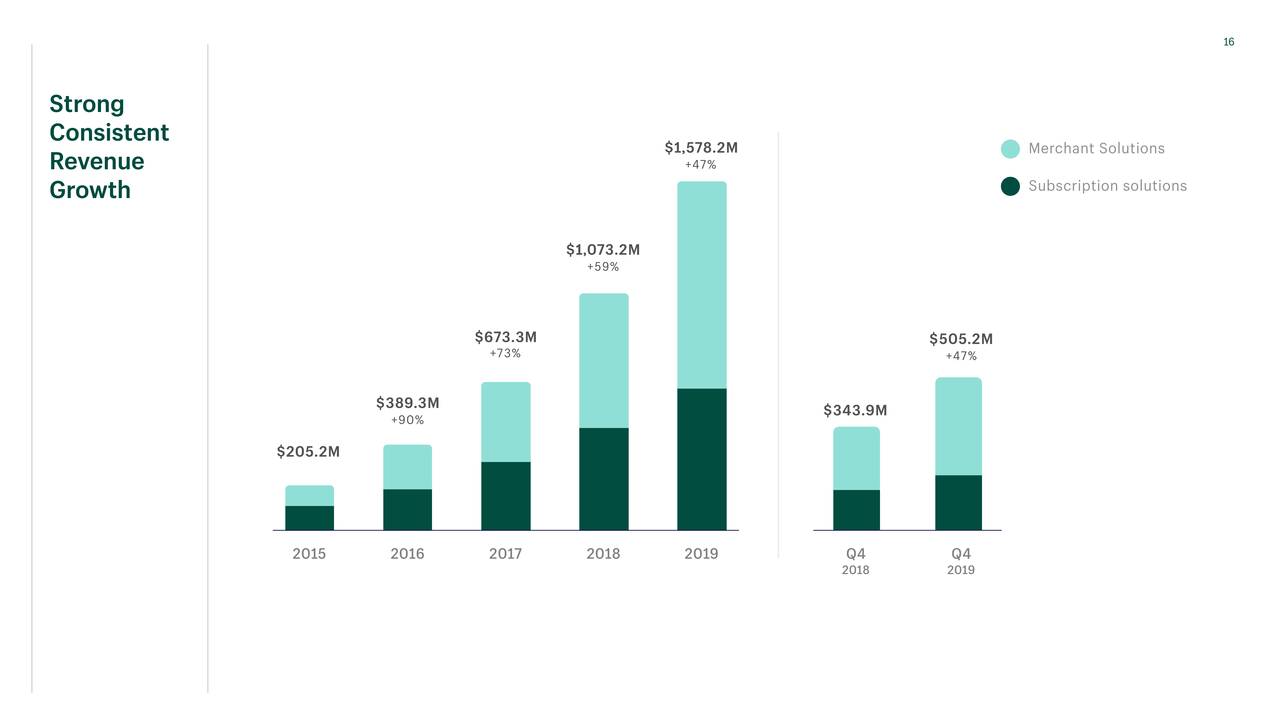

Robust Revenue Growth Supports Shopify Stock Price

The company topped fourth-quarter revenue estimate by $23ml while earnings beats consensus by $0.19 per share. Its fourth-quarter revenue of $505ml soared 47 per cent from the year-ago period. The full-year revenue came in at $1.57bn, representing an increase of 47 per cent from the past year. The world-leading Commerce Company believes that its strategy of investing in growth opportunities is helping in generating massive revenue growth. Its net income jumped to $0.8ml in the final quarter of fiscal 2019 compared with a net loss of $1.5ml in the same period last year.

“2019 was a milestone year for us,” said Tobi Lütke, Shopify’s CEO. “We’ve earned the trust of more than one million merchants, and we are motivated more than ever to keep lowering the learning curve so anyone, anywhere can become an entrepreneur.”

2020 Outlook Indicates Sustainable Growth

The company expects to accelerate revenue growth trend into fiscal 2020. Shopify anticipates 2020 revenue to stand in the range of $2.130 billion to $2.160 billion. This represents substantial growth when compared to the revenue of $1.57bn in 2019. It plans to invest $80ml in growth opportunities to expand its global presence. However, its earnings are likely to remain negative in 2020.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account