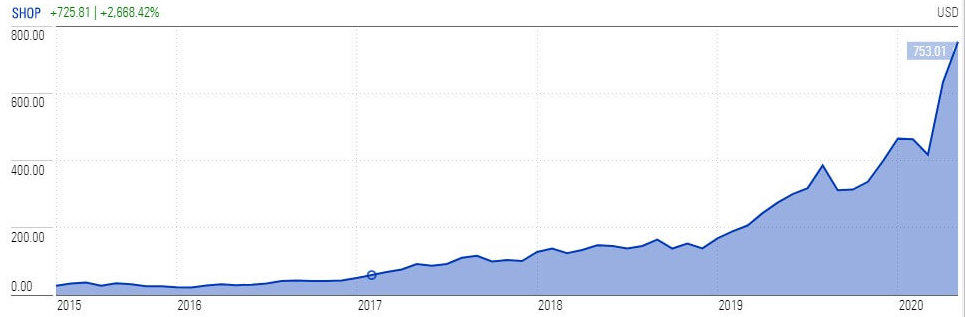

Shopify (NYSE: SHOP) stock price has had a good run in recent years, but the shift to online resources following pandemic has added to the bullish outlook of the e-commerce company that helps businesses and individuals set up their online stores.

The Ottawa-based online platform, which went public in 2015, has partnered with Facebook (NASDAQ: FB) to the launch a new Shops feature to help boost online sales. Facebook’s new Shops is a free tool that will allow consumers and retail companies greater access to Facebook’s base of 2.6 billion monthly users.

“By pairing Shopify’s platform and commerce capabilities with Facebook’s reach and scale, we are reducing the barriers to entrepreneurship and advancing the future of commerce,” said Tobi Lütke (pictured), chief executive of Shopify on Wednesday.

Shares in Shopify closed up 3.3% on Wednesday at $778. The stock has jumped by 90% this year.

Besides the latest partnership, Shopify, which hosts more than one million firms, said it has attracted new merchants over the last two months even as the coronavirus pandemic has devastated several small and medium-sized businesses.

The number of new stores jumped 62% between 13 March and 24 April compared to the previous six-week period indicates that the company will see substantial revenue growth in the second quarter, with expectations that gross merchandising volume will stay above 46%.

Its first-quarter year over year revenue growth of 47% to $470m, topped analysts’ estimates by $27m.

The stronger-than-expected merchant and store growth has pushed Shopify stock trading price to an all-time high of $770 last week. Shares of Canada’s largest e-commerce company rose 2,600% since it went public in 2015, with most of the growth arrived in 2019 and extended into 2020. Its stock is up 84% year to date despite the historic stock market collapse on virus spread.

If you are interested in investing in stocks, you can review our featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account