Find more information about how to buy and trade stocks in our stock trading guide.

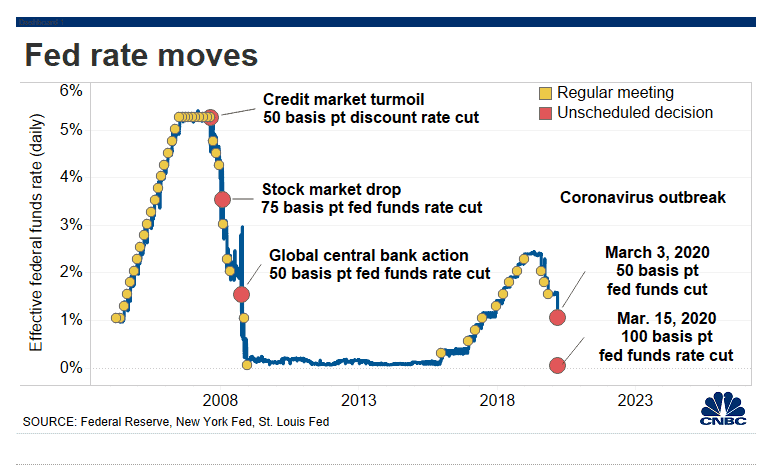

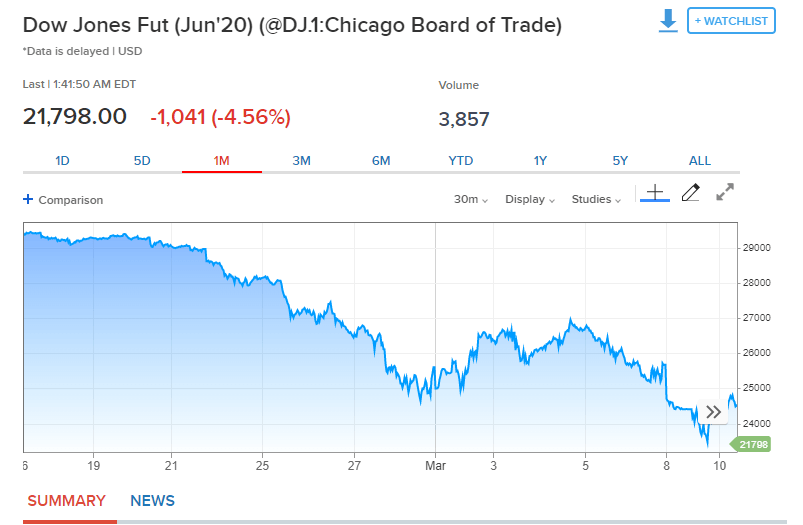

US stock market futures hit ‘limit down’ levels on Sunday evening and the Dow futures begin Monday trading with the loss of more than 1000 points after Federal Reserve slashed interest rates to near zero. This is the second unscheduled rate cut from the Fed in a few days, which reduced the rates to a historically low level since the 2008 financial crisis.

US President Donald Trump welcomed the move by Fed chairman Jerome Powell, saying: “I think that people in the markets should be very thrilled.”

Stock market futures hit ‘limit down’ levels of 5% lower, a move made by the CME futures exchange to reduce panic in markets. No prices can trade below that threshold, only at higher prices than that down 5% limit.

The Fed hopes its rate cut, along with emergency moves to pump $1.5trn into the financial system, will calm market fears about a recession. However, the market players are closely watching the full impact of coronavirus on US and European economies over the coming days before making significant investment decisions. Investors fear this second rate cut means central banks suspect the virus will have a hugely damaging effect on economic activity.

“This, coupled with an important fiscal package, should help cushion the economic downside from the virus’ effect on economic activity,” said Quincy Krosby, chief market strategist at Prudential Financial. “It’s going to be positive, but the market is at the mercy of the virus and at the mercy of whether the containment policies work.”

Dow Jones Industrial Average is down more than 1,000 points while the S&P 500 and Nasdaq Composite slipped close to 4.5% each. All three US stock market indices are down almost 20% from their peak that they had hit in February. The analysts are expecting US stock market to fall by almost 5%when trading opens.

However, investors around the world remain spooked by the impact of the virus, despite the Fed’s moves. Markets across Asia extended the declining trend with Hong Kong’s Hang Seng Index down 2.2% and China’s Shanghai Composite dipped 0.6%.

Data from China, where coronavirus first broke, highlighted the largest drop on record as Industrial output plunged 13.5% and retail sales 20.5%. The People’s Bank of China announced to pump 100bn yuan into the financial system to improve the lending facility.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account